TCM industry feels chill

- By Chen Boyuan

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, November 5, 2015

E-mail China.org.cn, November 5, 2015

For Traditional Chinese Medicine (TCM), an industry of thousands of years old, its recent development has been anything but smooth. Chinese patent medicine, generally consisting of extracted condensed pills called teapills, saw a sharp production decline in the first half of the year. In last year's national catalogue of new medicine, TCM products only accounted for 2.19 percent of all the 501 items.

"The environment has been the worst for us TCM producers," said a company chief who wished to remain anonymous. His experience was echoed by many others in the industry.

Data from the Ministry of Industry and Information Technology shows Chinese patent medicine manufacturers reported slower growth of 5.2 percent during the first half of the year. The figure was far lower than the 14.09 percent registered during the same period in 2014.

|

|

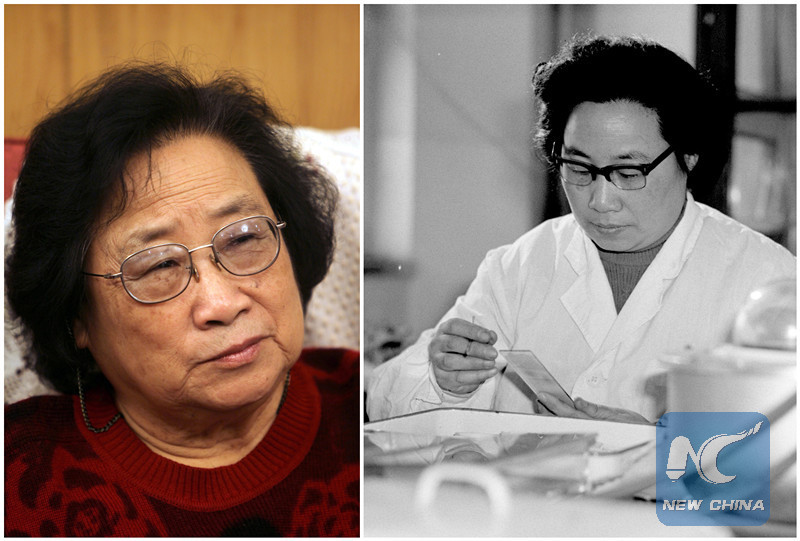

| Xinhua file photo of Tu Youyou. |

"Slower growth and shrinking market are a result of both home and international economic conditions," said Wu Feichi, vice chairman of China Association of Traditional Chinese Medicine. He said the soaring raw material costs combined with medical insurance stipulations were "inescapable facts" causing the adverse situation.

Despite the current gloom, many TCM insiders remain optimistic with much room for growth as a result of an aging society, changing spectrum of disease and the country's favorable policies.

TCM manufacturers also made proactive changes to better accommodate the current difficulties. Kanion Pharmaceutical in Jiangsu Province set up the largest intelligent herbal extract factory in the country, Guizhou Bailing Group established its own diabetes hospital to boost its medicine sales, and Yunnan Baiyao has pioneered merging TCM into modern life.

Learning she had won this year's Nobel Prize in Medicine, Chinese TCM pharmacist Tu Youyou said: "TCM is indeed a huge treasure chest. We need to find, explore and research the treasures inside."

At this critical moment when crisis and opportunity both exist, how to tap TCM's potential so as to recover, optimize and upgrade the industry concerns both TCM manufacturers and the government regulator.

There are also opinions supporting a structural reshuffling of the TCM industry. According to Yang Hongjun, vice director of the Institute of Chinese Materia Medica at the China Academy of Chinese Medical Sciences, the distribution of TCM producers is like that of a pyramid in that the proportion of companies above a certain scale is less than five percent nationwide, while middle and small-scale producers account for 75 percent.

Yang said that although the government encourages quality products, it has yet to make them affordable for everyone. Meanwhile, lower-quality, mediocre TCM products are more likely to take a larger market share.

The General Manager of Yunnan Baiyao, Yin Pinyao expressed optimism about an industrial reorganization, saying it would benefit leading manufacturers. At the same time, he criticized the obsolete standards used in national regulation, which sometimes would affect new production processes. For example, quality control inspectors sometimes paid excessive attention to the shape and color of medicine material. Traditionally dried material looks dark, but that processed by freeze-drying looks different, and would fail the quality control examination for this reason alone.

The public's lukewarm interest in TCM also lies in the fact it hardly yields immediate effects in dealing with a patient's symptoms. Similarly, the lack of direct evidence to prove TCM's clinical effectiveness has affected its research.

"Another major problem in the development of TCM is that its research and theory are disconnected," said Yang. In TCM, the treatment and medicine should be united; if they are detached, they stop supporting each other.

Since 2009, the central government and its subordinate agencies have issued multiple memos to encourage Chinese TCM companies to go international, hoping the industry will develop apace with the Chinese economy and profit from both the home and international markets.

Statistics show that in the first half of the year, TCM exports stood at US$1.93 billion, growing 13.5 year on year, although in general the growth was slower than last year. Asia is still the principal market of Chinese mainland's TCM exports, especially Hong Kong, Japan, Malaysia, South Korea and Indonesia. China's TCM exports to this region totaled US$1.16 billion in the first half of the year, accounting for 60.7 percent of the total TCM exports. In the same period, the United States imported US$270 million-worth of TCM from China, representing a 17.2 percent year-on-year growth.

TCM's international promotion faces three serious obstacles. First, the TCM culture has yet to be recognized throughout the world; second, TCM's has difficulty in registering with many countries, whose medical administration is based on modern medicine; third, the sales and marketing of TCM is not to compete with that for western medicine.

While TCM cannot compete with modern medicine in producing immediate effect, its strength lies in treating chronic diseases, easing symptoms and prolonging life, and above all, TCM treatment is usually less expensive in reaching the same effect, such as on patients with Stage-4 liver cancer.

However, medical research and exploration is vital for TCM's advancement, which will also call for innovation so as to seek a larger market share.

Go to Forum >>0 Comment(s)