Bike plants ride sharing boom well

0 Comment(s)

0 Comment(s) Print

Print E-mail China Daily, March 27, 2017

E-mail China Daily, March 27, 2017

In 1999, when he was still 18, Ruan Hongming found employment in a bike factory in Shenzhen. But the worker from Guangxi Zhuang autonomous region left the job in 2002 as he didn't forsee bright prospects for the industry. Fifteen years on, he has rejoined the business.

Now 36, Ruan was persuaded by an ex-colleague at Komax to return. "I decided to rejoin when I learnt Komax had received a huge order," Ruan said.

Komax hired him to lead and train 40 fresh hires for a new production line, one of 12 such lines the factory is building in Shenzhen, Dongguan and Foshan, to meet the demand from a new business segment-bicycle sharing.

Xue Mingjun, CEO of Komax, said upon completion, the new and old production lines' monthly capacity will increase from 5,000 units to 500,000 units. Another 200 new workers will be hired by this month-end.

Komax received an order for 200,000 units from a bicycle-sharing company for delivery in the first quarter, which prompted Ruan's comeback.

Komax is not the only company benefiting from the boom in bicycle sharing. The business has spawned new opportunities for bicycle manufacturers across the country.

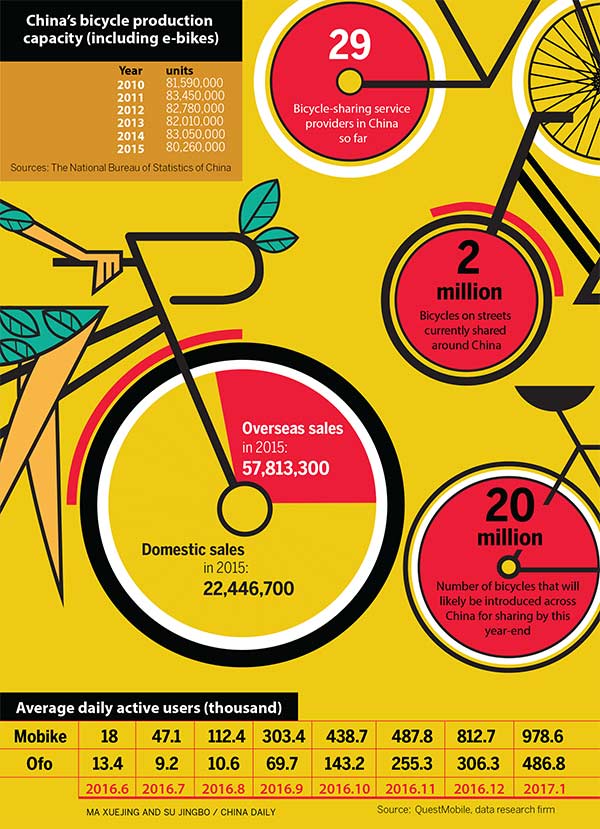

About 29 bicycle-sharing service providers have placed more than 2 million bicycles on streets around China. This figure is expected to rise tenfold to 20 million units this year, equal to last year's total sales in the domestic market, according to the China Bicycle Association.

Bicycle-sharing companies are striving to cover many cities as quickly as possible, a move requiring large-scale production, which should explain big orders of the kind that Komax received recently.

The trend started in the second half of 2016, stirring up a wave of facility expansions across the whole industrial chain, encompassing time-honored brands, medium-sized assembly factories to small accessory plants.

The ongoing frenetic production is evidence of how innovation leads to upgradation of China's real economy, as Premier Li Keqiang stressed in this year's Government Work Report.

He said "the nation will further implement the strategy of driving development through innovation, optimize the structure of real economy and keep improving quality, efficiency and competitiveness".

Four factories of Tianjin Flying Pigeon Cycle Development Co Ltd, one of the earliest bicycle brands in China, are scheduled to produce 900,000 bikes in March, half of which are for bike-sharing startups, according to Xinhua News Agency.

Like Komax, the manufacturer is expanding capacity and hiring more workers, thanks to the ever-increasing orders.

Shenzhen Xidesheng Bicycles Co Ltd, a leading bicycle assembly plant, is also overwhelmed by orders from bicycle-sharing companies. It enhanced its production ability by 30 percent in just a few months. Its workers now put in extra hours every day.

Shenzhen Yibotong Bicycle Part Co Ltd, a bike seat manufacturer, has had orders for about 1 million pieces every month since the second half of 2016, double its previous monthly average. To cope with the spurt in demand, it has increased production capacity by three times and hired more than 100 new staff.

It is a new opportunity for bicycle manufacturers, Wang Yiping, secretary-general of the Shenzhen Bicycle Industry Association, said.

She said the city has about 150 bicycle-related factories, including assembly lines and accessory producers, and at least 40 of them are contract-manufacturing for bicycle-sharing companies now.

She said there are more opportunities to tap. "Owing to high usage frequency of shared bikes, their disposal rate is high," she said. "Such bikes can be used for only about half a year."

Bike disposal firms may benefit next from the boom in sharing economy, she said.

Ofo, a major bike-sharing service provider, said it is trying out a disposal mechanism in some cities, but refused to disclose more details.

Wang said a long-term opportunity could be guidance services for users of bike-sharing services. Once they grow familiar with cycling around and develop an interest in riding high-end bicycles like sports bikes, there could be new opportuniries for manufacturers.

Typically, the shared bicycles tend to be low-end products. Profit margins for manufacturers may be low in spite of large volumes. So, factories are keen to find a sustainable development model.

Also, the euphoria over bike sharing may be related to service providers' efforts to secure funding for their startups, hence may not last long, resulting in expanded production facilities turning idle in the long run, she said.

Bicycle-sharing service providers are yet to turn profitable, said Yang Zhiwei, an analyst at BOC International. He believes the business has the potential to ring in profits when it reaches a certain scale and its operations mature.

For example, in Yang's conservative estimate, each ofo bicycle can generate about 3 yuan per day from rental and advertisement fee. Gross profit margin can be as high as 90 percent. Besides, the provider has expanded its service to overseas countries.

Fan Zhen, deputy secretary-general of the China Bicycle Association, said the primary challenge is to ensure shared bikes' quality and safety. The CBA will draft a national standard in this regard, he said.

On Thursday, the bicycle associations of Shanghai and Tianjin issued a draft guidance on production, operational and maintenance standards, seeking feedback from all concerned. They urged service providers to ensure their bikes have a GPS function, are not parked in downtown areas and discarded after three consecutive years of use. The draft may take effect in May.

Go to Forum >>0 Comment(s)