6. Financial management and oversight were enhanced.

The timeframe for budgetary preparation was extended, and procedures for preparing and submitting budgets were standardized. Supervision of budgetary preparation was strengthened. Budget implementation work was strengthened. Relevant institutions and measures were improved, and budgetary implementation became more efficient. Trials of paying the expenses of official business with bankcards progressed smoothly. Review of state-owned assets in administrative bodies and government-affiliated institutions was completed. A number of laws and regulations, including the new Law on Corporate Income Tax, were enacted. Research on reform of government accounting was deepened. The new General Rules on Corporate Finance and Rules on Finance in Financial Enterprises were issued and implemented. A system of corporate accounting norms was steadily implemented in both listed companies and some unlisted SOEs. The new system of auditing norms was widely instituted in accounting firms. Notable results were achieved in fiscal oversight. A total of 56.9 billion yuan was found to have been used contrary to regulations or disciplinary rules, of which 21.5 billion yuan was recovered, and responsible persons were held accountable for the losses. Steady progress was made in the computerization of financial management, and its successes are gradually becoming apparent. The State Council gave careful consideration to the relevant decisions and resolutions of the NPC as well as the comments and suggestions raised in the auditing report, and it requested that the Ministry of Finance and other relevant departments willingly accept the oversight by the NPC, the auditing authorities and the public, and take effective steps to rectify their problems. The Ministry of Finance and other relevant departments have worked hard to identify the causes of problems and conscientiously rectified them. The State Council has submitted a report on this matter to the Standing Committee of the Tenth NPC.

The year 2007 was the last year in the term of this government. A review of the past five years shows that work in public finance took on a new aspect.

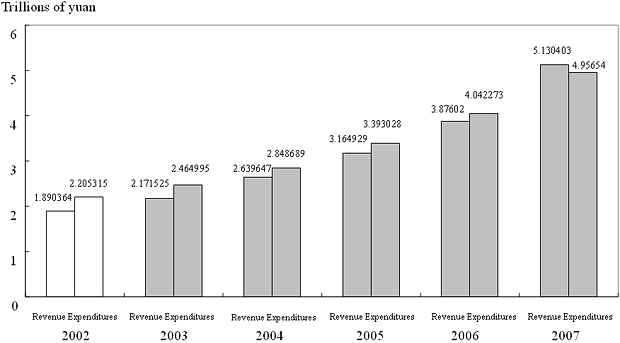

Financial strength was constantly increased. Between 2003 and 2007, national revenue totaled about 17 trillion yuan, 10 trillion yuan more than the total of the preceding five years, and an average annual increase of 22.1 percent. National expenditures totaled about 17.7 trillion yuan, 9.6 trillion yuan more than the total of the preceding five years, and an average annual increase of 17.6 percent.

Figure 4 National Revenue and Expenditures from 2003 to 2007

Note:

Figures for 2007 are performance figures and may differ somewhat from the final accounting figures.

Public finance played an effective role in macroeconomic regulation. As necessitated by the changing economic situation, we shifted from a proactive fiscal policy to a prudent one and reduced the central government deficit considerably. We improved regulatory measures in a timely and targeted way, which in turn promoted sound and rapid economic development.

Figure 5 Central Government Deficit in Yuan and as a Percentage of the GDP

Public finance played a visible role in ensuring the wellbeing of the people and improving their lives. We improved the structure of expenditures. More financial resources were expended on improving people's lives. Vigorous efforts were made to establish long-term mechanisms for ensuring the wellbeing of the people and improving their lives. All this contributed to the building of a harmonious society. Between 2003 and 2007, 2.43 trillion yuan of national revenue was spent on education, 629.4 billion yuan on medical and health care, 1.95 trillion yuan on the social safety net and 310.4 billion yuan on culture and sports. Compared with the preceding five years, the above expenditures are increases of 126 percent, 127 percent, 141 percent and 130 percent respectively. The central government spent a total of 1.6 trillion yuan on solving problems related to agriculture, rural areas and farmers.

Major progress was made in fiscal and taxation reforms. The agricultural tax, livestock tax and special product tax were fully rescinded, and the tax and fee reform in rural areas successfully entered a new stage of overall rural reform. The reform of the export tax rebate system obtained significant success. The taxation system was further improved, and various reforms in the budgetary system were deepened. Improvement was made to the financial system, and reform of the income distribution system steadily advanced.

Steady progress was made in the standardization of financial management and oversight. Budgetary preparation and implementation were improved. Management of state-owned assets by administrative bodies and government-affiliated institutions was gradually strengthened. Much progress was made in running fiscal affairs through legal means. The financial accounting system was improved; the financial oversight mechanism was strengthened, and the computerization of financial management was accelerated.

At the same time, we are fully aware that there still exist problems concerning public finance work. Budgets are crudely prepared, and they are not scientific and accurate enough. The fiscal systems at and below the provincial level need further improvement, the transfer payment system is not yet sufficiently standardized, and some counties and townships are still experiencing financial difficulties. The structure of taxes and fees is not reasonable. The proportion of non-tax revenue in some localities is still too high. The fiscal expenditure system needs to be improved, and support to weak links including agriculture, rural areas and farmers needs to be increased. Fiscal management needs to be more meticulous. There is still serious loss and waste. The legal framework of public finance is weak. The risk of liabilities in public finance cannot be overlooked. We need to give these problems our full attention and take further measures to solve them.