Red-hot growth fuels economy

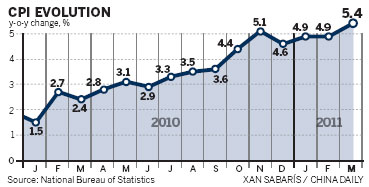

China's economy continued its rapid expansion in March as the inflation index climbed to a 32-month high.

Meanwhile, GDP rose marginally faster than expected in the first quarter, indicating that the government still has much work to do to prevent the economy from overheating.

The consumer price index (CPI), a main gauge of inflation, rose 5.4 percent year-on-year in March, the National Bureau of Statistics (NBS) said on Friday. The growth rate is the fastest since July 2008 and exceeded most economists' forecasts of 5.2 percent

"Imported inflation has strongly contributed to domestic price rises," Sheng Laiyun, an NBS spokesman, told a news conference.

Prices of crude oil, iron ore and grains rocketed to the highest level in two years in March. Food prices, which account for around one-third of the CPI basket, surged 11 percent from a year earlier, and housing costs jumped 6.5 percent year-on-year.

GDP rose 9.7 percent in the first quarter from a year earlier - beating economists' expectations of 9.5 percent - marginally lower than the 9.8 percent registered in the last quarter of 2010, according to the NBS data.

"The March data confirmed that China's economy is still overheating and the inflation risk is still very much to the upside," said Wei Yao, China economist from Societe Generale SA's Global Research and Strategy unit.

Fixed-asset investment rose 25 percent year-on-year in the first quarter, according to the NBS.

Fixed-asset investment statistics indicate continued strong investment from local governments, while the growth of central government-approved projects declined to the lowest level since 2005, Wei said.

According to Lu Zhengwei, chief economist with Industrial Bank Co, the government's tightening measures are not expected to ease before the third quarter of the year, because all the key economic indicators exceeded expectations.

"More tightening policies might be expected, with the required reserve ratios for banks likely to raised again, probably within two weeks, and one or two further rises in interest rates before the end of the second quarter," said Lu.

To soak up excess liquidity in the market, the central bank has raised the benchmark interest rate four times since October and has required the country's biggest lenders to lock up a record 20 percent of their deposits as reserves.

On Wednesday, Premier Wen Jiabao said that the government will use all the tools at its disposal to bring inflation under control.

"As these measures need more time to show their effect, I believe that the government could still meet the target it set for macro adjustment this year," said Jiang Jianqing, chairman of Industrial and Commercial Bank of China Ltd.

The government set this year's CPI target at 4 percent, a figure most analysts said will be difficult to achieve.

0

0

![Investors monitor stock prices at a securities exchange company in Shanghai. Goldman Sachs Group Inc predicts the Shanghai-Shenzhen 300 Index will reach 3,500 points by the end of the second quarter and hit 4,000 points at the end of the year. [Bloomberg] Investors monitor stock prices at a securities exchange company in Shanghai. Goldman Sachs Group Inc predicts the Shanghai-Shenzhen 300 Index will reach 3,500 points by the end of the second quarter and hit 4,000 points at the end of the year. [Bloomberg]](http://images.china.cn/attachement/jpg/site1007/20110416/000cf1a48b7f0f1372932c.jpg)

Go to Forum >>0 Comments