US inflation surges 8.3% in April

0 Comment(s)

0 Comment(s) Print

Print E-mail Xinhua, May 12, 2022

E-mail Xinhua, May 12, 2022

U.S. consumer inflation in April surged by 8.3% from a year ago, marking the second straight month of inflation over 8%, the U.S. Labor Department reported Wednesday.

The consumer price index (CPI) last month rose 0.3% from the previous month after increasing 1.2% in March, according to the department's Bureau of Labor Statistics (BLS).

The April CPI surged 8.3% from a year earlier, a slightly smaller increase compared with the 8.5% growth in March. The March figure was the largest 12-month increase since the period ending December 1981.

Headline CPI has remained over 6% year-on-year since October last year. April's report marked the first time since August last year that the rate of inflation slowed.

"Although price growth showed signs of easing in April, inflation still came in stronger than expected," Sarah House and Michael Pugliese, economists at the Wells Fargo Securities, said in an analysis.

"April's CPI data served as a stark reminder that the Fed has a long road ahead of it in bringing down inflation," they said.

The so-called core CPI, which excludes food and energy, rose 0.6% in April following a 0.3% growth the prior month. Core CPI jumped 6.2% over the last 12 months, after climbing 6.5 % in March.

The core CPI "is twice the subdued pace of March and underscores why the Federal Reserve is hesitant to declare a peak in inflation," Diane Swonk, chief economist at the major accounting firm Grant Thornton, said in a blog.

"Inflation remained remarkably resilient and broader based in April as consumers pivoted from big-ticket spending on goods to services," Swonk noted.

Increases in the indexes for shelter, food, airline fares, and new vehicles were the largest contributors to the seasonally adjusted all items increase, according to the BLS report.

The index of shelter, which includes rents and homeownership costs, increased 0.5% over the month, at the same pace of growth as in March. Compared with a year ago, the shelter index in April grew by 5.1%.

"Worse yet, much of the surge in shelter costs - the largest single component of the CPI - are still ahead of us," Swonk said. "It takes at least a year for an acceleration in rents and homeownership costs to show up in inflation measures; both were still accelerating in the first quarter."

The food index rose 0.9% over the month as the food at home index rose 1.0%. The food index climbed 9.4% year-on-year, and the food at home index surged 10.8% over the last 12 months, both at the highest levels in over four decades.

The index for meats, poultry, fish, and eggs soared 14.3% over the last year. The other major grocery store food group indexes also rose over the past year, with increases ranging from 7.8% (fruits and vegetables) to 11.0% (other food at home), the BLS report showed.

The new vehicles index climbed by 1.1% in April, after a tepid 0.2% growth in March. The new vehicles index soared 13.2 % year-on-year. The used cars and trucks index, despite a modest monthly drop, surged 22.7% year-on-year.

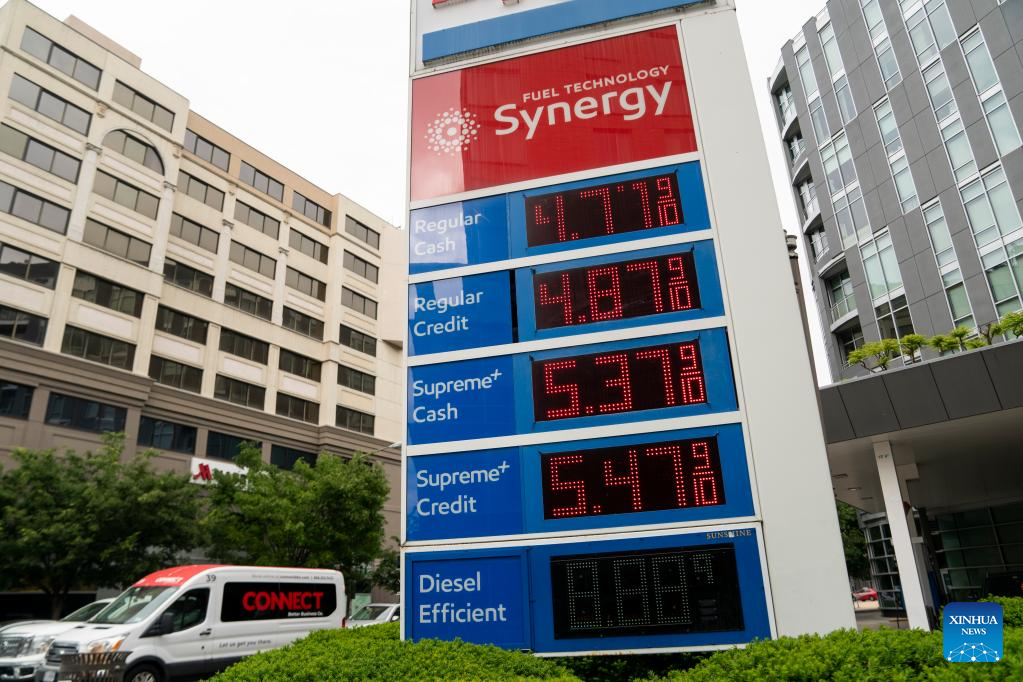

The energy index declined by 2.7% in April after soaring by 11.0% in the previous month, dragging down the headline CPI. Compared with a year ago, the energy index surged 30.3%.

"Outside the motor vehicle sector, goods inflation largely slowed on a sequential basis," House and Pugliese noted, while adding that relief on core goods prices will be needed as "services prices continue to heat up."

Core services prices rose 0.7% in April, up from a 0.6% increase in March and a 0.5% increase in February. Airfare prices, in particular, were up 18.6% in the month, the largest monthly increase since the inception of the series in 1963.

"I know that families all across America are hurting because of inflation," U.S. President Joe Biden said in a speech Tuesday. "I'm taking inflation very seriously and it's my top domestic priority."

"Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures," the Federal Reserve said in a statement after a two-day policy meeting last week.

The Fed noted that the Russia-Ukraine conflict and related events are creating "additional upward pressure" on inflation and are likely to weigh on economic activity.

The central bank raised its benchmark interest rate by a half %age point last week, marking the sharpest rate hike since 2000, and signaled it would keep hiking at that pace at the next couple of meetings.

"Although base effects are starting to help drive the year-over-year rates of inflation lower, that will no longer be the case come mid-summer," said House and Pugliese, adding that another 50-basis-point rate hike at the Fed's June 14-15 meeting seems "all but assured."

Go to Forum >>0 Comment(s)