Real estate in Erdos falls into deadlock

- By Wu Jin

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, September 2, 2012

E-mail China.org.cn, September 2, 2012

Following the frenetic flush of capital influx for almost a decade, the bell of the burgeoning housing market in Erdos, a city perched on the southwestern plateau of Inner Mongolia, is tolling.

Gone is the substantial level of capital raised from over 90 percent of local residents that was poured into the ostentatious new apartment blocks.

|

|

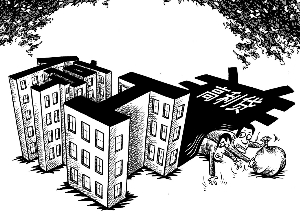

Suspended construction sites crowd Erdos, nicknamed "Ghost Town" for its low apartment occupancy. |

Now, the city's ubiquitous abandoned construction sites are overflowing with jittery creditors, whose eager anticipation for the fat returns seemingly guaranteed under the ceaseless rumbling cranes and tinkling hammers has caused a recession.

According to local government, the area of land used by apartments has increased by more than 22.25 million square meters between 2009 and Nov., 2011. The publication Chinese Business Weekly has reported that the majority of these apartments have been put into suspension.

An anonymous developer pointed at the surrounding projects to the Weekly that almost 60 percent of the investments came from the accounts of local residents.

"From last June until today, my only job has been to get my money back," said Shanxi native Qiao Shigang, who had pumped 6 million (US$ 944,664) to 7 million yuan, comprising the savings both of his relatives and his own, into the property market via Inner Mongolia Tengtu Investment Group. However, according to Qiao, he was only repaid a total of 3,000 yuan during the previous year and he would continue to try and claim repayment since he doesn't have any other choice in the upcoming year.

Like Qiao, dozens of creditors surrounding the office building of Tengtu Investment Group on Aug. 10, were unanimously asking for the return of their money, individually ranging from thousands to millions of yuan each.

According to another local developer who also required speaking on the condition of anonymity, Tengtu is only one of the 400 to 500 investment groups that sprouted in Erdos over the past few years, many of which cover industries such as coal mining, catering and hotels, as well as real estate.

Usuries have prevailed in the city since the coal mine boom in 2001, when families in the town found they were soon rich through the payments given by the mining companies.

The high-rate of lending subsequently flowed into real estate with the sprawling urban construction in 2003. Farmers turned to millionaires almost overnight with the relocation reimbursements that reached thousands of yuan per square meter. In 2007, nearly all the town's residents were involved in real estate usuries.

"A three-percent interest rate would guarantee you an income of 30,000 yuan a month only if you lend 1 million yuan [to developers]. Then what about an interest of five percent? You needn't do anything but waiting for the payback within two years," said Li Zhe, a local, who graduated from a university three years ago and remains unemployed because of the high yields from the usuries.

"It is not necessary to work like a dog, usually for a meager pay of 3,000 to 4,000 yuan a month," Li said.

According to Chinese Economic Weekly, many families in Erdos stay unemployed, indulging in mahjong and extravagance, and care little about saving.

The city's Gross Domestic Product (GDP) per capita allegedly surpassed the bustling free-trade port city of Hong Kong in 2010, and the overall GDP that year hit 264.3 billion yuan, by which the investments in fixed assets account for more than 70 percent. About half of the investments were directed into the housing market.

Many companies in Erdos have followed a fundraising chain model in the past three or four years as local residents began loaning money to the popular investment groups, Chinese Economic Weekly reported. And the managers in these investment groups' finance departments were responsible for bringing in more relatives and friends to add greater value to the total pool of investment.

According to the Weekly, a single department like that in a local conglomerate could collect an aggregate of 2 billion yuan.

But the chain would easily break up under the flickering real estate market. In addition to the constant vexation of the high apartment vacancy rate, which resulted in a ludicrous nickname—Ghost Town--of the wealthy city despite its swanky facelift, a cascade of local creditors' claims for the return of their investments amid the continuous tightening policies in the property market have devastated the local economy.

Pushed by the colossal amount of debt, hordes of developers fled the town. The approximately 300,000 migrants that came to the city since 2009 have been reduced to less than half their original number.

"The developers are no longer trying to pay off the debts even if they are left with some available currency on deposit, because the mammoth vacuums are impossible to tap," a local developer told Chinese Economic Weekly, who declined to reveal his name.

"Many of the developers raised funds at the cost of 2.5 percent to three percent interest rates each month. Therefore, if s/he collected 1 billion yuan from local residents, the repayment would be 3 billion yuan," the developer explained.

Erdos made a big mistake by spending one yuan on a project which asks for 10 yuan, the Chinese Economic Weekly commented.

With real estate speculators on the retreat, the hoarded apartments and land are facing imminent depreciation. Zhou Qiliang, a business man who used to invest in buildings and hotels in the city, said he won't give a single cent more. He'll move to northeastern China after selling his land for 50 million yuan, a price barely covers his cost.

Almost all Erdos government officials declined to comment on the looming depression, reported Chinese Economic Weekly. Yet a supportive sign are two pieces of outdated news from the previous two years posted at the postal website of local land and resources bureau: No bids have yet been renewed.

"The prosperity built on extensive economies and speculative capitals rather than solid industrial upgrades on real economies are nothing but a transient wealthy illusion," He Hui, a reporter from Shanghai Financial News, wrote in her opinion article on Erods' predictable decline.

Go to Forum >>0 Comment(s)