Multinationals feel pressure of Chinese companies

0 Comment(s)

0 Comment(s) Print

Print E-mail CRI, May 26, 2012

E-mail CRI, May 26, 2012

|

|

Foreign multinationals are increasingly having to glance back over their shoulder to make sure they are not being outpaced by fast-paced Chinese entrepreneurs.

The growing strength of Chinese companies - both State-owned and in the private sector - has been highlighted in two recent reports.

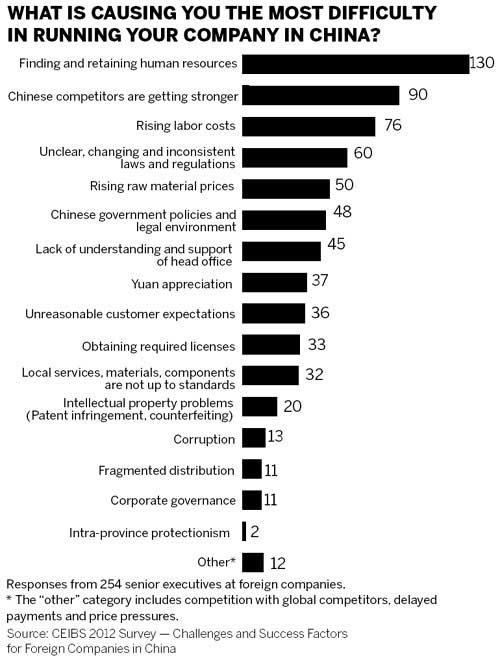

Last month the China Europe International Business School 2012 Survey, Challenges and Successes for Foreign Companies in China, highlighted that competition from Chinese firms was now the second biggest challenge for foreign multinationals doing businesses in the country.

Of the 254 respondents to the survey - many of them CEOs of major foreign businesses - 90 ranked competition from indigenous enterprises as the biggest challenge.

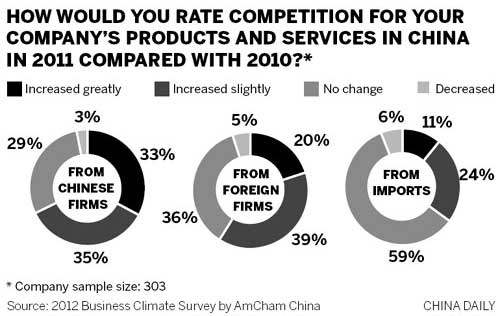

In a separate survey, the 2012 White Paper of the American Chamber of Commerce China, more than two-thirds (68 percent) of respondents said they had faced increased competition from Chinese firms, with a third saying that this competition had "increased greatly". The period measured was between 2011 and 2010.

AmCham, which represents 1,200 businesses in China, claims some of the competition was unfair, saying that Chinese companies often receive preferential treatment.

"AmCham China member companies are not seeking to hold back competition; they just want to make sure that competition occurs on a fair playing field," says Ted Dean, chairman of AmCham China.

"We have seen specific examples in terms of credit where local competitors are able to get cheap financing, and in terms of taxation where local companies may pay much lower tax than foreign companies, and in terms of regulatory policy where local competitors may have much more favorable regulations."

Regulatory factors are unlikely to be the only reason for increased competition.

Some argue the financial crisis, which has forced many Western companies to cut back on investment, has caused a shift in the balance of power.

Meanwhile, Chinese companies, often cash-rich and less dependent on capital markets to raise funds, have taken advantage of depressed asset prices in Europe and the United States and have strategically bought companies that have boosted their competitiveness.

Fosun, one of China's leading private conglomerates, alone has set aside $2 billion to acquire stakes in medium-sized technology companies in Germany.

Speaking from Miami, Florida, Edward Tse, chairman, Greater China for management consultants Booz & Co and author of The China Strategy, believes the economic crisis has tilted the balance.

"It has really given Chinese companies the opportunity to step up. While some of the multinationals have been reducing their investment, Chinese companies have continued to build up their strength. They have been acquiring foreign companies in order to acquire technologies and capabilities," he said.

|

|

China has not been a market where Chinese and foreign companies can compete on completely level terms. Certain sectors of the economy - including natural resources industries, financial services and telecommunications - have restrictions on foreign competition. These sectors are typically dominated by large State-owned enterprises.

A new factor, however, is the changing nature of China's private sector which is rapidly upscaling from largely low-tech, export-oriented manufacturing to more high-tech sectors, which was once solely the preserve of foreign companies.

The Chinese private sector is being driven into making this change largely by rapidly rising labor costs, which is reflected in both the recent surveys.

More than four-fifths (82 percent) of those interviewed in the AmCham survey said rising labor costs were affecting their business operations. Finding and retaining human resources was the biggest challenge facing those in the CEIBS survey, cited by 130 - more than half - of the respondents.

Hans Hendrischke, professor of Chinese political economy and director of the Confucius Institute at the University of Sydney, said that because of this, Chinese firms are increasingly entering markets dominated by multinationals.

"Rising labor costs put pressure on Chinese enterprises and they are spreading their wings and extending into other areas and you are finding this tightening of competition," he says.

Juan Ignacio Motiloa, vice-president of the EU Chamber of Commerce in China, which has 1,700 members and will highlight competition in its own Business Confidence Survey later this month, said Chinese companies are certainly moving up the value chain.

"That is probably the cause of the increasing competition we are seeing today," he said.

He said it has never been more important for European and other foreign companies to maintain their lead.

"This is the only way for us to sell, survive and compete by preserving the technology gap between domestic and European companies. We have to ensure it is wide enough so our clients recognize the premium."

Despite the increasingly tough market conditions, Motiloa said China is a better place to be than the West at present.

"If you look at the world and what is happening in Europe and the US, we are looking to China as one of the sources of growth these days," he says.

"This is the Champions' League. If you really want to succeed worldwide you really have to succeed in China, even though it is a tough market and very competitive in some sectors," he added.

Those who have worked closely with Chinese private companies believe they now have the capability to outwit large foreign companies since they have flatter management structures and are able to make quicker decisions.

Paul Cheng, the Hong Kong politician and businessman who examines the competitiveness issue in his new book On Equal Terms, said Chinese firms are proving themselves very responsive.

"I always tell my multinational friends while you are spending days in a conference room talking about mission statements, your local competitors are already out there selling," he said.

"Chinese entrepreneurs are very entrepreneurial in the sense they are willing to gamble. They are risk takers and they are willing to go from rags to riches and back to rags, if necessary."

Tse at Booz & Co agrees that the new generation of Chinese entrepreneurs can prove more than a match for some foreign companies.

"They are mostly still much first generation businesses with the founders still running them. They tend to be very good at synthesizing information and making decisions whereas the multinationals have a set of processes, systems, checks and balances which might be appropriate in a modern enterprise but is not an advantage in China where things can move very quickly," he said.

|

|

But it would take more than nimble footwork to be a match for some of the multinational giants.

Procter & Gamble, the US consumer goods company, which has its China headquarters in Guangzhou, has been in the mainland since 1988, and has an entrenched market position in many product areas.

There are many other companies whose products and brands are staples for China's growing and increasingly affluent consumer society.

Eric Schmidt, founder and president of China Entrepreneurs, a leading network group, says there are few Chinese companies that can match the brand strength of the consumer goods giants.

"If you look at the number of dollars Procter & Gamble alone spends on product design and development, it is pretty hard for Chinese companies to compete," he said.

"You have got other companies too like McDonald's and KFC that have perfected their marketing techniques and can just multiply them across the Chinese market. Chinese companies don't have that long history or money to spend on marketing."

Mike Bastin, a researcher at Nottingham University's School of Contemporary Chinese Studies, said Chinese companies realize the value of brands and if they are incapable of developing their own they will go out and acquire those of others.

"Chinese companies will increasingly choose growth by acquisition of foreign brands which poses a constant threat to foreign brands operating in China," he said.

A recent trend has been for Chinese private equity companies to target investments at sectors where foreign companies have enjoyed almost monopolistic positions.

The China market itself is likely to become even more competitive this year with the economy expected to slow down.

More and more companies - both Chinese and foreign - will be scrapping it out for what will probably be reduced action.

"Chinese companies will face similar competitive pressures to foreign companies," says Hendrischke at Sydney University.

"In China itself there are huge personnel constraints, increasing labor costs and a lack of middle management which affects everyone. Foreign multinationals still have greater global reach, however, and the Chinese can only catch up slowly on this by their own foreign investment."

Go to Forum >>0 Comment(s)