The collapse of 'China collapse' theory

- By Wang Wen

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, August 28, 2014

E-mail China.org.cn, August 28, 2014

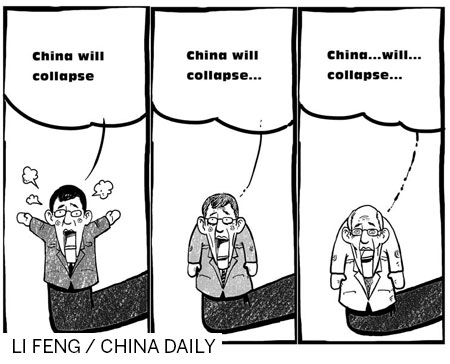

Many people, including some Chinese scholars, have been pessimistic about China's future since the global financial crisis broke out in 2008. In my view, many predictions about the Chinese economy over the past 20 years have been wrong, especially those theories forecasting the collapse of China.

Three rounds of predicting "China's collapse"

The first round of predicting China's collapse began in 1989 and can be called the "political collapse of China." After dramatic changes in Eastern Europe and the disintegration of the Soviet Union, many socialist countries fell in quick succession, and the entire Western hemisphere believed that China would be the next country to collapse. Though many of these countries failed to transition smoothly, China found its own path and realized a national revival. China's nominal GDP increased 155 times between 1978 and 2013, and the country has become the world's second largest economy.

The second round of predicting China's collapse, or the "collapse of the Chinese economy," began with the 1997 Asian financial crisis. China experienced a sharp decrease in exports, insufficient domestic demand and a large-scale drop in economic growth. Speculative investments in Hong Kong by global financial giants also put the momentum of the Chinese economy at risk. But not only did China overcome the financial crisis, the Chinese mainland also helped Hong Kong get through the crisis and stabilized the Asian economy. The Chinese economy maintained an annual growth rate of 10.5 percent and an inflation rate of 3 percent from 2003 to 2012, and Chinese strength and constancy through the crisis improved the country's relations with its Southeast Asian neighbors.

The third round of predicting China's collapse, or the "collapse of Chinese society," began after the 2008 global financial crisis. During this period, the stock market devalued and the economic growth rate dropped sharply, causing significant overproduction in some industries. Chinese society also experienced unrest and insecurity; some people even threatened to bring down China via social media, and foreign media expected a so-called "Jasmine revolution" to break out in China. Nevertheless, China still managed to overcome the triple threat of international pressure, economic slowdown and social panic. By implementing a proactive fiscal policy, a moderately loose monetary policy and social support policies, China not only realized steady economic growth, but also contributed to the stabilization and recovery of the global economy.

Each round of theorizing about China's collapse coincided with a slowdown in the Chinese economy. Though these theories are related to temporary setbacks and risk accumulation in the Chinese economy, they are primarily efforts by external forces to deny China's prospects and to engender panic whenever China experiences short-term recession. China has managed to combat these collapse theories with 35 years of robust growth and development.

How to assess theories of "financial collapse in China"

As the Chinese economy slowed and risks amassed in 2012 and 2013, a new round of pessimistic predictions about the Chinese economy emerged, especially focused on the sluggish real estate market, local government debt and systemic financial problems.

The Chinese economy has recently slowed because the Chinese economic engine is in the process of adjusting its growth rate, rearranging its economic structure and processing the macroeconomic stimulus. As domestic labor costs have rapidly increased, as the demographic dividend has gradually dwindled, and as the cost of resources has risen, the growth of the Chinese economy has switched from a high speed to a medium speed. At the same time, China is transitioning to an intensive economic development mode that differs from its traditional resource- and energy-dependent development mode. Some industries are bound to experience decline, and unemployment is bound to increase as China adjusts its economic structure. The stimulus package introduced at the beginning of the financial crisis is also still being processed through the economic structure, and many of its negative effects, such as increasing local government debt, an increase in non-performing loans at banks, and excess production, are only now emerging. The Chinese economy may transition from long-term double digit growth to a growth rate of 7.5 percent or lower, so it may take time for people to adjust.

Some indexes for the performance of China's financial and economic sectors are also declining, accelerating the spread of pessimistic expectations for the real estate market, local debt risks and the shadow banking system.

Led by shrinking investment growth and a sluggish real estate market, the heavy industrial sector and the lighter manufacturing sectors are slowing at the same time. The cooling real estate market is the major cause behind overwhelmingly pessimistic predictions for China's economy in 2014.

Turning to debt risks, debt default poses a significant risk to the economy. By June, 2013, local debt had risen to 17.9 trillion yuan (US$ 2.9 trillion), accounting for 33 percent of the Gross Domestic Product (GDP). Over 10 trillion yuan of this local debt is related to local-government-backed investment units.

Go to Forum >>0 Comment(s)