Global economic growth reached 3.8 percent in 2004 --the fastest rate in four years. Developing countries outgrew high-income countries, and the gains were widespread -- all developing regions grew faster in 2004 than their average over the last decade. But global growth momentum has peaked, and developing country gains are vulnerable to risks associated with adjustments to ballooning global imbalances -- especially the US$666-billion US current account deficit -- says the World Bank’s annual Global Development Finance 2005 report.

The strong global performance was underpinned by solid US growth and rapid expansion in China, India, and Russia. Record expansion of 6.6 percent in developing countries was encouraged by favorable global conditions and supported by years of domestic policy improvements. As a result, financial flows to developing countries during 2004 reached levels not seen since the onset of the financial crises of the late 1990s.

Net private capital flows, including debt and equity to developing countries, increased by US$51 billion to US$301.3 billion in 2004. Of this, net foreign direct investment (FDI) totaled US$165.5 billion, up by US$13.7 billion in 2004. Developing countries themselves continued to increase their exports of capital in tandem with their strengthening current account balances, which reached an aggregate surplus of US$124 billion in 2004. FDI outflows from developing countries rose to an estimated US$40 billion in 2004, up from US$16 billion in 2002; these outflows are coming, for the most part, from the same countries receiving the bulk of private capital inflows, namely Brazil, China, Mexico and Russia.

“This recovery of financial flows is a welcome sign of renewed market interest in developing countries and a tribute to the substantial strengthening in economic fundamentals achieved in many countries,” said François Bourguignon, the World Bank’s Senior Vice President for Development Economics and Chief Economist. “But we should also keep in mind that current global financial imbalances pose risks—of disorderly exchange rate movements, or of interest rate increases—that could threaten these gains. Developing countries need to prepare themselves for adjustments, some of which could be sudden.”

The report, Mobilizing Finance and Managing Vulnerability, points to a baseline scenario in which tightening of US fiscal policy and higher interest rates, along with strong growth among developing countries, starts to redress global imbalances and reduce the US current account deficit. But it also highlights the risks to this outlook, and argues that developing countries need to reduce their vulnerability to shifts in market sentiment prompted by higher-than-expected interest rate hikes, or a greater-than-expected depreciation of the US dollar.

“History has shown, time and again, that financial crises often take markets and policymakers by surprise,” said Uri Dadush, Director of the Bank’s Development Prospects Group, which produced the GDF 2005. “There is a tendency for financial markets and policymakers to miss the warning signs and overshoot, making the necessary adjustment larger when it does occur. For developing countries, the key question is whether the pickup in flows witnessed over the last two years can survive under less favorable and less stable global conditions.”

Tightening global conditions will test developing country resilience

Features of the current global recovery have contributed to some of the risks facing developing countries going forward. The dramatic increase in the US current account deficit—now equivalent to 5.6 percent of US GDP—has meant that developing countries as a whole are running larger and larger current account surpluses, equivalent to two percent of their GDP in 2004. For most developing countries, these surpluses have been directed in part towards increasing foreign reserve accumulation in 2004. Foreign reserves held by developing countries grew by US$378 billion in 2004, to an estimated US$1.6 trillion—an all-time high. China held US$610 billion, India, US$125 billion, and the Russian Federation, US$114 billion.

For most countries, reserve accumulation is part of a sensible strategy to reduce external vulnerability and improve creditworthiness. For a few countries that have accumulated excess reserves, there are also risks, arising from the possible impact of changing exchange rates, and fiscal costs, from the need to borrow in local currency to offset higher reserves. As a result, high-reserve countries may need to reevaluate the desirability and sustainability of continued reserve accumulation.

Tightening global conditions also highlight the vulnerability posed by increased debt burdens, which have been at the heart of the financial crises over the last decade. The GDF notes good news in that, as aggregate external debt indicators are down, many developing countries have improved their capacity to manage debt, and acted aggressively to address the weaknesses that contributed to previous crises. But external debt burdens have risen in more than half of emerging market economies, and, in many, domestic borrowing has risen dramatically as well. Although the shift from external to domestic borrowing can reduce vulnerability to external shocks, it also carries risks from possible over-borrowing or inadequate supervision.

“While these risks should not be overstated, policymakers in developing countries need to keep them in mind,” said Jeffrey Lewis, Manager of the Bank’s Finance Team and Lead Author of the report. “As long as conditions remain favorable, efforts to strengthen fiscal positions and take advantage of low interest rates to restructure debt should continue. And the lessons from past financial crises remain clear – excessive borrowing, whether external or domestic, is risky, and problems in one arena can quickly spill over into the other.”

The report notes that the encouraging economic performance in developing countries in 2004 coincides with sound policies in those countries, namely openness to trade and investment, prudent fiscal stances, and exchange rate flexibility, all of which have improved the countries’ credit quality. These policies, it argues, have served developing countries well, and should be sustained.

Pressures on aid flows pose biggest risks for poorest countries

For low-income countries, risks from the current global environment are linked less to the evolution of interest rates and exchange rates (since they have only limited access anyway) and more to the possible impact on aid flows (from both bilateral and multilateral sources) and other financing sources. While the challenge of generating sufficient ODA to help these countries reach the MDGs remains large, there are some encouraging signs of progress, as a number of donors have increased their commitment levels and ODA flows have turned upwards. But there remain concerns about the increase in ‘net’ flows, and whether adequate flows are being directed towards crucial regions, such as Africa. ODA levels remain well below those reached in the early 1990s.

The GDF also highlights growing evidence that non-aid flows are becoming more important financing sources for poor countries – from rapid expansion in FDI outlined above, to grants from NGOs, which rose by US$5 billion between 1990 and 2003, up from 10 to 17 percent of official development aid. Workers’ remittance flows also rose, from US$116 billion in 2003 to US$125.8 billion in 2004. More broadly, South-South linkages are emerging as a key factor in poorer countries – in terms of FDI, remittances, and even development assistance. Such flows cannot and should not substitute for sustained and targeted official aid, they nonetheless highlight the growing options and opportunities open to low-income countries.

While alternative financing sources are important, the GDF notes that “industrialized country governments continue to play the leading role in mobilizing finance.” “To ensure that progress towards the MDGs is not derailed by lack of resources, donors must scale up ODA substantially,” Bourguignon said, citing the report’s observations. “But they must also seek to make these aid flows more stable and predictable, continue with initiatives to improve donor coordination and focus on results, and expand efforts to increase the engagement of the private sector in these efforts.”

Gains everywhere but South Asia and Middle East, as moderate slowdown seen

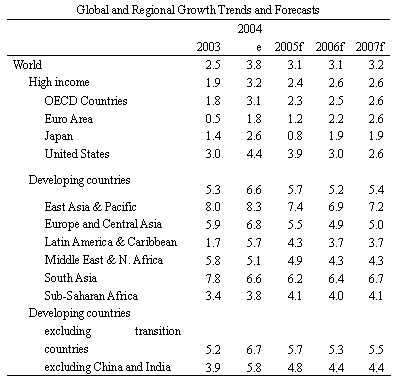

The GDF 2005 forecasts that global growth will slow down to 3.1 percent in 2005, as a result of increases in US interest rates, fiscal tightening, and the effects of the 25-percent real effective appreciation of the Euro. A reduction in demand for developing-country exports is expected to slow growth among them to 5.7 percent in 2005, which still remains above recent growth trends.

This comparatively buoyant growth among developing countries is led by East Asia, South Asia, and Eastern Europe and Central Asia, where regional GDP grew respectively by 8.3, 6.6 and 6.8 percent in 2004.

In East Asia, it is projected to slow in 2005 and 2006, but only to still-high levels of 7.4 and 6.9 percent respectively. High oil prices helped Russia’s growth and boosted Eastern Europe and Central Asia’s economies; their growth, overall, is expected to be 5.5 percent in 2005, and 4.9 percent in 2006.

Latin America and the Caribbean also experienced a strong rebound from 1.7 percent in 2003 to 5.7 percent in 2004, driven by output gains in Mexico, Chile and Brazil, along with a substantial bounce back in Argentina, following its real-effective depreciation of 39 percent. There too, growth is expected to slow down in 2005 and 2006, but only moderately, to 4.3 and 3.7 percent in 2005 and 2006 respectively.

South Asia and the Middle East and North Africa (MENA) were the only developing regions to register a slowdown in growth in 2004. Even if South Asia’s 2004 growth was impressive at 6.6 percent, this was down from 7.5 percent the previous year. MENA’s growth slowed to 5.1 percent in 2004, down from 5.5 percent the year before.

Economic activity in Sub-Saharan Africa increased by an estimated 3.8 percent in 2004, with virtually all countries reporting positive growth, and some reaching five percent. While the continent’s growth is expected to pick up, reaching 4.1 percent in 2005 and 4.0 percent in 2006, this will remain behind the performance of most other developing regions.

East Asia & Pacific GDF 2005 Summary

(China.org.cn April 7, 2005)