H1 economic growth in line with expectations

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, July 28, 2016

E-mail China.org.cn, July 28, 2016

|

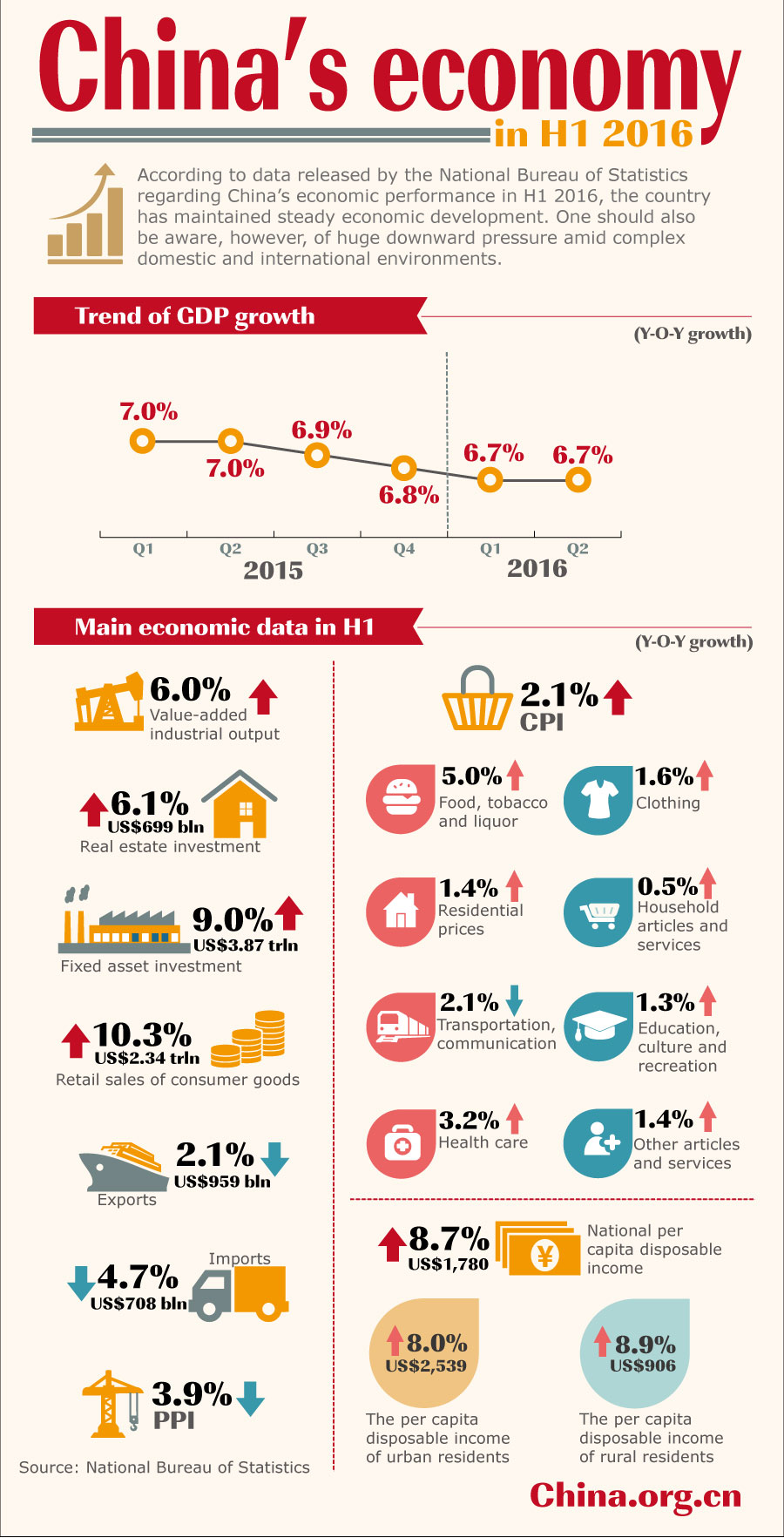

China's economy expanded 6.7 percent year on year in the first half of 2016, indicating that the government's policies meant to counter economic slowdown are paying off.

Such steady growth laid a solid foundation for the world's second largest economy to achieve its full year growth target.

Economic growth steady

China's GDP reported a steady 6.7 percent growth year on year in the first half of 2016 to reach 34.06 trillion yuan (US$5.08 trillion), according to data released by the National Bureau of Statistics (NBS) on July 15.

The service sector expanded 7.5 percent year on year in the first half, accounting for 54.1 percent of the overall economy, up 1.8 percentage points from a year earlier. This growth rate also outpaced a 3.1-percent increase in primary industry and 6.1 percent in secondary industry.

Retail sales of consumer goods grew 10.3 percent, property investment rose 6.1 percent, fixed-asset investment grew 9 percent and fiscal revenue grew 7.1 percent.

In June, foreign direct investment (FDI) into the Chinese mainland rose 9.7 percent year on year, and China's exports in yuan-denominated terms rose 1.3 percent year on year, while imports dropped 2.3 percent.

The stabilization suggested "the infrastructure-centric stimulus strategy, supported by a mixture of monetary accommodation and fiscal expansion has had some degree of success," said Julia Wang, an economist with HSBC Greater China.

Downward pressure remains

"We must be aware that domestic and external conditions are still complicated and severe and that the downward economic pressure remains," warned NBS spokesperson Sheng Laiyun.

It is noteworthy that the growth of fixed-asset investment slowed further to 9 percent in the first half of 2016, the lowest growth rate in years, and private sector fixed-asset investment growth fell again to 2.8 percent during the period, from an already weak 3.9 percent in the first five months.

Overcapacity in traditional industries, entrance barriers for private companies in some sectors and limited access to loans have caused the slowdown in private sector investment, said Sheng.

Meanwhile, a potential deceleration in global demand also pointed to downside risks. Data showed that China's exports in U.S.-dollar terms fell 4.8 percent year on year in June, while imports were down 8.4 percent.

The shake-up of Britain's departure from the European Union and rising geopolitical tensions worldwide are posing further challenges for China's foreign trade.

China's exports may face relatively large downward pressure in the third quarter as global demand is likely to remain sluggish, warned General Administration of Customs spokesperson Huang Songping.

Targets within reach

With reforms on all fronts, and especially with the supply-side structural reform advancing and new growth engines picking up steam, economic stabilization will continue despite all the downward risks, noted Sheng.

His words were echoed by Premier Li Keqiang, who was confident that China will achieve its main full-year development targets.

"New economy is vibrant, new business forms are booming, and new growth momentum is accumulating," he said in a keynote speech at the 11th Asia-Europe Meeting (ASEM) Summit, adding that China's current government debt ratio is low while the household savings rate is high, with still ample policy tools available.

"While GDP growth remained decent in the second quarter, in the second half of the year it will be challenged by the loss of momentum in real estate construction and subdued prospects for exports and corporate investment. Thus, the achievement of the government's overly ambitious growth target of between 6.5 and 7 percent will rely on further macroeconomic stimulus," analyzed Louis Kuijs, head of Asian economics at Oxford Economics.

Go to Forum >>0 Comment(s)