The World Bank launched China Quarterly Update on April 27, 2005, providing an update on recent economic and social developments in China, as well as findings from ongoing World Bank work on China. The full text follows:

Overview

Domestic demand is cooling down, but external demand keeps GDP growth high. Real fixed asset investment (FAI) growth was 17.2 percent year-on-year (yoy) in the first quarter of 2005, which is down from 24.9 percent in the year 2004, although up from the 15.5 percent in the final quarter of last year. Investments are shifting away from sectors previously considered as overheated such as steel and cement. Retail sales growth is gaining momentum, although consumption growth is still likely to lag GDP growth for the year. Tax revenues also suggest slowing in domestic demand, and trade data confirm this trend. At the same time, the rising trade surplus is boosting industrial production and kept GDP growth rate at 9.5 percent in the first quarter, the same as that in the fourth quarter of 2004.

Slower money growth indicates that external surpluses pose as of yet little risk for China's monetary policy. Money growth in the first few months of 2005 is compatible with the 15 percent growth target for the year, and the record balance of payment surpluses seem as of yet to pose little complications for monetary control. The authorities have announced measures encouraging capital outflows to dampen upward pressure on the exchange rate, although this might result in increased vulnerability down the road. The authorities have also taken steps to improve the operations of the foreign exchange market.

The macroeconomic outlook for 2005 remains favorable. Global growth is expected to slow down from its record 2004 level, but still remain robust, barring sharp adjustments in the dollar, global interest rates, and oil prices. For China, we expect further easing domestic demand growth, notably investment, on the back of limited credit growth and sliding profits. Inflation is likely to remain within the Government's target range, whereas China will retain its strong fiscal and external positions. We project a GDP growth of 8.3 percent and inflation of 3.5 percent.

Given the constellation of risks, prudent economic policies are appropriate. Domestically, risks are on the upside, particularly on investment. Externally, downside risks appear to dominate, largely weaker than expected world growth and complications stemming from the large trade surplus.

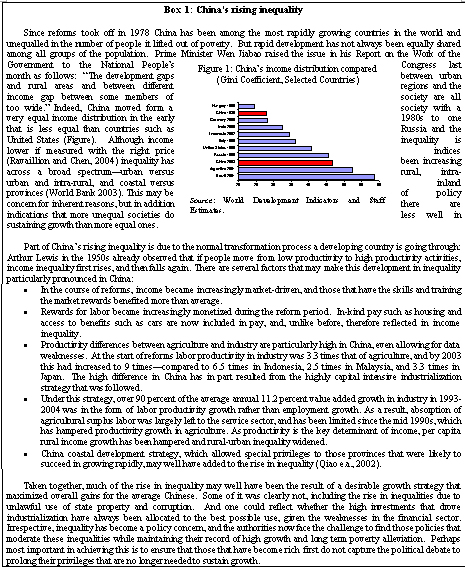

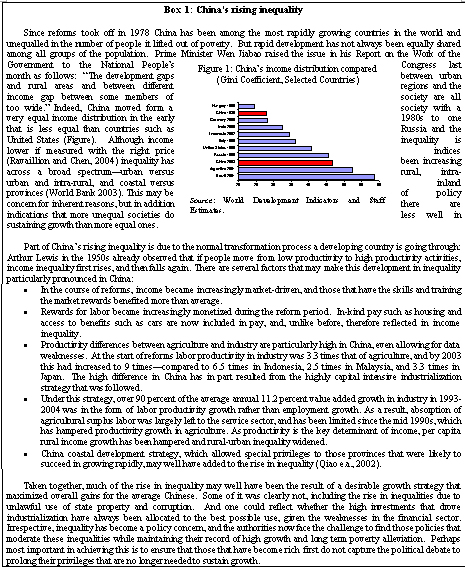

The National People's Congress' March session confirmed a broadening of Government policy objectives. Beyond growth, these now include improving the quality of growth and the creation of a harmonious society. New areas of policy focus include:

· Agriculture and rural areas; including by increasing productivity, improving rural infrastructure, and speeding up the transfer of rural surplus labor. The latter is key for boosting rural incomes and mitigating urban-rural inequality.

· "Weak links in social development," including

o education, where a new initiative aims at improving access in poor areas, and

o support for counties and townships in financial difficulties.

· Changing the role of the government, with Premier Wen Jiabao emphasizing the need to move toward a service-oriented government that withdraws from attracting business and investment and intervening in production.

Recent Economic Developments and Outlook

Changing composition of demand abates overheating concerns

A rebound in investment in early 2005 raised concern among analysts, but the trend remains one of a slowdown, and the changing composition should give some comfort to policy makers that the policies introduced in 2004 are working. Fixed asset investment grew by 17.2 percent year-over-year (yoy) in the first quarter in real terms, which is up from the 15.5 percent growth in the last quarter of 2004, but still lower than the 24.9 percent in 2004 (Figure 3). Moreover, the number of new projects declined in January-February, with a 6.6 percent fall in new investment volume. The differences in the pace across sectors reflect last year's administrative tightening policies: investment in industries considered bottlenecks, such as coal mining, oil refining and utilities, grew rapidly, while investment in metals and non-metal mining industries, which were considered as overheated in 2003 and 2004, actually fell (yoy) in the first few months of 2005.

A sector that has attracted the authorities' attention is real estate. Nominal investment in this sector grew 26.7 percent in the first quarter (yoy), amidst price increases of around 10 percent for rents and housing prices according to a recent NBS-NDRC survey. In real terms, real estate investment growth is thus broadly in line with overall investment growth. Moreover, possible regional bubbles notwithstanding, double-digit growth in real estate is not necessarily excessive, particularly for a rapidly growing economy in which housing services still takes up a small share of household consumption. Nevertheless, the authorities announced steps to help damp investment in this sector, including a tightening of credit and land supply. Mortgage interest rates were increased, and the recommended down payment on houses was increased from 20 to 30 percent of the price. The city of Shanghai announced that owners could only sell their property after they have paid off their mortgage. While such steps will take time to have effect, the announcement may already affect market expectations, which in turn could help curb real estate investment.

Household consumption has remained buoyant in the wake of strong household income and employment. Urban per capita income increased 11.3 percent in the year to January-March, and rural per capita cash income increased an even higher 15.9 percent. Nominal retail sales grew by 13.7 percent in the first quarter (yoy), compared to an average of 13.3 percent in 2004. (Figure 4).

Exports have continued to soar in 2004, while imports have slowed down significantly. This has provided a boost to industrial production and overall GDP growth, but the resulting rise in the balance of payments surplus may complicate monetary management. Merchandise exports rose by 34.9 percent in January-March 2005 (yoy), whereas import growth slowed to 12.2 percent, reflecting an easing of domestic demand growth, as well as a particularly high base in early 2004 (Figure 5). As a result, the trade surplus reached US$16.6 bn. in the first three months, compared with a US$8.4 bn. deficit in the same period last year. If current trends were to continue, the trade surplus in 2005 would reach well over $100 bn., compared to $32 bn. last year. However, a closer look at the driving forces of the turn-around in the trade balance indicate that a significant component is cyclical, and should diminish in importance in the course of 2005.

The turnaround in trade flows was particularly pronounced in basic materials (Figure 1).[1] Domestic demand for these products cooled off as sectors such as construction and cars were affected by the policy tightening, and, in the case of cars, by the prospects of reduced tariffs next year. In contrast, production capacity had expanded rapidly due to high investment in previous years. For example, crude steel output capacity will have increased about 40 percent between 2003 and 2005. With strong incentives to sell abroad, these industries suddenly turned from net importers into large net exporters. A more secular improvement in the trade balance of "machinery and transport equipment" (SITC 7) is related to the rapid development of the electronics industry in China. Sourcing an increasing share of components from domestic suppliers, this sector contributed over one-quarter to the total turnaround. The increase in textile exports after removal of the Multi-Fiber agreement has made a more modest contribution. In fact, growth in textile exports is lagging that of overall exports, and China's trade surplus in this sector declined in the first few months of the year. But in markets previously protected by the Multi-Fiber Accord, China's market share still grew rapidly.

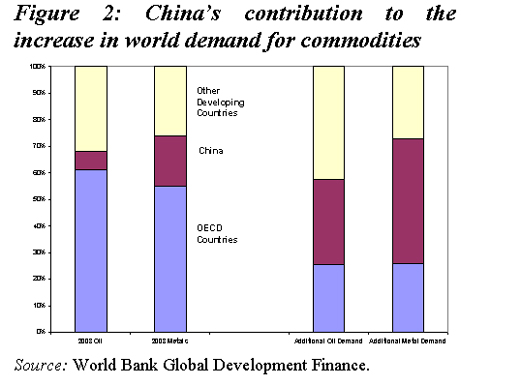

China's terms of trade deteriorated further in 2004. Their deterioration by about 5 percent translated in a 1.5 percentage point of GDP purchasing power loss. This was in spite of an increase in export prices of 5 percent in 2004. However, import prices, notably commodity prices, rose more rapidly, and China's appetite for commodities was contributing to this trend. Although China's share in the world demand for oil (7 percent) and metals (19 percent) is still modest, the countrie's take in the additional demand is high: about 1/3 of additional oil demand and almost half of additional metals demand in 2004 (Figure 2).

Driven by strong external and to a lesser extent consumer demand, industrial production rose 15.1 percent year on year (yoy) in January-March, up from 14.4 percent in December (Figure 6). The metallurgical and electronic industries grew particularly rapid, by 26.8 percent and 19.1 percent in January-February, followed by the chemical industry, electricity production, telecommunication instruments and textiles industries, while automobile output was sluggish.

The strong showing of exports and industrial production led to GDP growth in the first quarter of 2005 of 9.5 percent, the same as the fourth quarter of 2004. Nevertheless, with a significant component of the trade

turnaround cyclical, its impact on GDP growth should decline throughout 2005.

Inflation slowed down. The increases in the overall PPI and the PPI for raw materials declined to 5.6 and 10.1 percent (yoy) in January-March, from their peak in October 2004 of 8.4 and 14.2 percent (Figure 7). Tariff cuts, productivity gains, and intense competition continued to push down many consumption goods prices, while prices of food and housing increased by 6.1 and 5.6 percent (yoy). CPI inflation reached 3.9 percent in February, boosted by the spring festival holiday, but then fell to 2.7 percent in March.

The outlook remains favorable

The macroeconomic outlook for 2005 remains favorable. Although world growth is likely to come down from the record 3.8 percent in 2004, with 3.1 percent it is still above trend. World trade is expected to grow by 7.7 percent, 2.5 percentage point below 2004 growth. On the back of moderate credit growth and sliding profitability, domestic demand is likely to ease, although it remains robust. We expect moderate underlying inflation pressures, and strong fiscal and external positions. The authorities' (indicative, non-binding) targets for 2005 are a GDP growth rate of 8 percent and average CPI inflation of 4 percent. We project GDP growth of 8.3 percent and average CPI inflation of 3.5 percent, recognizing that the newly released data suggests upward risk to our projection (Table 1).

Risks remain, domestically as well as on the international front. Domestically, risks are still on the upside, as a rebound in investment activity remains a possibility as long as the incentives on local governments to pursue growth remain unaltered and real interest rates remain low. Internationally, the biggest risk is a slowdown in growth in key markets, although China's strong external position (including low external debt) provides a buffer. Further, the rapidly increasing trade surpluses may yet compromise monetary management, while it could also result in mounting trade tensions, especially in sectors such as textiles, where China's exports shifted to markets previously protected under the Multi-Fiber Accord.

In these circumstances, the prudent monetary and fiscal policies the government has announced remain appropriate, if this means that there is flexibility to adjust the policy stance to changing circumstances. Over time, implementing the Government's goal of a more flexible exchange rate regime would help in focusing monetary policy more on domestic goals.

Economic and Social Policies

Macroeconomic management

Fiscal policy -- intended to remain prudent

In 2004, fiscal policy started to withdraw stimulus from the economy. Of the RMB 406 bn. (3 percent of GDP) of higher than budgeted revenue, RMB 248 bn. (1.8 percent of GDP) was spent, of which RMB 128 bn. (0.9 percent of GDP) on repayment of arrears on VAT rebates and the remaining RMB 120 bn. (0.9 percent of GDP) in other spending. If the latter payment is considered to be a repayment of debt, and therefore a below-the-line item, the deficit was, with 0.6 percent of GDP, considerably smaller than the 2.8 percent recorded in 2003, as well as the planned 2.5 percent of GDP for 2004.

Fiscal policy is to be "prudent" in 2005, as announced in Minister Jin's report to the NPC plenum. Targets for 2005 include a fiscal deficit of 2 percent of GDP, and a decrease in the issuance of construction bond to RMB 80bn., RMB 30bn. less than in 2004. Compared to the outcome in the deficit in 2004, a 2 percent deficit still seems rather large for an economy that still faces considerable demand pressures. However, with a growth assumption of 8 percent underlying the fiscal numbers there is again considerable potential for revenue growth higher than budgeted. Indeed, in the first three months of the year, revenue growth amounted to 20.4 percent -- lower than last year's 25.7 percent, but still far outpacing the projected 11 percent even though the slowdown to a 17 percent increase (yoy) in March reflects the expected slowdown in domestic demand. It would be prudent to refrain from spending these additional revenues, or use them to pay off debt, either directly, or indirectly, for instance by replenishing the Social Security Trust Fund.

Monetary and exchange rate policy -- monetary independence intact

Though large and potentially volatile external surpluses have complicated monetary policy operations, they have not affected the people's Bank of China's (PBC) ability to reduce money growth to 14 percent (yoy) at end-March, below the year-end target of 15 percent. With CPI inflation projected to be broadly in line with the target of 4 percent in 2005, pressures for further tightening of the overall monetary policy stance have receded.

In March the PBC cut the interest rate paid on commercial banks' excess reserves from 1.62 percent to 0.99 percent, leaving the interest rate paid on required reserve unchanged at 1.89 percent. While the decline may induce more liquidity in the market, it facilitates the development of the currency market by establishing a better-structured yield curve. It should also lower the cost of sterilization operations.

The concerns about overheating of the real estate sector have, however, also led the PBC to effectively raise the interest rate for mortgage loans by 20 bp, by changing the formula that links the mortgage rate to the commercial lending rate -- from a level lower than the commercial lending rate to no less than the lower band of commercial lending rate, or 90 percent of the benchmark lending rate. Bringing the long-term mortgage rate to 5.51 percent, compared to targeted inflation of 4 percent, this move has only limited impact on the incentives for real estate investment stemming from a relatively low interest rate. The PBC also encouraged commercial banks to raise the ratio of the initial down payment from 20 to 30 percent.

In its 4th quarter 2004 monetary policy implementation report, the PBC announced planned structural and institutional reforms, including building up pricing capacity among financial institutions, developing financial market, carrying forward banking reform, and deepening foreign exchange management reform.

Increasing exchange rate flexibility and relaxing capital controls -- what is the right order?

In response to increasing pressures on the RMB, as China's foreign exchange reserves rose by a record $206 billion in 2004 and the trade balance has shifted into a large surplus, the government is resisting rapid changes in the exchange rate regime but has announced a series of measures to encourage capital outflows.

Premier Wen Jiabao announced that China would change its exchange rate regime in an unexpected manner and at an unexpected time. Meanwhile, the experiment with market makers in the foreign exchange wholesale market has been widely viewed as part of a pragmatic movement toward a more flexible exchange rate regime.

The measures to encourage capital outflows include: encouraging Chinese companies to invest overseas through the "go global" initiative, allowing Chinese insurance companies and pension funds to invest in overseas stocks, giving companies more freedom to transfer foreign currency assets abroad, and letting them keep the capital raised abroad. In addition, companies are now allowed to keep their current account foreign currency receipts abroad longer. The government announced it will take further steps to liberalize outflows towards "full convertibility of the yuan".

So far these measures have not yielded significant capital outflows. Indeed, given the current favorable market sentiment, such policies are unlikely to be effective in reducing net capital inflows or counter pressures on the currency in the near term. In fact, the relaxation of restrictions on capital outflows may encourage more inflows as investors see that it has become easier to move the assets abroad in the future if necessary, hence reducing the risk of speculating inflows (Prasad, Rumbaugh and Wang, 2005). [1]

Relaxing controls on capital outflows too fast could increase vulnerabilities down the road. In particular, once the global economic situation changes and market sentiment turns -- for example, with a sharp rise in the US interest rates, or a weakening of China's growth prospects -- the relaxation of capital outflows will make it easier for capital to flood out. The resulting increased variability in capital flows would increase the vulnerability of China's currency and financial system. Given the already existing vulnerabilities in the domestic financial system, it may be appropriate for China to move slowly and cautiously in further liberalizing the capital account.

Structural, institutional, and social policies -- a broadening of policy objectives

The favorable macroeconomic outlook, on the back of an impressive growth record, allows policymakers to broaden policy objectives. As outlined by Premier Wen Jia Bao, in his speech to the March National People's Congress, the government's objectives are now to create a "harmonious society" and focus on the "five balances" including the balance between economic and human development, domestic and external economy, man and nature, rural and development, and interior and costal development. For 2005 the Prime Minister announced the policy priorities to be (i) the government's function and organization; (ii) SOEs and corporate governance; (iii) the financial sector; (iv) rural finance; and (v) social security.

Modifying the pattern of growth and growth strategy

Under the capital and resource intensive growth strategy focused on industry, since the early 1990s, urban job creation has been modest despite strong growth, which has hampered the reduction in urban unemployment and the transfer of surplus labor out of agriculture, and fuelled urban-rural inequality. A changing pattern of growth, with more growth of services sector and more urban employment growth, would have favorable impact on urban employment and urban-rural inequality.

As the heavy and chemical industries continued to outperform other industries, a debate has ensued on whether China should follow the experience of Japan and Korea by encouraging the development of heavy and chemical industries. Local economists are divided on the issue: some argue that the development of heavy and chemical industries is unavoidable, and that the market should decide. Others argue that their development should be discouraged in light of their unfavorable impact on natural resources and the environment, and limited job creation. A third group argues for "smart" development of heavy and chemical industries by introducing energy-saving and environment-friendly technologies.

Public finances -- the key instrument in striving to a harmonious society.

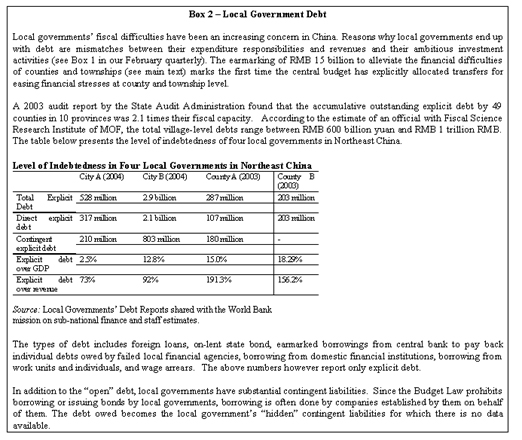

The government intends to shift spending from financing infrastructure investment to providing public goods and services. In light of the above refocusing, the 2005 budget identifies as key targets: agriculture and rural areas; counties and townships in difficulties; and investment for weak links in social development (education and health); although many of the specified policy initiatives appear modest in 2005.[2]

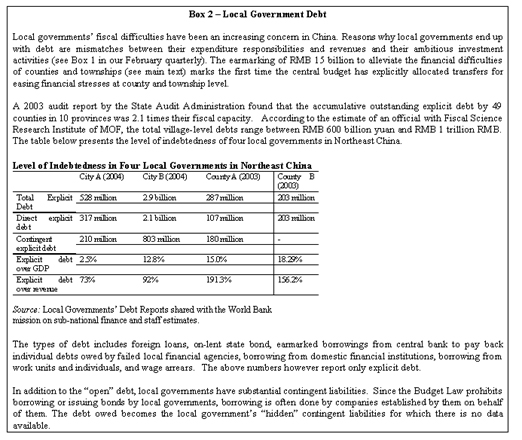

The government's "3 rewards and 1 subsidy" initiative recognizes the significant fiscal problems of counties and townships, it tries to structure a set of incentives and sanctions to improve local fiscal performance, and recognizes that local spending is often inefficient and that counties and townships may be overstaffed. RMB 15 billion (0.1 percent of GDP) is allocated for central government transfers to county-level government, based on performance judged using criteria including streamlining of the local government. Nevertheless, expectations on its impact should be modest, given that the size of the transfers involved is limited and there is little international evidence that transfers have been used effectively as an incentive to increase local revenue mobilization. The initiative does also not address the deficiencies in the intergovernmental fiscal system. Further reforms aimed at increasing local revenues could usefully consider giving local governments more local autonomy in taxation, reducing the overall level of transfers in the system and targeting them better to the poorest areas, and linking tax payments to services delivered.

More fundamental reform of the intergovernmental fiscal system would entail:

(i) a change in expenditure assignments, funded by a change in revenue assignments; (ii) a change in the transfer framework to move away from earmarked transfers to general transfers and revenue assignments; and (iii) improving the efficiency of local governments by increasing the decision making autonomy, but combined with mechanisms to hold them accountable for performance.

The initiative to improve access to education in poor areas includes giving education subsides to rural students in primary and middle-school, exempting them from tuition, text books, and living expenditure in case of boarding schools.

|

|

Other fiscal and taxation reform initiatives announced during the NPC session include raising the threshold of individual income tax, adjusting the consumption tax, and providing fiscal support to bank reform including through direct capital injection. Not agreed for 2005 were unification of foreign and domestic companies' corporate income tax regimes and introduction of a fuel tax.

Changing the role of the government

Changing the role of the government, especially separating government functions from enterprise management, has been on the reform agenda for a long time. In this year's NPC report, Premier Wen gave the subject particular attention and turned the focus on some new aspects of government reform. Emphasizing the need to move toward a service-oriented government, Premier Wen called for (i) streamlining local government agencies and work force (at county and township levels) to both make government more efficient and reduce the financial burden on farmers; (ii) shifting the composition of public spending towards public services and dealing with social issues; (iii) withdrawing from making decisions or working to attract business and investment on behalf of enterprises or directly intervening in production and operations; (iv) cutting red tape.

The increased emphasis on the role change of the government and the identified specific areas are important steps in the long process of government reform. It will take a great deal of complementing measures, capacity building, and fiscal resources to make the process a full success. Reforms to bring about changes in the role of the government along the lines the Premier outlined would include:

· Redefine public expenditure priorities towards social welfare and public services -- in order to change local governments' expenditure priorities, this also entails changing the criteria on which local government officials' performance is measured;

· Reform the inter-government fiscal system to ensure local governments in rural and poor regions are able to provide basic public services (for example, health and education);

· Streamline local government agencies and work force by merging some of the villages and township level governments, and redefining local government functions and structure;

· Streamline administrative and business approval procedures, and reduce the power of government agencies in approving investment projects and granting ad hoc preferences (such as tax);

· Pursue further SOE reforms in the following aspects: fundamentally reform the selection and evaluation of senior managers; continue to shift SOEs' social functions to the government; reform the utilities (transportation, railway, postal, urban utilities) to allow for market access and better services.

Financial Sector -- Policies for banking stability in China

When the recapitalization of China's big banks is completed, it will represent the largest injection of fiscal or quasi-fiscal funds in any banking system in history. This has been accomplished without disturbing confidence or interrupting the steady increase in banking depth.

Yet, success in avoiding financial instability may have come at the price of slower progress in structural improvements in the Chinese financial system needed to ensure that it is better geared to providing the financial services needed by China to support sustained and broad-based economic growth, and in particular by a heightened moral hazard.

Recognizing the moral hazard that is involved in generous compensation (including compensation for investors with securities companies, and depositors at trust and investment companies), as well as the cash costs, the authorities have recently moved to limit somewhat the costs that they will absorb. A ceiling of RMB 100,000 has been fixed, beyond which the authorities will only cover 90 percent of individuals deposits.

In addition, vigorous steps have been taken to reduce the flow of new non-performing loans at the big 4 banks (including by sanctioning no fewer than 58,000 responsible officials in two state banks alone).

As the authorities move to formalizing arrangements for depositor and investor protection, it will be important to take account of international experience in design of these arrangements to minimize moral hazard, including governance structures, funding (whether in advance or not), whether membership is compulsory, the sensitivity of premia to measures of risk, and above all to the level of coverage.

There is also a need for improved planning for crisis-preparedness, including better coordination procedures among the relevant agencies; and better modeling of institutional and systemic risk, which in turn requires more and better information both for the regulatory authorities and to be disseminated to market participants. After all, the signals provided by a well-informed and motivated market can also help the prudential regulators detect emerging problems as well as discouraging reckless behavior on the part of intermediaries.

It would be easy to point out how modest is the degree of co-responsibility newly proposed for individual depositors, and how gradual has been the process of privatization of state-owned banks. Yet, the authorities' success in avoiding any replication of the financial collapses or surges of high inflation that have accompanied the process of transition from a planned economy in so many countries offers the prospect that future policy decisions will continue to strengthen the financial system.

Corporate Sector Developments

China's manufacturing sector saw rapid expansion in 2004, without, on the whole, a weakening of financial indicators (Table 2). Sales growth was particularly high in coal, ferrous mining, furniture, and smelting, and profit growth in coal, oil and gas, mining, food processing, petroleum refining, smelting, metal products, and machinery. With net fixed assets growing somewhat less than sales, there were no obvious signs of over-investment. And, with liabilities only just outpacing overall net fixed assets growth, the overall liabilities/asset ratio increased only slightly, to 0.59, indicating leverage (liabilities/equity ratio) of 145 percent -- far below averages for companies in South Korea, Thailand, and Indonesia prior to the 1997 financial crisis.

|

A few caveats are in order. First, while overall investment seems generally in line with sales growth, anecdotal evidence suggests that many investments (e.g., in basic materials) are too small to be economic. This may reflect the role of local (e.g., municipal) state shareholders in capital investment decisions. Uneconomic capital investments could be a particular problem for cyclical industries in the next (inevitable) downturn. Second, the limited use of international accounting standards (i.e., just by publicly-listed companies and foreign-invested enterprises) warrants careful interpretation of financial indicators.

High overall profitability in state-owned enterprises (SOEs) has been driven by good performances in the basic materials sectors. On the other hand, 35 percent of SOEs remains loss making. Foreign-invested enterprises (FIEs) represent 25 percent of manufacturing assets, but 31 percent of sales and 30 percent of profits in 2004. A slight drop in their overall profitability possibly reflects tighter competition and higher input costs. Domestic-invested private enterprises (DPEs) in manufacturing are generally relatively small, with lower profitability and higher leverage than other firms. Their net fixed assets growth slowed in 2004 to 57 percent (from 60-100 percent during the prior three years). Given the high tempo of borrowing and investing by these DPEs, it is reasonable to expect some to make mistakes and fail.

Key current developments and issues include the following:

· With profits increasing, an important emerging issue for the central State-Owned Assets Supervision and Administration Commission (SASAC), the central government shareholder, is what cash surpluses to extract from centrally-administered SOEs in the form of dividends and whether to reinvest these in existing or new SOEs or return surplus cash to the ministry of finance.

· Local (e.g., municipal) SASACs, which oversee about 85 percents of China's SOEs, have greater management challenges. Locally-administered SOEs are often of lower quality, especially in northeast, central, and western China. Sales of loss-making SOEs are often hampered by the inability of local governments to finance "reform costs," including settlement of excessive enterprise debt and unfunded pensions and other benefits for redundant workers. A systemic response to the SOE reform costs issue (e.g., central/local government cost-sharing) seems warranted.

· An initiative in selected locales (e.g., Beijing, Tianjin, Chongqing, and Heilongjiang) to place local financial institutions (e.g., city commercial banks, securities firms) under local SASACs warrants further consideration. While the risk of politically-motivated directed lending is perhaps inevitable, it would at least make sense for local financial institutions to have a separate reporting chain through local finance bureaus to the ministry of finance, since these could well end up being charged with re-capitalization if any local financial institutions fail.

· China still lacks a modern market-based insolvency system. This is especially significant for China's emerging segment of domestic-invested private manufacturers. As noted earlier, these may tend to be less robust than other manufacturing segments in China. Introduction of a new enterprise bankruptcy law that provides sufficient protections for secured creditors would strengthen the legal environment for the private sector.

_______________________________________________________

[1] SITC 6: including steel, aluminum, chemicals, cement.

[2] Eswar Prasad, Thomas Rumbaugh and Qing Wang, 2005, IMF policy discussion paper PDP/05/1.

[3] China's fiscal transparency could be improved to inform policy makers better. The information on the 2004 fiscal outcome and 2005 budget released during the NPC plenum does not allow verification of actual expenditure increases in priority areas.

(China.org.cn April 27, 2005)