Home prices down in most major cities

0 Comment(s)

0 Comment(s) Print

Print E-mail Xinhua, April 18, 2012

E-mail Xinhua, April 18, 2012

|

|

|

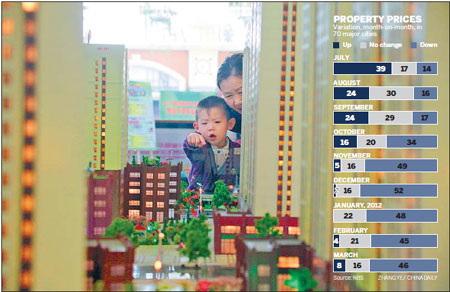

A family visits a housing exhibition in Jilin, a city in Jilin Province. Prices of new homes continued to fall in March amid government tightening measures. [China Daily] |

New home prices declined in most Chinese cities surveyed in March, the National Bureau of Statistics (NBS) said Wednesday.

In March, 46 of the statistical pool of 70 major cities saw drops in new home prices from February, while new home prices in 16 cities remained unchanged, according to the NBS.

Eight cities, up from four in February, saw gains of less than 0.2 percent in new home prices, the statistics bureau noted.

On a year-on-year basis, 38 cities saw new home price declines in March, up from 27 in January. The March figure was the highest since September 2011, according to NBS statistician Ma Xiaoming.

Ma said the price declines were mainly because cash-strapped property developers chose to lower prices to work off their overloaded inventories and some commercial banks lowered mortgage rates for first-home buyers to boost sales.

Lenders in Beijing and Shanghai are offering as much as a 15-percent discount off the benchmark interest rate on loans to first-home buyers.

Prices of resold homes stopped growing in 54 cities in March, compared with 59 cities in February, the NBS said.

In first-tier cities, including Beijing, Shanghai and Shenzhen, new home prices fell further on both monthly and yearly bases in March.

"This is further evidence of the government's property macro control measures," Ma said.

NBS data showed that new home prices ceased growing in most of the 70 major cities in February -- the result of the government's persistent efforts to cool the red-hot property market.

China started adopting measures to calm property prices in 2010. They included tighter lending policies, higher down payments, a ban on third-home purchases, property tax trials and the construction of low-income housing.

Premier Wen Jiabao has prioritized property control as one of the most important tasks this year, urging local governments not to relax curbs on the sector in order to bring prices back to reasonable levels.

"The March data shows that the property market is adjusting in the right direction, but still falls short of the government's targets," said Yi Xianrong, a researcher with the Institute of Finance and Banking of the Chinese Academy of Social Sciences.

Kuang Weida, professor at Renmin University, echoed Yi's views, saying that the trend of falling prices demonstrated how the property tightening policies have started to show results.

"But upward pressure in home prices still exists and the property tightening must not be relaxed so as to meet the ultimate goal of bringing prices down to reasonable levels," according to Kuang.

However, the March data fueled concerns that a cooling property market will accelerate the country's economic slowdown, with property development investment accounting for more than 10 percent of the nation's gross domestic product and affecting a number of related industries.

China's economy expanded 8.1 percent in the first quarter, the slowest pace in almost three years.

Yi rejected suggestions that the government will loosen its tightening measures to buoy the economy. "Real estate bubbles must be squeezed to ensure the industry's healthy development," he said.

The country's 10 largest property developers had an inventory of 25 million square meters of residential floor space at the end of March. And it will take at least one year for developers to work off the inventories, according to Centaline Property.

The agency said it expects developers to continue adopting flexible sales strategies this year to relieve pressures caused by record inventories of unsold homes and worsening balance sheets.

Go to Forum >>0 Comment(s)