Guizhou Qianyuan Power Co, a small-sized Chinese power producer, posted a 766 percent jump in net profit for 2008 thanks to the abundant water supply that fired its hydropower stations.

Its net profit rose to 120 million yuan last year, on sales of 722 million yuan, which was up 135 percent from 2007, the Shenzhen-listed company said in its earnings report.

Qianyuan's 2008 results stood in sharp contrast to those at other power companies, especially the coal-powered electricity producers, who took massive losses from the big increases in the prices of coal and other fuels in the first half of 2008. These companies were hit hard in the second half of the year when power demand weakened sharply amid the economic downturn.

Jointo Energy Investment Co Ltd, Hebei, the first listed fire-powered electricity firm to report its full-year earnings, posted an 88 percent drop in net profit in 2008.

According to the National Energy Administration, China's fire-powered firms recorded a combined 70 billion yuan in losses last year.

But Qianyuan was not affected by the factors that drained profits from its much larger peers. The water flow in the Sancha River in November 2008 was nearly three times the average of the past years, helping to dramatically raise the output of its hydropower stations.

Power output at the company, based in the southwestern province of Guizhou, soared 111 percent from a year earlier to 3.14 billion kilowatt-hours last year. And the increased selling price thanks to the tariff hikes and lowered interest rates last year, the company said, also contributed to its earnings growth.

The pricing regulators of Guizhou raised the price of hydropower electricity sent to power grids twice last year.

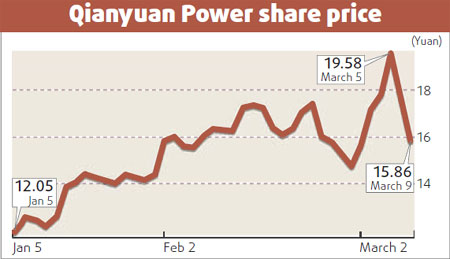

"Such sizzling (earnings) growth is very unlikely to sustain as the weather (which is very unpredictable in that region) changes," said Wang Wei, a power analyst at TX Investment Consulting Co.

The prediction is in line with the company's own assessment, which forecast an 80 percent drop in its net profits this year to 20 million yuan, citing uncertainty.

Qianyuan Power said it expected to record 1.13 billion in sales revenue this year.

(China Daily March 10, 2009)