China releases tax rate schedule for year-end bonuses

0 Comment(s)

0 Comment(s) Print

Print E-mail CGTN, December 29, 2018

E-mail CGTN, December 29, 2018

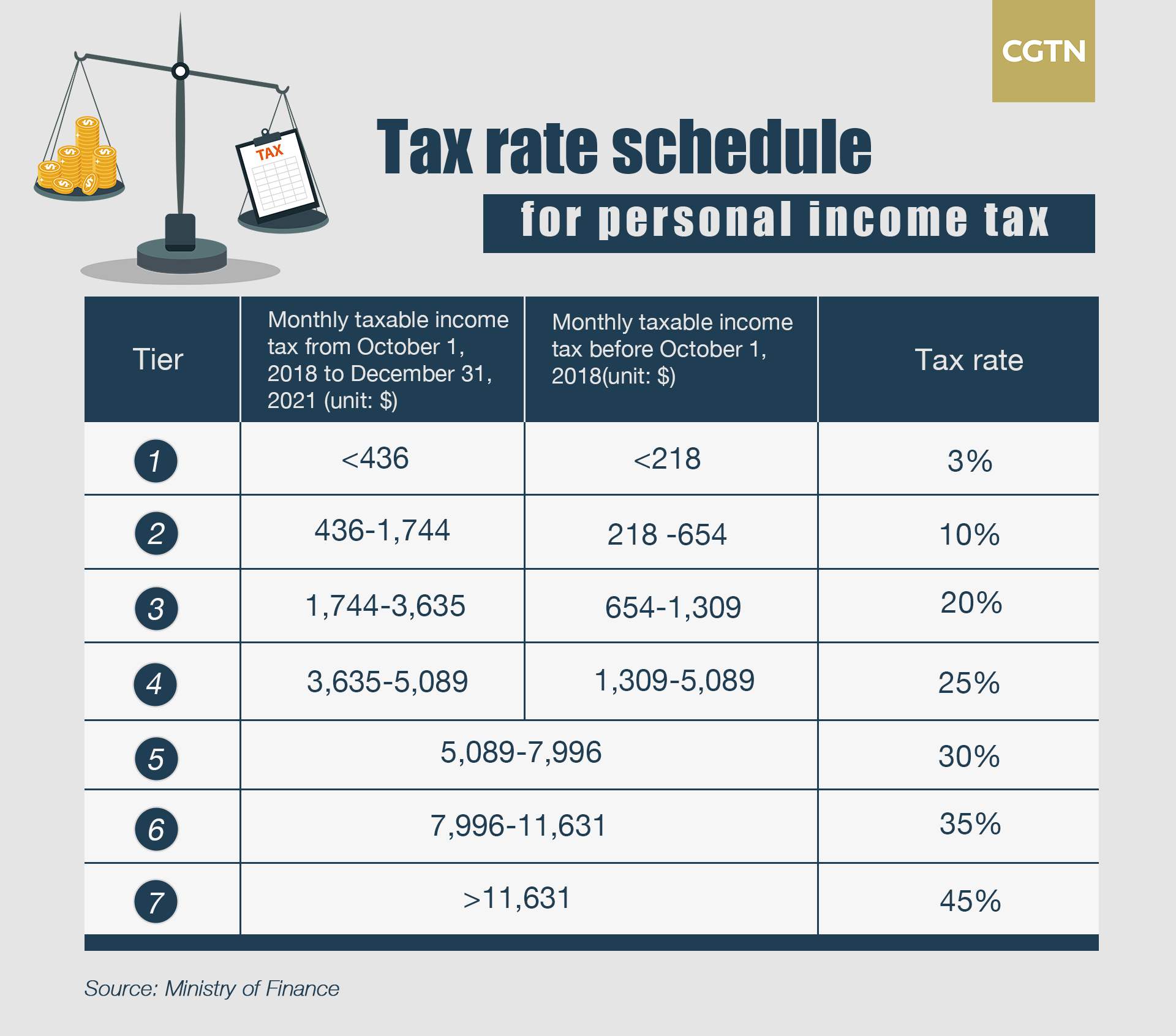

China released a new rate schedule for taxes on individual year-end bonuses following their revision to the individual income tax law, according to a statement released on the official website of the Ministry of Finance on Thursday.

Before December 31, 2021, individual year-end bonuses will not be incorporated into annual income but taxed separately, according to the schedule. The applicable tax rate and quick deduction depends on total amount of year-end bonus divided by 12 months.

It means less payable tax and more disposable income for the working class. For example, if Mr. Yang got 17,447 yuan as a year-end bonus before the revised law, his tax payable was: 17, 447 yuan (taxable income) * 25% (tax rate) - 146 (quick deduction) = 4,216 yuan. But according to the new law, the tax payable would be: 17,447 yuan (taxable income) * 10% (tax rate) - 31 yuan (quick deduction) = 1,714 yuan.

The tax difference is 2,502 yuan, which means Mr. Yang could pay this amount less in tax if he got a year-end bonus after the law went into effect.

"The personal income tax reform is primarily a good news for middle to lower income groups as people with less income will see a larger tax reduction," said Li Wanfu, head of the institute of tax science of the State Administration of Taxation.

"A lower tax means they will have more hard earned money to spend." said Liu Chunsheng, an associate professor from Central University of Finance and Economics.

This schedule will be implemented for three years. The statement showed from January 1, 2022, individual year-end bonus will be taxed as part of annual income.

Go to Forum >>0 Comment(s)