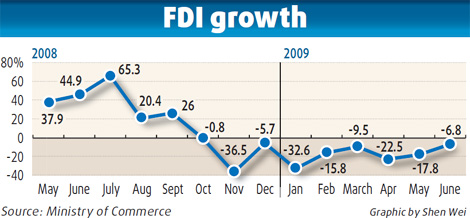

Foreign direct investment (FDI) into China contracted by a smaller percentage in June, the second straight month it has done so, signaling that the economy was poised to crawl out from the debilitating effects of the global downturn.

According to statistics released yesterday by the Ministry of Commerce, China's FDI in June contracted by 6.8 percent from a year earlier, to $8.96 billion. The number of newly approved foreign enterprises fell only by 3.8 percent to 2,529.

The decline began to ease off in May, when FDI contracted by 17.8 percent. It was minus 22.5 percent in April.

"The trend is poised to continue as the global economy shows signs of improvement," said Li Jianfeng, macroeconomy analyst from Shanghai Securities.

From January to June, FDI in China dropped by 17.9 percent to $43.01 billion, and the number of newly approved foreign enterprises was down by 28.4 percent to 10,419.

The manufacturing sector has attracted the most FDI, absorbing 56.2 percent of the total. Foreign investment in the sector fell by just 10.1 percent in the first half of the year.

The real estate sector performed the worst, with FDI in the sector falling in volume terms by 36.9 percent between January and June.

Eastern China saw an FDI fall by just 0.8 percent, while the figure was 26.5 and 34.1 percent for the western and central regions, respectively.

"The situation is still grim, and China will continue in its efforts to attract more FDI," said Yao Jian, spokesman of the MOFCOM.

In China, FDI in some way also shows how exports have fared, as a large percentage of overseas investors set up factories in China due to cheaper labor costs, and the products that they make are usually exported.

The FDI drop began since last October, followed by the decline in exports a month later.

Chinese exports showed signs of halting its decline in June as orders by overseas buyers grew. "The more FDI China absorbs, the more products the nation will sell abroad," said Li.

In the first half of 2009, China's overseas direct investment (ODI) in non-financial sectors shrank by 51.7 percent to $12.4 billion although the number of newly approved ODI cases grew by 43.5 percent to 907, the MOFCOM said.

"China is still upbeat about the ODI prospects as quite a number of State-owned and private companies are showing interest in going overseas and many projects are under discussion," said Yao.

"They are more clear about the target; and expanding sales network and acquiring new technology are top priorities," he added.

(China Daily July 16, 2009)