Who are buyers of global top luxury goods?

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, July 11, 2023

E-mail China.org.cn, July 11, 2023

Editor's note: Bernard Arnault, chairman and CEO of LVMH group, and Tesla CEO Elon Musk have been in a rivalry for the crown as the world's richest person. One thing they have in common is that their empires both heavily rely on China, the world's largest luxury goods market. How do Chinese cities and megalopolises play in the market? How are these cities and megalopolises different from each other when it comes to luxury spending? How does their spending on luxury goods give a peek into their economic development? Cloud River Urban Research Institute uses the Chinese Cities' Global Luxury Brand Index included in its annual China Integrated Development Index to provide an analysis and explanation.

In the past 20 years, globalization has significantly driven the growth of global wealth, and also led to an exponential increase in the global luxury goods market. The global personal luxury goods market has tripled since 2000. Such a boom has been mostly driven by China's economy. In 2019, China made up 33% of the global personal luxury goods market. Despite a slight drop during the pandemic, China's share is expected to reach 40% by 2030.

Ranking of the Chinese Cities' Global Luxury Brand Index

Cloud River Urban Research Institute complies the Chinese Cities' Global Luxury Brand Index in its annual China Integrated Development Index. It conducts an index-linked analysis based on the number of stores of 11 luxury brands – Hermes, Louis Vuitton, Gucci, Cartier, Prada, Fendi, Coach, Chanel, Dior, Burberry, and Bulgari – across 297 Chinese cities at prefecture-level and above.

Shanghai, Beijing, Chengdu, Hangzhou, Xi'an, Shenzhen, Tianjin, Chongqing, Shenyang, and Wuhan make the top 10 in the ranking. These 10 cities host a staggering 53.8% of top luxury brand stores in China, with Shanghai and Beijing contributing the most.

At 11th to 30th places are Guangzhou, Dalian, Ningbo, Changsha, Nanjing, Harbin, Taiyuan, Suzhou, Shijiazhuang, Xiamen, Kunming, Changchun, Jinan, Qingdao, Zhengzhou, Guiyang, Hefei, Wuxi, Nanning, and Urumqi.

The top 30 cities are home to 87% of top luxury brand stores in China. These cities are all core cities, except Suzhou and Wuxi. Undoubtedly, core cities such as municipalities directly under the central government, provincial capitals, autonomous region capitals, and cities specifically designated in the state plan are driving force for spending on top luxury goods in China.

According to the ranking, Chengdu, Xi'an, and Chongqing, all cities in western China, take third, fifth, and eighth spots, and other cities in western China like Kunming, Guiyang, Nanning, and Urumqi make their way into the top 30.

Zhou Muzhi, head of Cloud River Urban Research Institute, said their strong showing indicates that cities in western China are big drivers for the growth of the luxury market.

Zhou pointed out that despite its weak economic growth in recent years, the northeastern China region has a strong appetite for luxury goods, as Shenyang, capital city of Liaoning province, claimed the eighth spot, and other cities in the region like Dalian, Harbin, and Changchun have all move into the top 30.

He added that this indicates that once a city's economy reaches a certain level, its purchasing power for luxury goods is greatly influenced by its cultural traits.

Characteristics of spending on top luxury brands in megalopolises

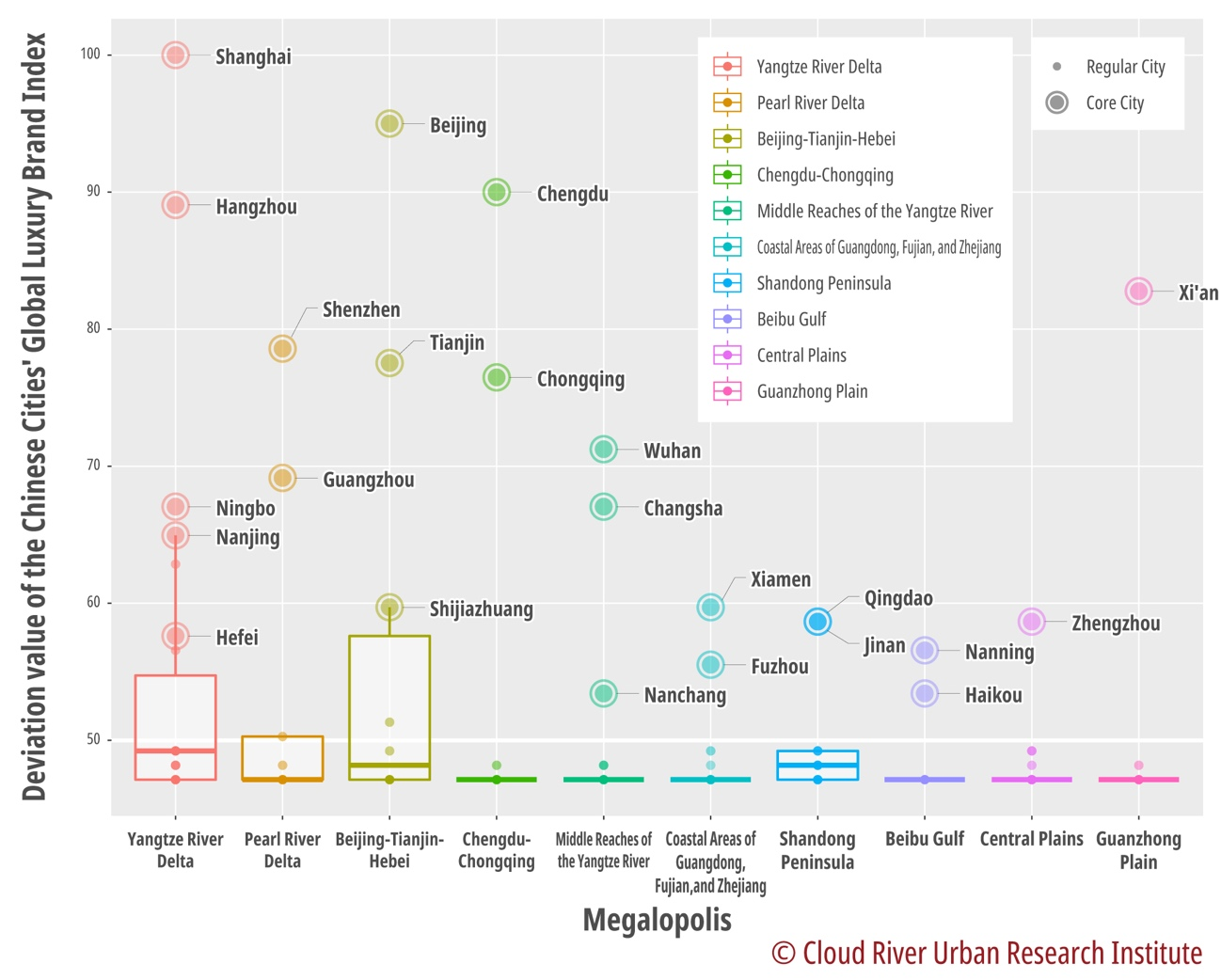

Spending on top luxury goods varies in different megalopolises. To make a more straightforward analysis of megalopolis development, this article dissects the deviation values for comprehensive evaluation of 10 megalopolises in China, and analyzes the data with a box and beeswarm plot to display differences of deviation values for comprehensive evaluation of the megalopolises.

The horizontal lines inside the boxes represent the medians of the samples, the top of the boxes represent the upper quartiles (75%), the bottom of the boxes represent the lower quartiles (25%), and the spaces inside the box indicate how 50% of the samples distributes. Beeswarm plot is a statistical chart that plots the distribution of individual data points. A combination of a box plot and a beeswarm plot shows the location of each sample and the distribution of the samples as a whole.

As shown in the figure, among the Pearl River Delta, the Beijing-Tianjin-Hebei region, the Chengdu-Chongqing region, the middle reaches of the Yangtze River, the coastal areas of Guangdong, Fujian, and Zhejiang, the Shandong Peninsula, the Central Plains, the Guanzhong Plain, and the Beibu Gulf, the Yangtze River Delta is home to the largest number of luxury brand stores, accounting for 26.8% of the national total. The region also dominates the top 30 ranking. Specifically, Shanghai comes at first, followed by Hangzhou. Ningbo, Nanjing, Suzhou, Heifei, and Wuxi make their way into the top 30.

The Beijing-Tianjin-Hebei region is home to 16.6% of top luxury brand stores in China. Beijing takes second place, Tianjin at seven, and Shijiazhuang at 20th in the ranking.

In the Chengdu-Chongqing region, top luxury brand stores concentrate in Chengdu and Chongqing, accounting for a combined 9.8% of the national total. The figure is a testament to the region's strong appetite for luxury goods.

Surprisingly, the Pearl River Delta, one of China's most developed regions, fares not very well in the ranking. Shenzhen only ranked sixth, after Chengdu, Hangzhou, and Xi'an, and Guangzhou drops out of the top 10. The delta makes up only 6.8% of the total number of top luxury brand stores in China, three percentage points lower than the Chengdu-Chongqing region.

Xi'an stands out in the Guanzhong Plain. The city's good showing – ranking fifth – has helped the region snap up 4.3% of the nation's top luxury brand stores, slightly higher than the Shandong Peninsula's 4.1%.

The coastal areas of Guangdong, Fujian, and Zhejiang, the Central Plains, and Beibu Gulf are home to 2.8%, 2%, and 1.8% of top luxury brand stores, which are mostly concentrated in their core cities.

Zhou said that in contrast to northeastern China, the Pearl River Delta, which is a rich region in China, has a weak demand for luxury goods.

Figure. Performances of Global Top Luxury Brands in 10 Chinese Megalopolises

Who are buyers of global top luxury brands

In order to explain the reasons behind the differences in spending on global top luxury goods, this article utilizes the Chinese Cities' Global Luxury Brand Index to provide a correlation analysis based on the Index and other key indicators of 298 Chinese cities at prefectural level and above, leading to several sets of comparative data.

Correlation analysis is a measure used to analyze the statistical relationship between two variables. The correlation coefficient ranges from 0 to 1, where a coefficient closer to 1 indicates a stronger correlation. A coefficient between 0.9 and 1 is considered "perfectly correlated;" a coefficient between 0.8 and 0.9 is considered "very strongly correlated;" a coefficient between 0.7 and 0.8 is considered "strongly correlated;" a coefficient between 0.5 and 0.7 is considered "correlated; " a coefficient between 0.2 and 0.5 is considered "weakly correlated;" and a coefficient between 0 and 0.2 is considered "not correlated."

The analysis found that the correlation between the Index and the manufacturing industry is low, with a coefficient standing at 0.51. In contrast, the Index has a perfect correlation with the financial industry, with a coefficient of 0.95, and has a quite strong correlation with the IT industry, with a coefficient of 0.87.

Zhou said Spending on luxury goods is closely related with the industries that consumers work for, as most manufacturing industry workers have a low pay, while people working for the financial and IT industries are likely to be professionals and well paid.

The correlation between the Index and the number of domestic and international tourists is at 0.52 and 0.54, respectively. In contrast, the Index has a very strong correlation with cinema spending, with a coefficient of 0.88.

Zhou noted that unlike Paris and Tokyo, Chinese cities' spending on luxury goods is not driven by foreign shoppers. Therefore, the Index chimes with the indicators that reflect endogenous consumption such as cinema spending. It also indicates that neither domestic nor international tourists have become the main force in purchasing top luxury goods in China.

Bernard Arnault, the world's second-richest man after Elon Musk and chairman of LVMH group, owner of more than 70 brands (including four in the Index), arrived in China for his first visit to the country recently. His visit reinforced the fact that the luxury empire relies heavily on the Chinese market.

Zhou pointed out that China has transformed from an economy driven by "Made in China" single to one driven by "world's powerhouse" and "world's market."

He asserted that the successes of Elon Musk and Bernard Arnault to some extent are attributed to the Chinese market.

In China, the world's largest auto market, Chinese EV manufacturers represented by BYD have emerged to compete with Elon Musk's Tesla. How long does it take for China, the world's largest luxury goods market, give birth to its own top international brands? We will see.

Go to Forum >>0 Comment(s)