Manufacturing continues to expand

|

|

|

Workers process cotton in the Xinjiang Uygur autonomous region. Hikes in the prices of raw materials such as cotton are cited for an increase in the purchasers' price index. [China Daily] |

Operating conditions for China's manufacturing sector continued to strengthen in October, showing the best improvement in six months, but analysts warned the figures could also point to rising inflationary pressure.

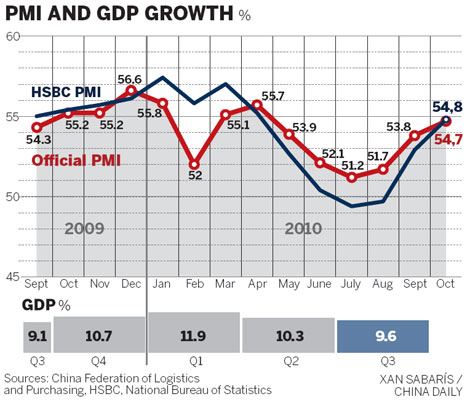

The official Purchasing Managers' Index (PMI), which measures the nation's industrial activity, rose to 54.7 in October, marking the 20th straight month that it has come in higher than the economic expansion boundary number of 50, the China Federation of Logistics and Purchasing (CFLP) said on Monday.

The PMI rose by 0.9 from 53.8 last month, indicating that the country's industries continued to gear up after year-on-year economic growth slowed in the second and third quarters, compared with the first.

China's year-on-year GDP growth reached a red-hot 11.9 percent in the first quarter, before slowing to 10.3 percent in the second and 9.6 percent in the third. However, it has shown an upward trend month-on-month in the third quarter.

"The (PMI) data reinforced the improvement of the Chinese economy since July, and indicated continuously stable economic growth in the fourth quarter," said Dong Xian'an, chief economist of Industrial Securities.

The output sub-index under the October PMI rose by 0.7 to 57.1. Meanwhile, the order sub-index exhibited a mixed performance as export orders dropped by 0.2 to 52.6 and new orders increased by 1.6 to 58.2.

The biggest contribution to the general improvement came from the purchase price sub-index, which climbed 4.6 to 69.9 in October. It has surged by more than 60 percent for three straight months.

"Noticeably, the overall sound performance of China's PMI was mainly propelled by purchase prices instead of core indices such as output and orders," said Australia & New Zealand Banking Group Ltd in a report.

"Analysts had expected a lower PMI number because China's electricity consumption has shown a month-on-month decline for several months - usually the index peaks in the third quarter before retreating in the fourth," the report said.

It also said the continuously rising purchase price sub-index may result in serious pressure on consumer prices.

"The jump in output prices reflects higher input costs amidst strong demand, which also heralds a higher consumer price index (a main measure of inflation) likely to reach its cyclical peak in October," Qu Hongbin, chief China economist and co-head of Asian Economic Research at HSBC, said.

Also published on Monday, the seasonally adjusted HSBC PMI climbed to 54.8 from 52.9 in October, representing one of the largest month-on-month rises since the index started being compiled in April 2004.

It suggested strong momentum in domestic demand will mean growth of around 9 percent GDP in the fourth quarter, despite the still soft increase in new export orders, Qu said.

0

0

![Workers process cotton in the Xinjiang Uygur autonomous region. Hikes in the prices of raw materials such as cotton are cited for an increase in the purchasers' price index. [China Daily] Workers process cotton in the Xinjiang Uygur autonomous region. Hikes in the prices of raw materials such as cotton are cited for an increase in the purchasers' price index. [China Daily]](http://images.china.cn/attachement/jpg/site1007/20101102/0011111fa1560e39a9d702.jpg)

Go to Forum >>0 Comments