Jewelry buyers cast golden glow on bullion in Q2

0 Comment(s)

0 Comment(s) Print

Print E-mail China Daily, August 16, 2013

E-mail China Daily, August 16, 2013

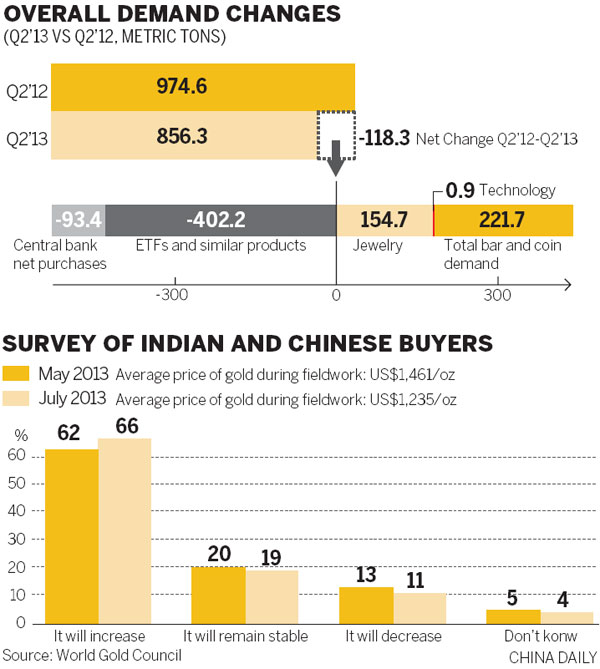

Low gold prices generated a surge in global jewelry demand to 575.5 metric tons, a five-year high, in the second quarter of 2013, according to data from the World Gold Council released on Thursday.

It revealed the average gold price for the second quarter of 2013 was $1,415 an ounce, down 12 percent year-on-year.

Analysts said that in China gold remains a compelling investment because the poorly performing stock market does not serve as an attractive investment option and concerns linger over the possibility of a domestic credit crisis.

Global jewelry demand rose 37 percent year-on-year in the second quarter of 2013 led by the Chinese and Indians. In value terms, demand showed a 20 percent year-on-year increase, the council said.

Outflows among exchange-traded funds dragged overall gold demand down to a three-year low in US dollar terms in the second quarter of 2013, according to the council's quarterly report.

"The second quarter continued the trend that we saw in the first - of a rebalancing in the market - as gold coming on to the market from ETF sales met with a wave of demand for bars and coins, as well as jewelry. This surge in bar and coin investment was a common theme in key markets around the world and has been particularly prominent in the world's biggest gold markets - India and China," said Marcus Grubb, managing director of investment at the council.

This shift from West to East has been further reinforced by recent data from the London Bullion Market Association showing that in June the volume of gold transferred between accounts held by bullion clearers hit a second consecutive 12-year high, buoyed by strong Asian physical demand, said Grubb.

"This quarter again demonstrates the unique diversity of global gold demand, in that the self-balancing nature of the market apparent in the previous quarter was even more clearly in evidence. Across the decades, different sectors in the gold market have risen in prominence at different points in the global economic cycle. The current shifts are just part of the normal ebb and flow of what is an extremely liquid market," said Grubb.

Second-quarter overall demand fell 12 percent year-on-year to 856.3 metric tons. In dollar terms, demand dropped 23 percent to $39 billion.

The biggest reason for the decline in demand came from a wave of outflows from exchange-traded funds after Western investors reacted to a "seemingly more positive outlook for the US economy and an eventual tapering of quantitative easing", according to the report.

Record demand for gold bars and coins was countered by sizable net outflows from ETFs. The technology sector saw marginal growth, with the 1 percent year-on-year increase the first in two years, the report said.

"In China demand for gold remains robust with both physical and investment financial products among the most popular investment channels," said Xue Ke, chief analyst and deputy general manager at Tianjin Jinhengfeng Precious Metals Management Co.

Central bank demand slowed in the second quarter of the year from the second quarter last year.

Total gold supply shrank 6 percent from the second quarter of 2012, almost solely because of the reduction in recycling.

Recent robust demand for physical gold has pushed up the spot price of gold, the latest data showed. The most recent spot gold prices rallied to the highest since July 24 on Thursday to $1,346.61 an ounce, despite a US filing that showed billionaire John Paulson had reduced his holding in the SPDR Gold Trust by 53 percent in the second quarter of the year. Bullion prices increased 1.1 percent on Wednesday.

A World Gold Council survey that polled 1,000 Chinese people in July showed 66 percent of respondents believe the average price of gold will increase over the next five years, which reflects the strength of the demand response, the council said.

Go to Forum >>0 Comment(s)