The financial turmoil stemming from the United States is expected to cloud the world's economic outlook for a long haul, but some economists see it as a good chance for Chinese firms with global perspectives.

"If not an opportunity, it is at least a special time of a win-win situation for China and overseas economies," said Zhang Youwen, director of the Institute of World Economy, Shanghai Academy of Social Science, at a recent economic forum.

"In view of the current economic condition, foreign companies are in need of credit and capital flows as they are struggling with the fallouts of the global credit crunch while China has the capabilities and opportunities to invest overseas," Zhang said.

China's foreign exchange reserve reached US$1.9 trillion by the end of September 2008, and trade surplus reached a record of US$262.2 billion in 2007, the world's No.1.

"It is better to encourage companies to invest abroad than to increase imports with the aim of narrowing the trade surplus," said Zhou Ming, executive vice president of China Council for International Investment Promotion.

Thirty years after China's reform and opening-up policy, the country has attracted thousands of investors around the globe. However, China's foreign direct investment overseas has not matched the scale of FDI as a host country.

After China's entry into the World Trade Organization, the economy has been growing on a fast track boosted by vibrant trade. But exporters have suffered pains recently due to the rising yuan and foreign companies limited their overseas investment to secure domestic capital flows.

Many economists and industry experts believed that it's time for China to develop new drivers to sustain the development of its state-owned enterprises.

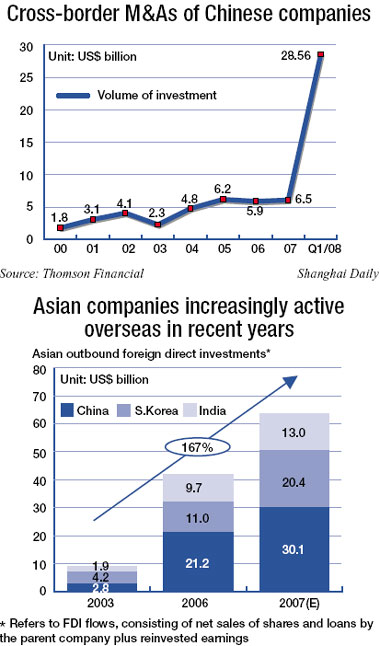

"As FDI flows from China continue to surge, it will become an increasingly important source of FDI in the world," said Supachai Panitchpakdi, the secretary-general of United Nations Conference on Trade and Development (UNCTAD).

Capital outflows from China rose from around US$2 billion in the late 1990s to US$27 billion in 2007 and is ranked No.17 globally, according to UNCTAD's World Investment Report 2008, launched last month.