Website shuts in new financial flop for Yao Ming

- By Lin Liyao

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, June 6, 2013

E-mail China.org.cn, June 6, 2013

|

|

|

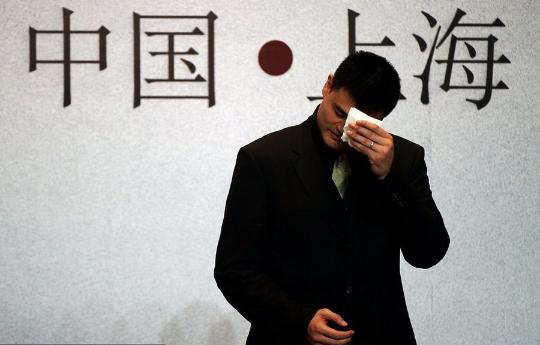

Yao Ming [file photo] |

Rumor has it that Top100.cn, which was jointly launched by former NBA superstar Yao Ming and Google, is now facing serious problems which might result in its permanent closure. In response to these rumors, the website's co-founder and CEO Gary Chen wrote on his Weibo microblog account: "After Google shut down its music search service on the Chinese mainland in October 2012, Top100.cn has faced tough choices and badly-needed restructuring. Of course, it is difficult. But we will spare no efforts."

Top100.cn went online in March 2006 to provide Chinese music fans with a free and fully licensed music downloading service following its agreement with the major record labels Universal, Sony and Warner. The website attracted great attention from the outset, thanks to the fact that the then newly retired NBA star Yao Ming was one of its investors.

It is believed that Gary Chen had already signed a cooperation agreement with Zhang Mingji, Yao Ming's agent and later the president of Top100.cn in early 2005. The terms of the agreement were said to include a US$3 million investment from Yao and Zhang at a time when Yao was still on his way to becoming a superstar in the NBA with the Houston Rockets.

Thanks to Yao's reputation, Top100.cn secured capital investment from Google totaling US$7 million in August 2008; and Google China linked its music search service with the website, which brought millions of users to Top100.cn.

Despite the backing of such big names as Yao Ming and Google, many business insiders questioned the viability of Top100.cn's operational model. The Internet commentator Hong Bo argued that as there is so little demand for foreign music in the domestic Chinese market, it would be difficult for the website to gain a true foothold in the mainland market. In addition, Top100.cn's product development and user experience have compared unfavorable both with Baidu Music and Tencent's QQ music.

Fall from grace

Gary Chen cited three reasons for the decline of Top100.cn:

• Overdependence on Google

After Google shut down its Chinese mainland music search service, Top100.cn saw its page views decline by around 80 percent, resulting in a loss of advertising revenue to the tune of 100 million yuan (US$16.3 million).

• Greed

In order to avoid stock dilution, the website refused two large venture capital investments in 2007 and 2009 respectively, and suffered two failed purchases by large companies in 10 years.

• Lack of delegation

The company's management team was unable to participate in major decision-making processes, which made it hard for the company to attract top-class management talent.

Commenting on the company's viability, Yu De, CEO of Dige.com said: "If the cooperation with Google could continue, the future of Top100.cn still seems bright." . In 2009, owing to its skyrocketing page views, Top100.cn attracted advertisements from a range of famous brands which resulted in revenue of 3-4 million yuan (US$48.9-65.2 million) in only three months.

The company was also hit by its inability to attend a forum on internet music development organized by Ministry of Culture in Guangzhou at the end of 2012. All of China's other online music service providers attended the forum.

According to Yu, it is hard to define what the term copyright actually means in the domestic music industry. In addition to this, Chinese music fans are accustomed to accessing free trial content, which makes it difficult to operate a music website which provides paid downloads through buying copyright.

Gary Chen believes that Top100.cn could still be transformed into a B2B digital music platform based on its superior resources and brand reputation; however Hong Bo maintains that the platform, which helps foreign artists enter the Chinese market, may not offer the best direction for the website's future development.

Yao's investment ignominies Yao Ming might not have enjoyed a career in either Internet startups or music, but, according to Zhang, he is an avid Internet user who is very interested in high-end and new media technology. He is also, apparently a huge music lover, all of which seemed to indicate that investing in a music website should be a natural progression for him.

After supporting Top100.cn, Yao also invested in the Shanghai Sharks basketball team as well as several wine brands. He was also the fourth largest shareholder in Beijing UniStrong Science & Technology Co., Ltd. before the company went public. In 2011, Yao also invested in two private equity (PE) firms: Tianjin-based D & F Investment Fund and Hongyuan Equity Investment Fund.

Until recently, Yao's involvement with the two PE firms was not public knowledge. Beijing UniStrong, a company which specializes in global navigation satellite systems, has brought Yao more than 60 million yuan (US$9.79 million) in income. The company, however, has not fared so well since going public in April 2010. What's worse is that, in business insiders' eyes, Yao's investments in both the Shanghai Sharks and wine industry have also been far from successful. It seems that Yao's off- court activities have not lived up to his on-court career.

As one anonymous person who is very familiar with Yao and his team put it: "The value of Yao's team could be realized on exploring the commercial potential of Yao Ming himself, rather than investing in specific areas and industries."

Go to Forum >>0 Comment(s)