Private equity and venture capital firms have substantially slowed their investment in China according a recent report from Chinese market research company Zero2IPO Group.

Private equity and venture capital firms have invested about US$419 million in 11 companies in China over January and February, said the report. They invested US$3.62 billion in 152 companies in China in the first quarter last year.

"Of course investment from venture capital firms will decrease this year. But while foreign venture capital firms will likely invest less, domestic yuan-based venture capital funds will probably develop rapidly, maybe to as much a combined total of 600 million yuan this year," said Zero2IPO CEO Ni Zhengdong.

Domestic venture capital firms have been involved in an increasing number of deals over the last few years. They made 270 deals in 2008, not far behind the 296 made by foreign venture capital companies.

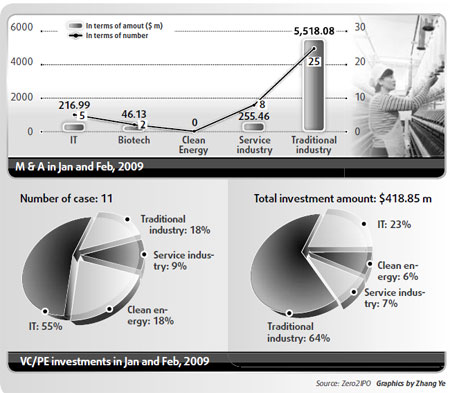

The report also revealed that venture capital and private equity firms favored companies in the traditional sector and IT industry, with 64 percent and 23 percent of investment, respectively, flowing to those industries.

Venture capital and private equity firms are taking a break from raising capital in the current economic downturn, the report said. Only 10 investment institutions set up new funds in January and February.

"It's not easy to raise capital these days but China could still be an attractive market for venture capital firms. Favorable policies for the venture capital industry are likely to come out in the next two years," said Ni.

Venture capital firms have played an active role in China's capital market. The market value of venture capital-backed Chinese listed companies has exceeded US$80 billion over the last 10 years, according to Zero2IPO.

There are 89 venture capital-backed companies listed on the overseas market with a combined market value of US$52.3 billion. There are 84 on the domestic market with a total market value of US$29.9 billion.

The report also noted that merger and acquisition activity flourished in the first two months of the year.

There were 51 such transactions worth about US$6 billion in January and February, the report said.

"The government has been focused on upgrading the country's industrial structure which obviously boosts acquisitions," said Zheng Xingguo, vice-president with Zero2IPO Group.

(China Daily March 23, 2009)