Taking advantage

"The country should take advantage of falling global energy prices to increase its oil reserves," Zhang wrote in a signed article in the official People's Daily in January.

Where China's new eight SPR tanks will be built so far remains unannounced, although there has been a lot of guesswork. All four existing SPR bases are in coastal areas but Pan said some of the new ones will likely be built in the hinterland.

The government's decision to increase oil inventory seems well-received across China. A recent web survey by People's Daily of 2,569 participants, showed 98 percent of them agree China should buy more oil now at a relatively low price. Surveys by other major Chinese portals showed similar results.

But China cannot simply take advantage of attractive prices and store as much oil as it wants because its current reserve capacity is not commensurate with its energy appetite.

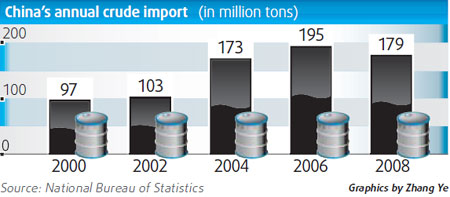

Customs statistics shows China's crude imports in January even fell 7.99 percent year-on-year. A slowing economy bears most of the blame but analysts said the country's limited capacity also played a role.

Zhao Youshan, head of the petroleum distribution committee of the China General Chamber of Commerce, an industry group, recently submitted a proposal to oil-related government agencies, calling for using tanks controlled by private companies to store more cheap oil.

Zhou said in his proposal that China's more than 600 private oil companies have 230 million tons worth of storage tanks, almost ten times the capacity of the eight new SPR tanks combined.

China has massive private oil storage facilities, built up by oil companies since China opened its oil markets to private operators in the mid-1990s. But State companies, mainly China National Petroleum Corp (CNPC) and China PetroChemical Corp (Sinopec), basically control oil-importing licenses and hundreds of private oil distributors and refiners are currently sitting on empty tanks.

Zhou said in his report that the industry slump last year has left many private oil companies broke and that some of the survivors are struggling with the high maintenance cost of empty tanks.

Using idle private tanks for national oil reserves could be a win-win situation; the country can cheaply increase storage capacity and private companies can use the extra business to pull through the recession, according to Guan Qingyou, an energy expert at Tsinghua University.

But some analysts said the involvement of private companies in SPR is not likely soon, as the government needs to make sure this is done the right way.

"If import licenses are issued to private companies and there is no proper management, that could lead to speculation and oil market disorder and even threaten national security," said Tong Lixia, a Ministry of Commerce researcher.

"So the government has to weigh the pros and cons very carefully."

(China Daily March 2, 2009)