12 Chinese companies in global top 100 auto suppliers: Report

0 Comment(s)

0 Comment(s) Print

Print E-mail chinadaily.com.cn, July 14, 2021

E-mail chinadaily.com.cn, July 14, 2021

Twelve Chinese companies have been included among the top 100 car parts suppliers globally in 2020, with the whole auto market demonstrating strong resilience amid the COVID-19 pandemic, an industrial report said on Monday.

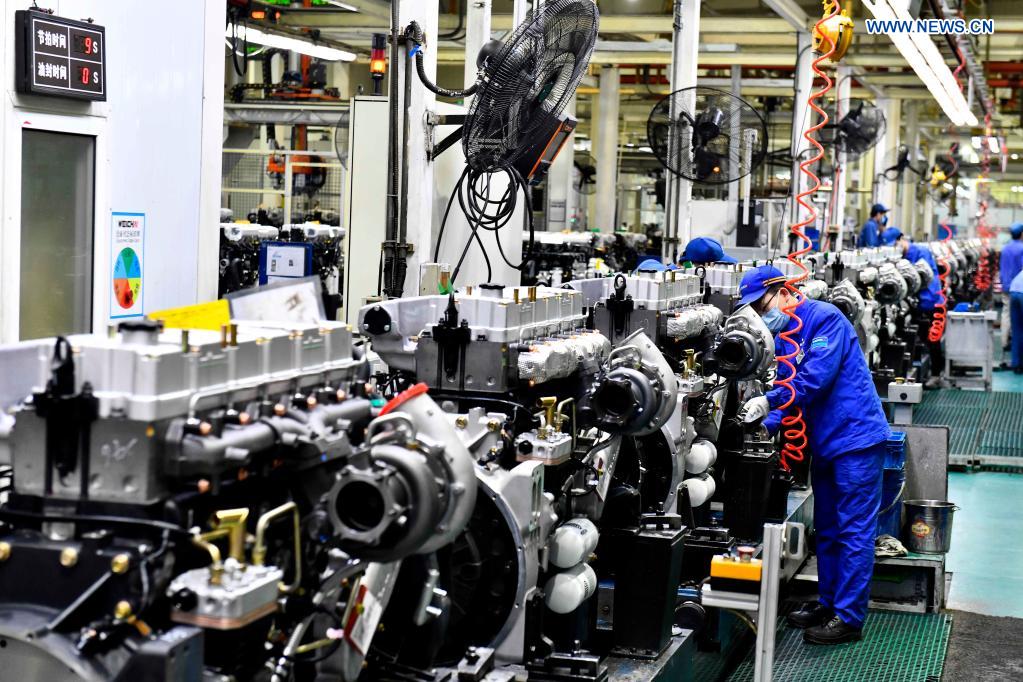

In cooperation with strategy consultancies Roland Berger and Berylls Strategy Advisors, China Automotive Daily analyzed the business revenue of nearly 500 car parts companies last year. China's Weichai Group took fourth spot in the global ranking, following German auto supplier Bosch, Denso Corp in Japan and another German industrial giant, Continental AG.

Weichai, the Shandong-headquartered manufacturer, generated revenue of 249.33 billion yuan ($38.50 billion) and crowned the domestic top 100 list. Hasco Automotive, BHAP, Joyson Electronics and CATL ranked second to fifth, respectively.

A total of 34 Chinese companies saw their revenue exceed 10 billion yuan last year, increasing from 31 in 2019, the report highlighted.

As the virus outbreak seriously struck car production and sales, cumulative revenue by the top 100 auto suppliers globally dropped over 10% year-on-year, while that in China witnessed a 4% growth against the world's economic downturn, from 1.29 trillion yuan in 2019 to 1.35 trillion yuan in 2020.

In the challenging world last year, Chinese suppliers demonstrated remarkable resilience and sustainability in industrial development, said Thomas Fang, senior partner of Roland Berger.

Chinese auto parts manufacturers also ramped up investment in research and development, and the proportion of which in total revenue rose from 3.9% to 4.1%, hitting over 40 billion yuan in 2020.

"We found that R&D investment in the new energy vehicle sector accounted for the biggest proportion of companies' revenue, especially in the next-generation technologies, such as smart connection, intelligent cockpit and drive system," Fang said.

Jan Dannenberg, co-founder and partner of Berylls Strategy Advisors, said overall sales of the top 100 global automotive suppliers went substantially back in 2020, and profitability shrank by more than 50% compared to a year before.

However, he noted that only eight of the 100 suppliers registered actual growth last year, and the majority of those came from China.

"When we first did the survey in 2012, there was only one company, Weichai Power that came from China, but nowadays, about 10% of the top 100 are Chinese suppliers, and we expect this number will grow in the coming year," Dannenberg said.

Massive market with challenges

With huge auto market scale and continuously growing consumer groups, China remains attractive for global and domestic car parts manufacturers.

Xin Ning, president of China Automotive Daily, said the heartland of the world's automobile industry has accelerated transfer to China, offering companies massive strategic opportunities.

In the first half of this year, car production and sales reached 12.57 million and 12.9 million units, up 24.2% and 25.6% year-on-year, respectively, data from the China Association of Automobile Manufactures showed.

A total of 17 million units of cars are expected to be sold this year, with 2.4 million new energy vehicles, said Chen Shihua, the association's deputy secretary-general.

Chen, however, emphasized the current risks that Chinese auto suppliers face – chip shortage and the price premium of raw materials, such as steel, nonferrous metals and precious metals.

Software defines the car

As new energy, artificial intelligence and internet ecology reconstruct the auto sector, suppliers are in fierce competition to scramble for a piece of the booming market.

"We have entered an era when 'software defines the car and those who master core technologies, for example, chips, are in the top class," said Wu Lijun, the product CEO of Chang'an Automobile Group.

Zhu Guangwei, vice-president of Bosch China, also emphasized putting simultaneous focus on both software and hardware in the digital transformation of auto suppliers.

"China is Bosch's largest single market in the world, and the country has been ahead of the globe in smart vehicle sectors. Bosch set up a new division in charge of intelligent drive and control last year, and an innovative software development center, to better get involved in the future trend," Zhu said.

Go to Forum >>0 Comment(s)