China 2012 by numbers

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, December 31, 2012

E-mail China.org.cn, December 31, 2012

|

|

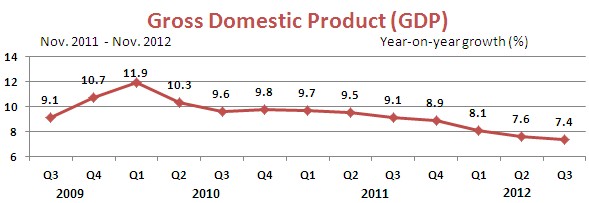

China's economy grew 7.4 percent year-on-year in the third quarter of 2012, slower from 7.6 percent in the second quarter and 8.1 percent in the first. The growth rate has slowed for the seventh straight quarter. |

|

|

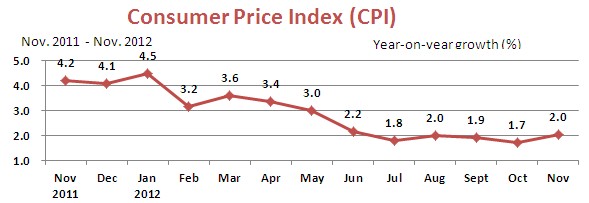

The Consumer Price Index rose to 2 percent in November from a year ago. The inflation rate rose from a 33-month low of 1.7 percent in October as food prices increased. In the first 11 months, the CPI grew 2.7 percent year on year on average. |

|

|

The growth of China's exports and imports slowed in November from one year earlier. Exports rose 2.9 percent from a year earlier in November, below October's 11.6-percent growth. Imports were flat compared with November 2011 and weaker than the 2.4-percent rise seen in October. |

|

|

China's value-added industrial output rose 10.1 percent year on year in November, picking up from 9.6 percent in October and 9.2 percent in September. The continued acceleration indicated that the nation's economy is rebounding after seeing its lowest expansion pace in more than three years. |

|

|

Retail sales in China grew 14.2 percent year on year to 18.68 trillion yuan (US$2.97 trillion) in the first 11 months of the year. In November, retail sales hit 1.85 trillion yuan, an increase of 14.9 percent over the same period last year. |

|

|

China's manufacturing Purchasing Managers' Index (PMI) stood at a 13-month high of 50.5 in November, backed by increasing new business and expanding production, confirming that the Chinese economy continues to recover gradually. |

|

|

New yuan-denominated lending reached 522.9 billion yuan (US$83 billion) in November, falling 40 billion yuan year on year. However, the figure was up from the 505.2 billion yuan in new yuan loans registered in October. |

|

|

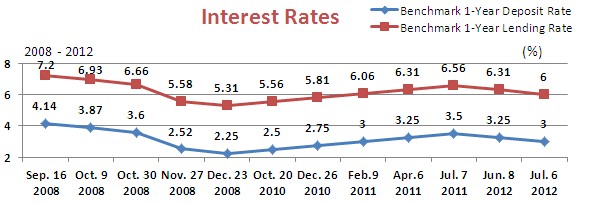

The People's Bank of China cut the benchmark interest rate for one-year deposits by 25 basis points to 3 percent. The benchmark one-year lending rate will also be lowered by 31 basis points the same time to 6 percent. |

|

|

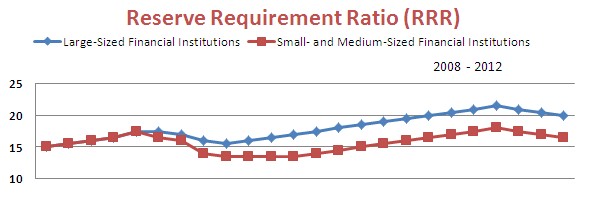

China's central bank cut banks' reserve requirement ratio by 50 basis points, as part of the government move to fine-tune macroeconmic policy amid current economic gloom. RRR will be lowered to 20 percent for large commercial banks and 16.5 percent for mid- and small-sized banks. |

|

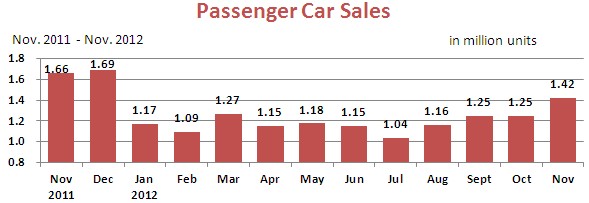

A total of 1.419 million cars, sports utility vehicles, multi-purpose vehicles and minivans were sold in November, a 13 percent year-on-year increase. The figure was a record as a series of positive indicators boosted the market. |

|

|

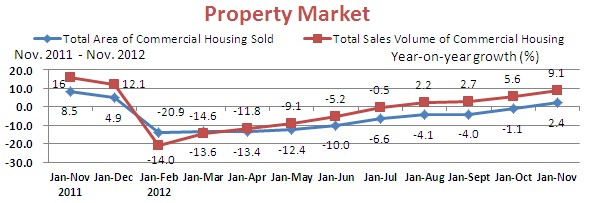

China's total area of commercial housing sold continue to pick up in November, rising 9.1 percent year-on-year. Total sales volume of commercial housing also increased by 2.4 percent from one year ago. |

Go to Forum >>0 Comment(s)