Internet finance: heading onto a healthy path

- By Guo Yiming

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, March 13, 2016

E-mail China.org.cn, March 13, 2016

|

|

|

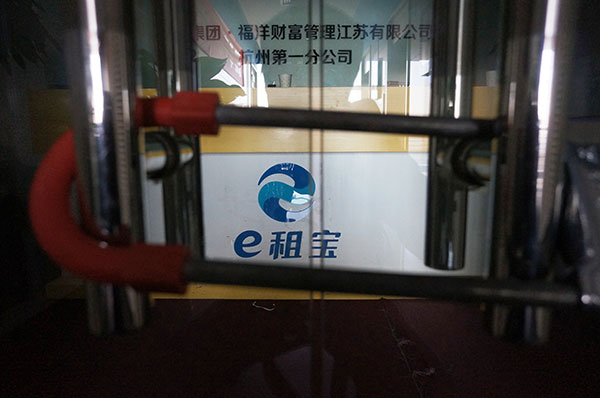

Office of Ezubao in Hangzhou, Zhejiang province, seen locked up last December. [China Daily] |

From low threshold investment products starting from one yuan (15.4 cents) to mobile Internet payments introduced to most retailers and restaurants, Internet finance, including peer-to-peer (P2P) lending, crowd funding and Internet payment, has become a part of daily life.

As an alternative to traditional financial services, it offers lower costs for small and medium-sized companies finding it hard to get loans from banks, said Yang Maijun, a deputy to the National People’s Congress (NPC) and Board Chairman of Shanghai International Energy Exchange, who sees the burgeoning business as a form of inclusive finance that can alleviate difficulties for business startups.

It also absorbs fragmented and sporadic investment from the public and reaps the benefits of the long tail effect that traditional banking services have overlooked, admitted Ma Weihua, a member of the Chinese People’s Consultative Conference (CPPCC) and former president of China Merchants Bank.

Problems looming large

While some are debating over its possibility of replacing conventional banking, problems due to its explosive, and some say, barbaric development are looming large.

The most well-known case is that of Ezubao, a P2P lending platform that fleeced over 50 billion yuan (US$ 7.6 billion) from 900,000 investors through fraudulent investment projects.

According to statistics, up to November last year, there were 3769 P2P lending platforms operating in China with a total business transaction level of 1231.47 billion yuan (US$ 189.65 billion), among which 1,157 firms were embroiled in problems of various kinds. Another report indicates similar problems in crowd funding.

“Those illegal fundraising schemes in the disguise of Internet finance not only pose threat to economic security but also to people’s well-being and social security,” said Chen Jingying, a deputy to the NPC and vice president of Shanghai Finance University who pointed out the underlying risks.

“Existing criminal cases in the Internet finance sector involve a large amount of money and countless victims who found their hard-won earnings being fleeced overnight, and this may sometimes cause mass disturbances.”

An overhaul in store

Observers say policy makers have noticed the rising risks and expect that an overhaul is in the pipeline.

In his 2016 Government Work Report, Premier Li Keqiang urged that Internet finance should develop in line with regulations, and vowed to promote inclusive and green finance, a slight shift from previous propositions of “encouraging the healthy development of Internet banking” in both 2014 and 2015.

Over-fastidious about wording as this may seem, a slight revision in the expression mirrors a change of attitude toward this burgeoning sector.

The report also indicates that the country will tighten institutional constraints, safeguard order in the financial sector and crack down on financial fraud and illegal fundraising, in order to keep systemic and regional financial risks at bay.

Cai E’sheng, a member of the CPPCC National Committee and former vice president of China Banking Regulatory Commission (CBRC), said lack of innovation and simplistic copying of successful businesses in the sector is a major problem. He also added that investors should anticipate potential risks under the market economy.

Ma Weihua declared: “While I do not suggest we impose exactly the same rules on Internet finance firms as for conventional banking, the logic of guarding against potential risks should also apply to this emerging sector.”

He said the sector should draw experience from the case of Ezubao and steer onto a path of healthy development under tightened regulation.

Zhou Xiaochuan, governor of People’s Bank of China, said self-discipline, tightened regulation and an overhaul of existing problems were essential to its healthy growth. He also noted that incentives were also necessary to encourage the sector’s growth.

As of November last year, Yu’E Bao, China’s largest online finance vendor under China’s internet giant Alibaba, is said to have gathered 103 million users, as its fund under its management ballooned to 600 billion yuan (US$92.4 billion).

A specialized body governing Internet finance sector will be in place soon to promote self-discipline, Zhou Xiaochuan revealed during a press conference at the height of the country’s annual session of NPC and CPPCC on Saturday.

Go to Forum >>0 Comment(s)