| Home / Books & Magazines / Literati | Tools: Save | Print | E-mail | Most Read |

| What Men Want |

| Adjust font size: |

On the surface, the market for men's lifestyle magazines is already cluttered with about a dozen titles, but the dynamics is such that even the winners are not cornering the market. Despite their self-claims of a broad reach, circulation is relatively low even for the best of the bunch, usually around 20,000-30,000 copies for each issue, notes Ma. China's publication market is unique in the sense that male readers are predominantly drawn to newspapers whereas women are the driving force behind magazines. As conventional wisdom goes, men prefer adventure and participation and are attracted to sports, politics, finance and travel. There are established magazine titles that serve each of these specific needs, leaving lifestyle a muddy area often without a clear catch. The demographic all titles covet is the so-called "successful people", wealthy types who can afford the products adorning those lavish full-page glossy ads. Even the price of a magazine, usually 20 yuan (US$2.6) but reaching a high of 50 (US$6.4), is way beyond the comparable price of a Western counterpart, which in purchasing parity terms, is no more than 5 yuan (US$0.6) at newsstand and even lower for subscription. This has created a dilemma for magazine publishers. While target readers are mostly over the age 30 it takes time to accumulate wealth and achieve social status, most of these titles have gained more than their desired share of 20-somethings. "They would love to be men's magazines, but some are just stuck at the youth market," Ma scrutinizes.

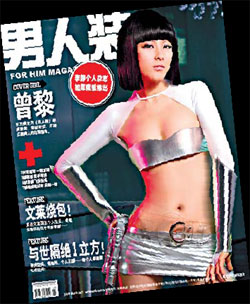

Ma uses the age of 28 as the demarcation line, and by that yardstick, even Esquire is skewed towards the young. Its former chief editor Feng Wei once revealed their reader profile as a white-collar office worker or student, aged between 25-35, college educated and with monthly income above 3,000 yuan (US$385). "Esquire is a very established brand. Many second-tier titles jostle for the position of the next Esquire, but so far they have failed," observes Ma Xuefen. Everybody knows that the main ingredients for this kind of magazine are sports, travel, luxury and design, but nobody seems to have mastered the recipe for success. "Getting the nuances right is elusive but crucial," noted Ma. For example, readers are often turned off by profiles of wealthy entrepreneurs or executives. They don't want another rags-to-riches story, but want to know how these men live their lives outside the office. In 2004, a flurry of new titles burst on the scene, shaking up the market. It was spearheaded by For Him Magazine (FHM), a British "lad mag". It quickly rose to be market leader in circulation. "We sell fun to the post-hippie crowd," as supervising editor Zhang Hanyu describes its positioning. Breaking free of the stolid image of Esquire and drawing inspiration from its bawdy British edition, FHM charged into the frat-boy area of scantily clad women and sexual titillation. Unfortunately, this is also a landmine-infested area where one misstep may lead to self-destruction. In a newly published book, editor-in-chief Jacky Jin describes how he pushes the boundary ever so gently and elbows into more room for content maneuvering. He pulled a column that directly talked about sexual adventures and added content from a call-in radio show.

"Regulators should be more tolerant," noted Zhang, "The market has a need for such information." He admits that the social atmosphere is getting more "open-minded". "A magazine like FHM would not be able to exist 10 years ago." Its audacity has certainly separated itself from the traditional titles that are "mannered" on their choice of subject matter. But industry observers have noticed a "facelift" in Esquire as they started to put younger celebrities on their cover and launch features on those born in the 1970s." However, this niche attracts a different band of advertisers, such as IT products and consumer gadgets. Jacky Jin, FHM's chief editor, sees it another way. "In China, a men's magazine commands roughly the same rate for advertising space as a women's title. But in the West, ads in men's titles are far more expensive because men have great purchasing power and their profile as consumers is easier to delineate." Except for GQ, which is still contemplating the China market, most major men's magazines in the West have already arrived through licensing agreements with local partners. However, as one editor reveals, due to the uniqueness of the market, they can use only a very small portion of the content from the original edition. The Western titles are actually known mostly by their Chinese names, which often have little to do with the original name and less to do with their content. Esquire is Trends Men, Maxim turns to Poise and FHM appears as Men's Garments. While these titles have to balance their global image and local needs, domestic titles rushed in to provide customized service. The cleverly titled Mangazine (Name Brands in Chinese) vows to capture the high end of this market. "Actually our Chinese title is a bit misleading," explains He Qun, Mangazine features editor. "We target the crme de la creme. They are no longer satisfied with information about luxury products. They want relaxation mixed with depth." Launched four years ago by Nanfang Media Group, Mangazine sells for 28 yuan ($3.6) a copy. "We may not have the highest circulation but we get readers of high value," added He. "Mangazine rubs off some of the sophistication from its sister publications such as Nanfang Weekend." Another Guangzhou-based domestic title, Life, aims even higher. It is as thick as a coffee-table book and sells for 50 yuan. "They carry nothing but absolutely the most upscale brands for advertisement," Ma Xuefen observes. During a recent cold spell, a young man on a Beijing construction site quickly took off his clothes and strategically positioned cameras started to snap pictures. Although passers-by were sheltered from seeing him totally nude, construction workers on the scaffolds above kept a watchful eye. It was FHM shooting a graphic essay on urban voyeurism and the nude model was a new arrival in the editing room. The scene was more comic than erotic, and the whole team had fun with it. In a sense, this scene is symbolic of the men's magazine market in China a little naughty, a little intrepid, yet at the same time somewhat timid while being monitored. More importantly, the weather is warming up and flashing would be less likely to induce a cold. (China Daily April 4, 2007) |

| Tools: Save | Print | E-mail | Most Read |

|

| Related Stories |

|