Connoisseurs of premier Chinese spirits such as Wuliangye and Moutai now face higher prices for their favorite drink after the government announced it was changing the way it levies a consumption tax on distilleries, effective from August 1.

The new tax is seen as a penalty aimed at distilleries that avoided factory-gate taxes by setting wholesale prices on distributors far below retail prices.

Forcing distillers of white liquor, known as "baijiu" in Chinese, to pay more tax is expected to adversely affect the bottom lines of major liquor makers, many of them publicly traded companies. The higher tax also may drive out weaker players and accelerate mergers in a market valued at about 170 billion yuan (US$24.9 billion) a year.

"The new tax will clearly squeeze the profits of major white liquor makers, and I believe most of them will choose to raise prices to make up the loss," said Liu Jinhu, an analyst at Sealand Securities Co Ltd.

China will still charge distillers of white liquor 1 yuan per kilogram. The new policy effectively sets a minimum tax of between 50 percent and 70 percent of the retail price on distillers if the wholesale price is 70 percent lower than the retail price.

Shao Wengzhong, an analyst with Changjiang Securities Co, said higher taxes will have a negative impact on the majority of "baijiu" makers. "We estimate that Wuliangye will be affected the most, with profit down by up to 31 percent," Shao wrote in a note to investors. "Other companies that will be hit include Luzhou Laojiao, Swellfun and Kweichow Moutai, which will see their profits reduced by between 10 percent and 20 percent." But he said the impact on Shanxi Fen wine will be moderate, because the difference between the wholesale and retail prices is small.

Shares of Shanghai-listed Kweichow Moutai rose 11 percent after the government announcement. Swellfun dropped 5 percent. On the Shenzhen Stock Exchange, Wuliangye slipped 4.5 percent, while Laojiao declined 2 percent.

Kweichow Moutai Co, the nation's largest liquor maker, famous for its namesake sorghum-based spirit traditionally served at state banquets, said last Friday that net profit for the first half of this year rose 25 percent from a year earlier to 2.79 billion yuan.

Distillers in danger

In the first quarter of 2009, Kweichow Moutai's operating revenue totaled 5.55 billion yuan, up a fifth. Its operating profit jumped 24 percent to 3.91 billion yuan. The company's net profit in 2008 jumped a third to 3.7 billion yuan.

Xiong Feng, an analyst at GF Securities Co Ltd, said distillers with the lowest profit margins will suffer the most from the tax and could be forced out of the market in an industrywide consolidation.

With the unveiling of the new tax, there is growing market expectation that retail prices for white liquors will rise.

Shanghai-listed Xinhuacun Fen Wine Factory Co raised the price of its 10-year-old Fenjiu Liquor by 10 percent, from June 26.

Another spirit maker, Tuopai Yeast Liquor Co Ltd, issued a notice on the first day of the tax increase that it was raising the price of its high-end Shede series products by 6.5 percent to 10 percent.

Although most distillers haven't publicly announced any price increases yet, some distributors and retail stores are already selling the spirits at higher prices.

A 500-milliliter bottle of the country's best-known spirit, Moutai, has risen 8.5 percent to 758 yuan in some Shanghai supermarkets.

Zhang Xiang, a shop owner in Shanghai, said he's had difficulty securing adequate supplies of Moutai in the past month.

"Some shops are piling up stocks on hopes of a price rise, so I can't get sufficient supply," Zhang said.

"Even if the price increases, I am still not worried about consumption being curbed because market demand usually picks up, beginning in September."

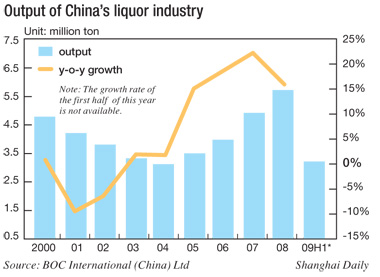

China's distillery industry has grown rapidly in recent years, but the economic slowdown in the country has taken its toll on premium-brand sales to company executives and high-ranking officials who are among the biggest consumers.

High-quality white liquors are also a mainstay at family banquets, especially during the period between October and the Spring Festival.

Industrial research firm China Investment Consulting said liquor production in China totaled 3.12 million tons in the first six months of this year, an increase of 20 percent from a year earlier.

It estimates distillery revenues will surge 21 percent to 170.8 billion yuan this year.

Chen Cheng, an analyst at the firm, said the industry will see average growth of 32 percent by 2012.

(Shanghai Daily July 15, 2009)