Concerns grow as Shanghai GDP trails national average

|

|

|

Workers walk at a construction site in Shanghai. The city's 9.9 percent year-on-year GDP growth for 2010, lower than the national average, has sparked concerns.[China Daily] |

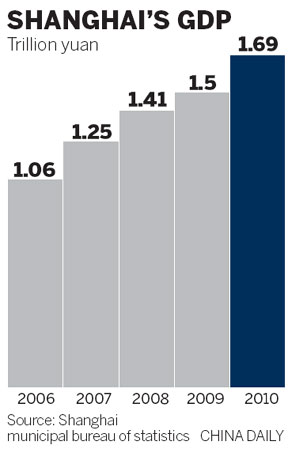

Shanghai's GDP growth in 2010 fell behind the national average for the third successive time, raising concerns over the development outlook of the eastern financial hub that has the biggest city economy in China.

The city's growth had outpaced the country for more than a decade before 2008, when its GDP growth first fell below 10 percent in 17 years. Analysts say the slowdown is a result of the city's effort to transform its development model.

According to figures released on Tuesday by the municipal government, Shanghai's economy grew 9.9 percent in 2010, four percentage points lower than the national average of 10.3 percent.

In the October-to-December period, GPD grew just 5 percent, 4.8 percentage points lower than the national average.

The 9.9 percent growth follows an 8.2 percent growth in 2009 and 9.7 percent in 2008.

The city's draft of 12th Five-Year Plan (2011-2015) released last year says economic growth will average about 8 percent over the next five years.

"One reason for the slowdown is the city's relatively large comparison basis, but the more important reason is that the city is aiming to restructure its economic growth model and is focused more on quality than speed," Cai Xuchu, spokesman for Shanghai municipal statistics bureau, said in a news conference on Tuesday.

Lu Zhengwei, chief economist of Industrial Bank, said he is "pleased" rather than frustrated to see the city's growth slow down.

"Shanghai's economic development had reached a point where growth can no longer be driven by massive investment and expansion," he said. "The city's land resources and environment can't afford the extensive growth model that it used over the past 20 years."

The city's fixed assets investment edged up 0.8 percent in 2010 to reach 531.7 billion yuan, slowing down from a 9.2 percent growth in 2009, the government said on Tuesday.

"To let the service sector drive the city's growth is a more sustainable way. And it's inevitable if Shanghai is really to become an international financial center by 2020," Lu said.

Yan Wei, chief economist with Oriental Securities said the city's move to shift its labor-intensive low-end manufacturing industry to China's less-developed middle and western regions also contributed to the slowdown.

"Development of labor-intensive manufacturing industry used to contribute significantly to Shanghai's growth, but now increased labor costs have cut the city's competitiveness in the area."

The average annual salary in the city reached 42,789 yuan ($6,500) in 2009, nearly triple the figure in 2000, while total salaries surged to 259.4 billion yuan in 2009 from 61.4 billion yuan in 2000, according to the yearbook of Shanghai's Municipal Statistics Bureau.

Lu said Shanghai's slowdown in growth is "inevitable" for the city to transform its development model.

"Developed nations, such as Japan and South Korea, have all gone through similar stages on their economic development path where they sought to upgrade their industries," he said.

Shanghai's mayor, Han Zheng, said in a news conference on Jan 21 that the next five years will be a critical time for the transformation of the city's growth model.

"Shanghai will deepen its growth model, restructure in the coming years and maintain the growth momentum, the city has to make breakthroughs in the development of the financial service sector and high-tech industries over the next five years," he said.

Oriental Securities' Yan said that while it's the right decision for the government to develop the financial services sector, the city still faces an uphill task in achieving that goal.

"Honestly speaking, Shanghai still has large gaps in many areas when compared with the world's leading financial centers, such as New York and London. And the one area that is most important is talent; in the financial services sector, talent is very important."

He said tax in Shanghai is too high and the government should cut income tax to draw talent to the city.

"One important reason why so much talent chooses to stay in Hong Kong is that income tax there is much lower than in Shanghai. Some of them even choose to fly between the two cities rather than staying in Shanghai due to its high tax," Yan said.

0

0

![Workers walk at a construction site in Shanghai. The city's 9.9 percent year-on-year GDP growth for 2010, lower than the national average, has sparked concerns.[China Daily] Workers walk at a construction site in Shanghai. The city's 9.9 percent year-on-year GDP growth for 2010, lower than the national average, has sparked concerns.[China Daily]](http://images.china.cn/attachement/jpg/site1007/20110126/0011111fa1560ea9c80f0a.jpg)

Go to Forum >>0 Comments