China's steel industry association said on Friday that it plans this year to unify the spot and long-contract prices for the country's iron ore imports.

It will also set a ceiling for charges levied by import trading firms, as part of an effort to regulate the market.

The proposal was the top item of discussion at the steel industry body's two-day semiannual meeting, said Luo Bingsheng, deputy chairman of the China Iron and Steel Association (CISA), at a press conference.

The term prices negotiated with global miners should become a benchmark unified price, and the import agencies could charge 3-5 percent in commission on top of the term prices, Luo said.

The move aims to regulate excess iron ore import by steel makers and trading firms, which distorted the supply and demand balance and disrupted the annual contract talks, Luo said.

The price talks, which are continuing, appeared to be snagged on China's insistence upon bigger reductions than the 33 percent cut agreed to earlier with Japanese and Korean steel mills. News reports and industry analysts say China wants a 40 percent price cut.

than the 33 percent cut agreed to earlier with Japanese and Korean steel mills. News reports and industry analysts say China wants a 40 percent price cut.

Luo said foreign iron ore suppliers promoted massive sales on the spot market, leading to huge stockpiles.

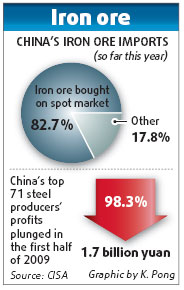

Spot iron ore accounted for 82.7 percent of imports this year, leading to excessive imports that far exceed actual needs, the CISA said.

Luo made the remark as the spot price of iron ore in China surged above the contract prices offered by three large miners - Rio, BHP and Vale.

Benchmark spot prices of iron ore in China rose above $100 a ton on Thursday, as compared with $58 a ton in April, according to industry consultant Mysteel.

Iron ore imports rose 29.3 percent year on year, to 297 million tons, in the first half of this year, while traders imported 131 million tons, up 90.4 percent from last year.

There are 152 iron ore importers in China this year, exceeding the 112 licenses that CISA issued, the association said.

Luo said the annual talks were ongoing and CISA would keep working to push them forward.

"We are working for a reasonable result and hope to reach a win-win situation," Luo said.

"For small steel companies, a unified price system is definitely good news," said Fan Haibo, a steel analyst from Xinda Securities. "Large steel mills and trading companies have made huge profits by selling iron ore to small steel factories who do not hold import license."

"But how to define which firms have 'agent license' seems essential. Giving them the privilege is akin to guaranteeing a business always makes a profit," he said.

(China Daily August 1, 2009)