Chinese economy stabilizing with positive signs

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, April 28, 2016

E-mail China.org.cn, April 28, 2016

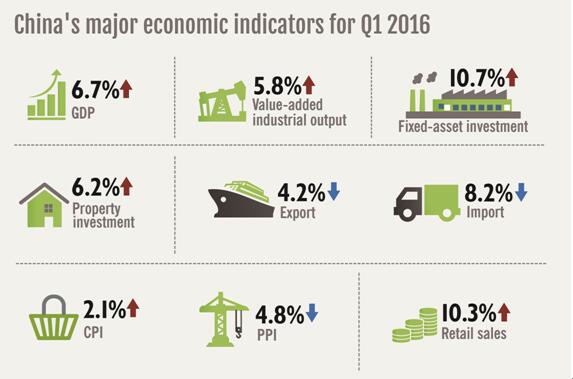

China’s Gross Domestic Product (GDP) reported a 6.7 percent growth year on year in the first quarter, showing that the economy still faces heavy downward pressure but has also remained fairly resilient despite a weak external environment and recent volatility in financial markets.

|

Indicators encouraging

The quarterly growth is in line with market expectations and remained within the government's targeted growth range of between 6.5 and 7 percent for 2016.

Besides GDP growth, other major economic indicators also show signs of stabilization.

In the January-March period, consumption expanded 10.3 percent year on year, fixed-asset investment was up 10.7 percent, while the added value of secondary industry rose 5.8 percent and investment in the property sector grew 6.2 percent.

Exports in yuan-denominated terms surged 18.7 percent year on year in March while imports dipped 1.7 percent, which led to a monthly trade surplus of 194.6 billion yuan (US$29.9 billion).

Consistent with the improvement in trade data, China saw stronger electricity consumption and railway freight growth in the first quarter.

The producer price index (PPI) dropped 4.3 percent year on year in March and the consumer price index (CPI) grew 2.3 percent.

In the first quarter, China generated 3.18 million new jobs, accounting for 31.8 percent of the target for this year, and fiscal revenue rose 6.5 percent year on year to 3.89 trillion yuan (US$607.8 billion) as the broader economy shows signs of stabilizing.

Zhao Chenxin, spokesman for the National Development and Reform Commission, said major economic indicators show that economic fundamentals have improved.

Positive changes

China’s economy has shown structural resilience by no longer relying on highly polluting heavy industry, low value-added shipments to overseas markets and local governments' debt-financed investments, analyzed Sheng Laiyun, spokesman for the National Bureau of Statistics.

The world's second-largest economy is now "more balanced and is of a higher quality," he said.

One of the positive changes is the fast growth of the tertiary industry, showing a 7.6 percent year-on-year jump in the first quarter, accounting for 56.9 percent of total GDP growth. Its growth rate is significantly higher than the rates for industry as a whole and for agriculture, which were 5.8 percent and 2.9 percent, respectively.

But it is noteworthy that manufacturing activity rebounded in March for the first time in nine months, and industrial companies' profits grew at their fastest rate in more than 18 months.

The manufacturing purchasing managers' index (PMI) rose to 50.2 in March, up from 49 in February. A reading higher than 50 indicates growth, while anything below represents a contraction.

Consumers also appear to be spending, with retail sales registering a robust 10.3% jump in the first quarter.

The fast growth of some new growth engines, such as internet-related sectors and advanced manufacturing, is also encouraging. January-March online sales rose 27.8 percent year on year, accounting for about 13 percent of gross retail sales, the NBS data showed.

Production of new-energy vehicles, medical equipment, intelligent electronic appliances and products related to environmental protection has also grown strongly.

Behind the fast growth of the high-tech sectors is the 55.3 percent increase in the number of patents approved in the first quarter.

The central bank--the People's Bank of China (PBOC)--cut commercial banks' reserve requirement ratio (RRR) by 50 basis points on March 1 to boost lending.

It was the latest in a series of moves to cushion the country's economic growth slowdown. Apart from lowering the RRR, the bank also lowered its benchmark interest rate six times in 2015.

"China has adopted a targeted monetary policy and encouraged different financial structures, which can better serve the reform policies to address the issues of overcapacity reduction, deleveraging and inventory destocking," PBOC Governor Zhou Xiaochuan said.

Cautiously optimistic

Positive changes in major indicators will help firm market sentiment, said Ning Jizhe, head of the National Bureau of Statistics (NBS).

Given the warming trend, the existing policy support will continue to take effect, Ning said, citing demand-stimulating measures and supply-side structural reform.

Improvements in market expectations will translate into real production and investment that will help resolve industrial overcapacity, enhance corporate performance and stabilize the economy, he said.

Furthermore, new economic drivers will grow rapidly as the government continues to cut red tape, support innovation and entrepreneurship, and liberalize markets.

"The Chinese economy is still resilient, full of potential and has ample wiggle room," he summarized.

The International Monetary Fund (IMF) also showed confidence by raising its forecast for China's economic growth in 2016 and 2017 to 6.5 percent and 6.2 percent respectively, both up 0.2 percentage point from predictions in January.

Despite the signs of "bottoming out," Sheng warned of persisting downward pressure due to uncertainty in the global economy and difficulties in the country's structural shift to consumption-driven growth and entrepreneurship.

Go to Forum >>0 Comment(s)