Economy Well on Track to Match Government Plan Zhao Huanxin |

|

By sticking to a proactive fiscal policy and plans to expand domestic demand, China is well on its way to obtaining the objectives it set itself for the ninth Five-Year Plan period (1996-2000), according to the State Development Planning Commission. By the end of this year, the country will have achieved an annual gross domestic product growth rate of around 8 percent for the period as a whole, and the total amount of foreign trade is projected to exceed US$400 billion, according to the latest estimates from the commission. Fiscal policy: from moderate to proactive The implementation of macro-control mechanisms and moderate fiscal and monetary policies in the first three years of the period enabled China to repress the high inflation that hurt the country at that time. However, there was little time to relax before the government had to face the impact of the Asian financial crisis in 1997. The crisis put market demand in a sluggish spell. As a result,

China's foreign trade and the influx of overseas capital declined

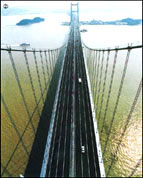

significantly. Consequently, market prices fell dramatically and domestic demand became feeble. To react and adapt to the unprecedented economic scenario, the central government decided to promptly shift the focus of its macro-control policies and pursue a proactive fiscal policy. A raft of economic policies to prod domestic market demand and reign in deflation were deployed. Since 1996, China has lowered bank deposit interest rates seven times in a row and increased the money supply to encourage investment and improve the performance of traditional industries. Investment, consumption fuel economic growth The above efforts were followed by the issuance of long-term treasury bonds to boost investment demands. Since 1998, China has issued 310 billion yuan (US$37.35 billion) worth of such bonds to increase the construction of infrastructure, especially railways, highways and main communications lines and infrastructure to conserve water, as well as to support the technological upgrading of enterprises and accelerate the application of high technology to production. The funds raised by the bonds were also used to aid the western regions of the country to protect the environment and to aid the development of the region's education, science and technology sectors. More grain depots in major grain production areas have also been built with the money. The country has also raised the income of low-income urban residents and government employees and ensured that workers laid off from state-owned enterprises are looked after. The government has also made sure that all retired people receive their pensions on time and in full. In addition, the government implemented a policy of purchasing at protective prices all the surplus grain farmers had to sell and tried to reduce the irrational charges and measures affecting farmers so as to increase their incomes. These efforts, along with increased enrollment in higher education institutions and a stepped-up residential housing reform, have fuelled consumption, which has in return shored up the country's economic expansion. Every effort made to increase exports Apart from expanding domestic demand, China has left no stone unturned in its efforts to increase exports and attract more foreign funds. The country has increased export tax rebates, and optimized the mix of export products by prioritizing high-tech exports. China has also reduced the number of export commodities on which voluntary quotas are imposed and improved the quota management and bidding methods. Furthermore, the country has encouraged domestic enterprises to invest in factories abroad to open up foreign markets. Banks have also given increasing support to export-orientated firms. As a result, China has overcome the detrimental influence of the Asian financial crisis. The foreign trade volume is as such expected to exceed US$400 billion, and the foreign funds attracted will total US$280 billion by the end of the ninth Five-Year Plan period. (China Daily 09/20/2000) |