BRICS gets more byte

- By Zhou Xiaoyan

0 Comment(s)

0 Comment(s) Print

Print E-mail Beijing Review, September 3, 2017

E-mail Beijing Review, September 3, 2017

Facilitating investment

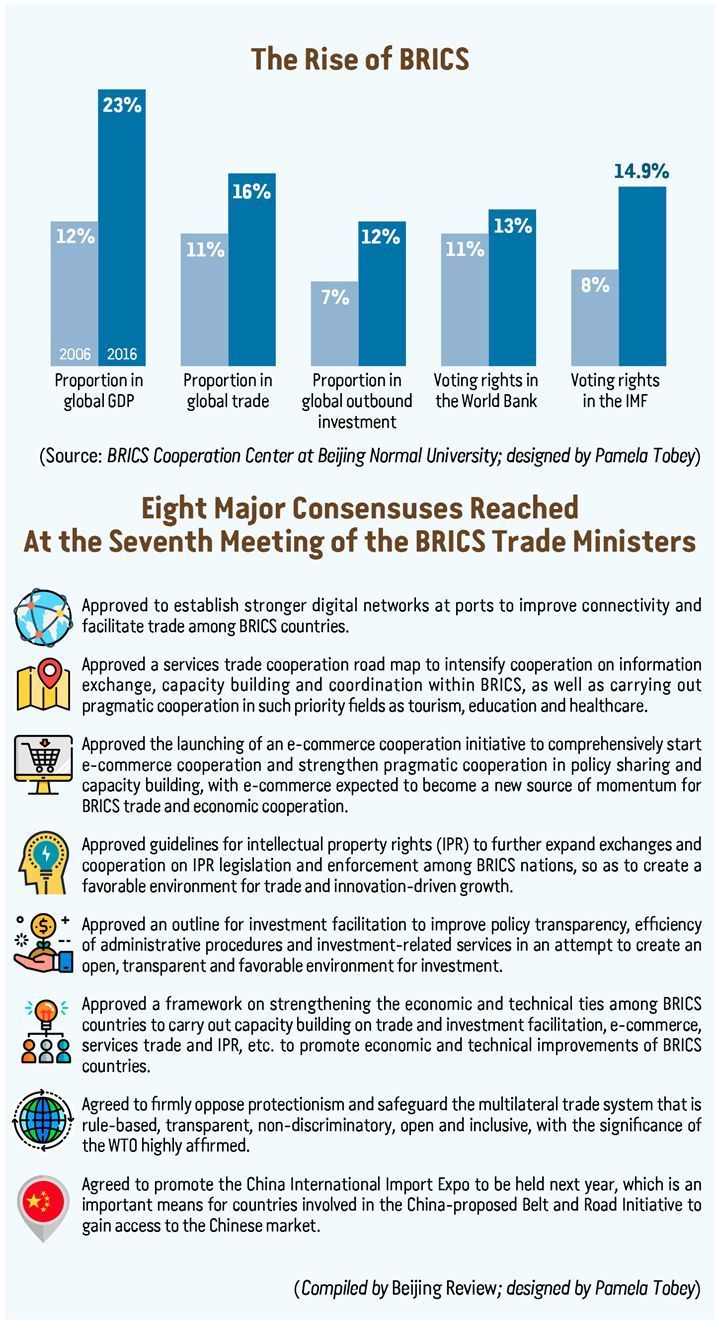

BRICS trade ministers also think investment is a key engine for global economic growth and job creation. In 2016, outbound direct investment from BRICS countries totaled $197 billion, but intra-BRICS investment accounted for only a meager 6 percent of the total, implying great potential yet to be tapped.

In light of this, BRICS trade ministers adopted an investment facilitation outline. Zhong called it another major achievement in global investment policies and the first special document in global trade facilitation after the G20 guiding principles for global investment policymaking adopted at the G20 Summit in Hangzhou in 2016.

The outline covers three areas: increasing transparency of laws, regulations and policies; improving investment-related administrative efficiency in BRICS countries by informing investors of approval results in a more timely manner; and enhancing the intra-BRICS investment cooperation level by establishing public-private dialogue mechanisms.

Bai said intra-BRICS investment is limited because BRICS countries are at similar development stages, while cross-border investment requires the investment destination to be at a different stage.

"For instance, if Chinese businesses want to invest in labor-intensive industries, they tend to choose Southeast Asian countries; if they want to invest in high-end industries, they would turn to the United States or some European countries," he elaborated.

To make up for such shortcomings, his suggestion is that BRICS countries implement the trade facilitation measures adopted at the trade ministers' meeting. "Moreover, instead of using preferential policies to lure investment, BRICS countries should seek closer industrial distribution based on each other's industrial chains. Since we are less complementary to each other than we are to the United States and European countries, more cooperation is needed to unlock potential opportunities."

Go to Forum >>0 Comment(s)