Yuan drops 2nd day after policy adjustment

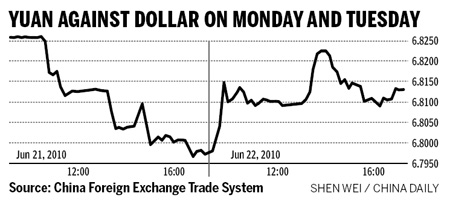

The yuan fell against the dollar on Tuesday, despite a jump in the reference central parity rate set by the central bank.

The People's Bank of China set the central parity rate of the yuan against the dollar at 6.798 on Tuesday, compared with 6.828 on Monday.

The Chinese currency rose by more than 0.4 percent - the biggest rise in a day since its revaluation in 2005 - on Monday, close to hitting its trading limit of 0.5 percent.

But the yuan on Tuesday saw its biggest decline since December 2008, weakening 0.23 percent to 6.8136 per dollar, the China Foreign Exchange Trade system in Shanghai showed.

"The central bank does not want to see a strong, one-way revaluation of the yuan, as indicated by its weekend statements," said Liu Dongliang, currency analyst of China Merchants Bank.

"But the dollar has been strong on the international markets in the past two days and it's normal for the yuan to weaken against the dollar today," he said.

The yuan will not rise continually and strongly, Liu said, going against expectations of some US politicians and industry players.

The Fair Currency Coalition (FCC), an alliance of US industry, agriculture, and worker organizations, on Monday urged the US Congress to pass effective legislation on the yuan issue, despite China's pledge to make its currency more flexible.

"Even if China allows the yuan to rise by 3 to 5 percent over the next few months, it would come nowhere close to eliminating the yuan's estimated 35 to 40 percent undervaluation relative to the dollar," FCC Executive Director Charles Blum said.

Still, industry analysts were cautious that the new policy change would benefit the US economy as maintained by yuan revaluation advocates.

While the US has failed to provide solid proof that the yuan is undervalued by up to 40 percent against the dollar, Brenda L. Foster, President of American Chamber of Commerce in Shanghai, warned that the yuan policy move will not significantly reduce the US trade deficit with China.

The trade imbalance will only be solved through increased US exports, she said. "I do believe that it is the exports that will make a difference in US-China trade imbalance and not necessarily the yuan flexibility or what it pegs to," Foster said.

Foster told China Daily on Monday that the US government should revise current high-tech export controls to boost exports.

The revision of the US high-tech export control system is very important for a large number of US companies exporting to China because many deals cannot be done under the current system, she said.

Foster said she did not think the US trade deficit with China will drop quickly, although China's move to give more flexibility to the yuan will increase Chinese purchasing power for products from foreign countries.

Most US producers in China are serving the Chinese market and less than 22 percent of their exports are for the US, she said.

The central bank said it will proceed further with the reform of the yuan exchange rate regime to enhance its flexibility, although it ruled out fast, one-off revaluation.

"I think it takes an irritant off the table on the US-China relationship," US Ambassador to China Jon Huntsman told reporters in Hong Kong on Monday.

Tan Yingzi in Washington, Timothy Chui in HK and Bloomberg contributed to this story.

0

0

Go to Forum >>0 Comments