Cycle maker gets Buffett share bump

|

|

|

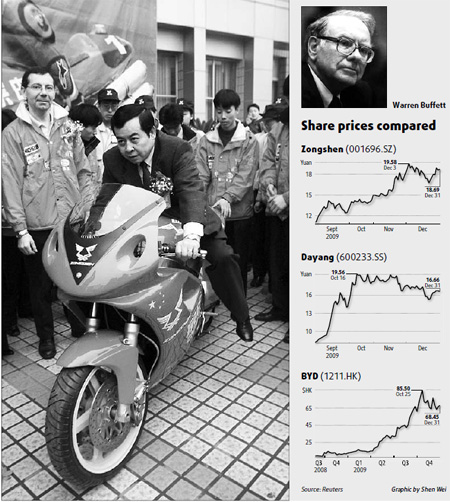

The chairman of Chongqing Zongshen Power Machinery Co Ltd, Zuo Zongshen, test rides one of the company's new motor cycles. Media reports said Warren Buffett has expressed an interest in the Shanghai-listed firm. [China Daily] |

Everything that Warren Buffett mentions an interest in turns magically to gold, or at least it appears to in China.

The most recent beneficiary of Buffetts' influence over Chinese markets is Zongshen Power Machinery Co Ltd, a Chinese motorcycle maker that has captured market attention after media reports said the US investment guru had shown an interest in the company.

Just last Friday a rumor that company's chairman Zuo Zongshen was heading to the US to meet with Buffett this month sent the company's shares soaring to hit the 10 percent trading limit, closing at 20.1 yuan. The market value of the company skyrocketed to 1.1 billion yuan and trading volume also surged substantially that day.

Yesterday, Zongshen confirmed the meeting but declined to provide additional details. Its stock was suspended from trading yesterday.

Zongshen Power's ambitious energy sector expansion plan is believed to be the main reason for the meeting between its chairman Zuo and Buffett. It remains to be seen whether Buffett will invest in the company or not.

Last November, Zuo announced his company's plan to expand into the business of new energy, including the production of lithium batteries and electric motorcycles. The company is also actively seeking long-term strategic partnerships in the field, taking advantage of China's booming green revolution.

There has been widespread speculation that Zongshen Power could become another Buffett-backed stock after Chinese electric car-and-battery maker BYD and suit maker Dayang Trands. Both firms saw a sharp surge in their share prices after Buffett's endorsement.

The stock price of BYD has undergone a six-fold leap since September 2008 when MidAmerican Energy - a unit of Buffett's Berkshire Hathaway - agreed to buy a 10-percent stake in BYD for $230 million.

A similar incident occurred at Dayang Trands, a Dalian-based suit maker. Its share price rallied more than 200 percent from 8 yuan to 20 yuan in less than a month after Buffett said he had tossed out all his old suits to wear only the Trands brand.

But analysts urged caution when engaging in speculative trading of Zongshen's shares because the company's plan to expand into the new energy sector has not yet been completed.

"The company just made the announcement but no substantial moves have been taken," said Huang Shichuan, an analyst at Southwest Securities. "Any sharp surge in stock prices will be risky for investors to follow in the short term."

Huang said that the stock may rally again after trading resumes, Buffett's impact may already be factored in.

"The current price is really at a reasonable level that accurately reflects the company's fundamentals," Huang said.

0

0

Go to Forum >>0 Comments