HSBC Holdings yesterday said it would raise a total of US$17.7 billion in new capital from shareholders in a rights issue to strengthen its financial structure after reporting a more than 50 percent fall in 2008 earnings and, as expected, a surge in bad debts in the US.

|

| HSBC to raise new capital, cut jobs. [China Daily] |

Europe's largest bank is in the process of offering 5.1 billion new shares at 254 pence apiece, or a 48 percent discount on Friday's closing price, for subscription by its existing shareholders. In Hong Kong, the issue price per new share is at HK$28, or a 50.2 percent discount to its Friday close of HK$56.95.

Group Chairman Stephen Green disagreed that the rights issue had come too late. "I think it is the right timing when we get the information about our 2008 performance."

HSBC's finance director Douglas Flint said: "We want to position ourselves both defensively for turbulent times and opportunistically for the options that will appear."

Patrick Shum, Karl Thomson Securities' chief portfolio strategist, said HSBC had missed the golden time for issuing new shares - when the Hang Seng Index was above the 15000-mark. "The managements might think that they could handle the problems themselves," he said.

He said individual shareholders have no option but to accept the offer. "If they do not buy the new shares, their shareholding will be diluted. That will make them lose money, since many of them have been holding the shares for long," he said.

The rights issue is subject to shareholder approval on March 19. This will add 150 basis points to HSBC's capital ratios, strengthening the core tier 1 ratio to 8.5 percent.

The bank also said pre-tax profit last year fell 62 percent to US$9.3 billion from US$24.2 billion a year earlier after it was hit by a goodwill impairment charge of US$10.6 billion in the US.

Excluding the charge, pretax profit fell by 18 percent to US$19.9 billion, slightly ahead of the US$19 billion expected by analysts.

The bank cut its dividend for the full year by 29 percent to 64 cents per share and said it would close its troubled US consumer loans business. The bank maintained a dividend growth of 10 percent or more per annum up to 2007.

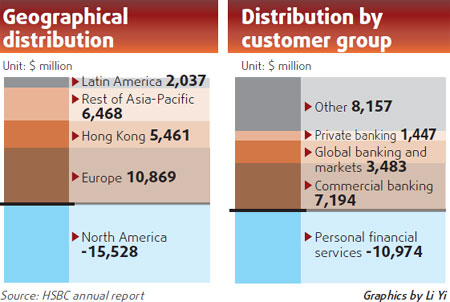

HSBC's losses in North America last year amounted to US$15.5 billion, including the US$10.6 billion goodwill impairment charge, stemming from its troubled acquisition of Household, the US consumer lending business it bought six years ago for US$14 billion.

"With the benefit of hindsight, this is an acquisition we wish we had not undertaken," Green said, for the first time admitting that the bank had made a wrong decision in acquiring Household.

Green said that the credit environment has experienced fundamental changes over the past year. "It's a painful decision to close the business," he said: "We don't want to make people redundant as well."

The bank said it would close the majority of its HFC and Beneficial-branded US branch network, resulting in the loss of 6,100 jobs and that, with the exception of credit cards, the US divisions would write no further consumer finance business.

Group-wide, the bank said that losses on bad loans jumped 44 percent versus 2007 to US$24.9 billion.

(China Daily March 3, 2009)