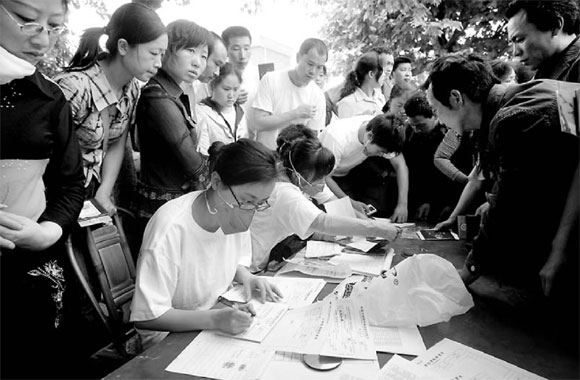

China Da Di Property Insurance Co employees on May 18 handle claims of parents whose children were killed in the quake.

The country's insurance regulator has taken steps to ensure claims of policyholders in the quake-hit areas are settled as fast as possible and they get the best services.

Among the eight steps the China Insurance Regulatory Commission took yesterday were: settling claims of policyholders who have lost their certificates, allowing medical treatment in non-designated hospitals, extending the deadline for premium payment, extending services, offering bigger loans against policies at a lower interest rate and a longer pay-back period.

"The measures are designed to ensure timely and efficient payment to policyholders," CIRC spokesman Yuan Li said.

The country's insurance companies had paid 92.3 million yuan ($13.2 million) against 202,000 claims till Sunday, with 64.9 million yuan being settled for life insurance and 27.4 million yuan for property and casualty insurance, the CIRC said.

China Life, the country's largest life insurer, is expected to pay 180 million yuan against 11,400 quake-related claims, making it the world's biggest settlement for a single incident, company president Wan Feng said.

All insurance companies are trying to shorten the payment process to ease policyholders' pain.

Hanyuan, a subsidiary of China Life in Sichuan, took less than one hour to pay 24,225 yuan to the parents of a student surnamed Zhang after getting the claim papers. The boy was killed when a wall collapsed in the quake.

Fang Guozheng, a manager with Taikang Life Insurance's Anhui branch, was one of the first group of claim agents to reach Sichuan. On May 16, the day he reached Pengzhou, he heard about the death of Zhang Laichun. After a quick investigation, Fang found Zhang's husband and son in a nearby tent and paid them 40,000 yuan against his client's policy. The entire process took only half an hour.

To provide the best service when the claims reach the peak, the regulator is working on a coordination scheme that would require all insurance companies to get details of all the claims. The insurance firms will have to send the details of a policy to their counterparts within 24 hours if a claimant is not their client.

(China Daily May 27, 2008)