Full Text: Report on China's central, local budgets

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, March 14, 2012

E-mail China.org.cn, March 14, 2012

REPORT ON THE IMPLEMENTATION OF CENTRAL

AND LOCAL BUDGETS FOR 2011 AND ON DRAFT

CENTRAL AND LOCAL BUDGETS FOR 2012

Fifth Session of the Eleventh National People's Congress

March 5, 2012

Ministry of Finance

Contents

I. IMPLEMENTATION OF CENTRAL AND LOCAL BUDGETS FOR 2011

II. DRAFT CENTRAL AND LOCAL BUDGETS FOR 2012

Fellow Deputies,

The Ministry of Finance has been entrusted by the State Council to submit this report on the implementation of central and local budgets for 2011 and on draft central and local budgets for 2012 to the Fifth Session of the Eleventh National People's Congress (NPC) for your deliberation and approval and for comments and suggestions from members of the National Committee of the Chinese People's Political Consultative Conference (CPPCC).

I. IMPLEMENTATION OF CENTRAL AND

LOCAL BUDGETS FOR 2011

In 2011, the people of all the country's ethnic groups worked diligently with one heart and one mind under the firm leadership of the Communist Party of China (CPC). All localities and government departments comprehensively carried out decisions and arrangements of the central leadership, conscientiously implemented relevant resolutions of the Fourth Session of the Eleventh NPC, firmly grasped the theme of scientific development and the main thread of accelerating the transformation of the pattern of economic development, and strengthened and improved macro-control. As a result, the economy developed in the direction anticipated through macro-control, living standards constantly improved, reform and opening up continued to deepen, and the Twelfth Five-Year Plan got off to a good start. On this foundation, further progress was made in fiscal development and reforms, and government budgets were satisfactorily implemented.

1. Implementation of Public Finance Budgets

National revenue totaled 10.374001 trillion yuan, an increase of 24.8% over 2010 (here and below). Adding the 150 billion yuan from the central budget stabilization fund, utilized revenue totaled 10.524001 trillion yuan. National expenditure amounted to 10.892967 trillion yuan, up 21.2%. Adding the 289.2 billion yuan used to replenish the central budget stabilization fund and the 191.834 billion yuan of local government expenditure carried forward to 2012, national expenditure came to 11.374001 trillion yuan. Total national expenditure therefore exceeded total national revenue by 850 billion yuan.

Breaking them down, central government revenue amounted to 5.130615 trillion yuan, 111.9% of the budgeted figure and an increase of 20.8%. The central budget stabilization fund contributed 150 billion yuan, bringing the total revenue used by the central government to 5.280615 trillion yuan. Central government expenditure amounted to 5.641415 trillion yuan, 103.8% of the budgeted figure and an increase of 16.7%. This consists of 1.651419 trillion yuan of central government spending, up 3.3%, and 3.989996 trillion yuan in tax rebates and transfer payments to local governments, an increase of 23.4%. Adding the 289.2 billion yuan used to replenish the central budget stabilization fund, central government expenditure totaled 5.930615 trillion yuan. Total expenditure exceeded total revenue, leaving a deficit of 650 billion yuan, 50 billion less than the budgeted figure. The outstanding balance on government bonds in the central budget was 7.204451 trillion yuan at the end of 2011, which was under the budgeted limit of 7.770835 trillion yuan for the year.

Figure 1

Balance of Central Government Finances in 2011

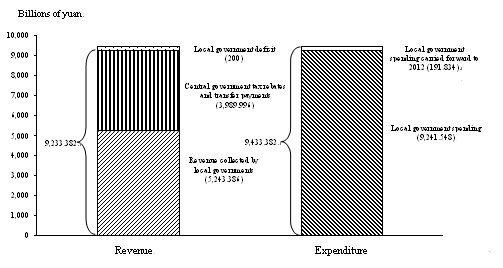

Revenue collected by local governments came to 5.243386 trillion yuan. Adding the 3.989996 trillion yuan in tax rebates and transfer payments from the central government, local government revenue totaled 9.233382 trillion yuan, an increase of 26.6%. Local government expenditure amounted to 9.241548 trillion yuan, up 25.1%. Adding the 191.834 billion yuan carried forward to 2012, local government expenditure totaled 9.433382 trillion yuan. Total expenditure exceeded total revenue by 200 billion yuan.

Figure 2

Balance of Local Government Finances in 2011

1) Implementation of main items in the central budget

(1) Main revenue items and use of surplus revenue

On the whole, the revenue situation was good in 2011, which reflected factors including steady and robust economic growth, good corporate performance, price increases, improved tax collection and administration, and the placement of past off-budget funds under budgetary management. Central government revenue exceeded the budgeted figure by 544.6 billion yuan, mainly because revenue projections in early 2011 were based on calculations using relevant targets for economic and social development. As it turned out, most economic indicators surpassed forecasts in the course of implementing the budget, and consequently tax revenue exceeded the budgeted figure. Specifically, imports greatly exceeded the figure projected at the start of the year, up 24.9%, and revenue from import taxes surpassed the budgeted figure by 272.9 billion yuan. The value added of large industrial enterprises increased by 13.9%; fixed asset investment, 23.6%; retail sales of consumer goods, 17.1%; the consumer price index, 5.4%; the output producer price index (PPI), 6%; and the input PPI, 9.1%. All of these increases exceeded forecasts at the beginning of the year, and revenue from domestic value-added tax (VAT) and excise tax surpassed the budgeted figure by 114.3 billion yuan. Profits of large industrial enterprises nationwide rose 25.4%, higher than projected early last year, and corporate income tax revenue exceeded the budgeted figure by 164.2 billion yuan. (Export tax rebates surpassed the budgeted figure by 120 billion yuan, which resulted in a decrease in revenue by the same amount.)

Main revenue items

Domestic VAT revenue was 1.827739 trillion yuan, 104% of the budgeted figure; domestic excise tax revenue, 693.593 billion yuan, 106.7% of the budgeted figure; receipts from VAT and excise tax on imports, 1.356026 trillion yuan, 120.9% of the budgeted figure; revenue from customs duties, 255.91 billion yuan, 117.9% of the budgeted figure; corporate income tax revenue, 1.002181 trillion yuan, 119.6% of the budgeted figure; individual income tax revenue, 363.306 billion yuan, 116.4% of the budgeted figure; VAT and excise tax rebates on exports, 920.474 billion yuan, 115% of the budgeted figure; and non-tax receipts, 267.695 billion yuan, 128.7% of the budgeted figure.

Use of surplus revenue

In accordance with relevant laws and regulations as well as the relevant resolution of the Fourth Session of the Eleventh NPC, of the 544.6 billion yuan in central government surplus revenue, we disbursed 94.4 billion yuan to increase tax rebates and general transfer payments to local governments, 30 billion yuan to increase education spending, 7.6 billion yuan to increase science and technology spending, 16 billion yuan to increase funding for low-income housing projects, 62.1 billion yuan to increase expenditure on road construction and fuel subsidies for certain people with financial difficulties and some public service industries, 20.7 billion yuan to increase one-off living allowances to poor people, 50 billion yuan to reduce the central government deficit, and 263.8 billion yuan to replenish the central budget stabilization fund for budgetary purposes next year. The State Council has reported on the use of central government surplus revenue in 2011 to the twenty-fourth meeting of the Standing Committee of the Eleventh NPC.

(2) Main expenditure items

On the basis of the decisions and arrangements of the central leadership, and following deliberation and approval by the NPC, the central government further increased investment in agriculture, education, medical and health care, social security, employment, low-income housing, culture, science, and technology, thereby ensuring spending on key items.

Education spending reached 324.86 billion yuan, 109.6% of the budgeted figure and an increase of 27.5%. This figure consists of 99.905 billion yuan of central government spending and 224.955 billion yuan in transfer payments to local governments. We spent 10.13 billion yuan to support the development of rural preschool education in the central and western regions and ethnic minority areas. A total of 85.91 billion yuan was used to improve the mechanism for guaranteeing the costs of rural compulsory education. Benchmark public funding per student per year for rural primary and secondary schools was increased by 100 yuan; all of the country's rural compulsory education students were exempted from tuition and miscellaneous fees and supplied with free textbooks; 12.28 million boarding school students from poor families received financial assistance; and 26 million students received subsidies for nutritious meals. We used 18.681 billion yuan to implement the plan for upgrading weak rural schools providing compulsory education. A total of 7.7 billion yuan was disbursed to exempt 29 million urban compulsory education students from tuition and miscellaneous fees and help 11.67 million children of rural migrant workers to receive compulsory education in cities. Altogether 13.398 billion yuan was spent to strengthen vocational education infrastructure and exempt 3.95 million secondary vocational school students who are from families with financial difficulties or studying agriculture-related majors from tuition. We appropriated 31.119 billion yuan to improve the policy system for providing financial aid to students from poor families, which benefited roughly 18.67 million students. We also spent 109.054 billion yuan to support the development of higher education.

Spending on science and technology came to 203.406 billion yuan, 104.6% of the budgeted figure and a 17.7% increase. This figure consists of 194.214 billion yuan of central government spending and 9.192 billion yuan in transfer payments to local governments. We spent 43.5 billion yuan to implement major state science and technology programs, 29.48 billion yuan to support Program 973 and other basic research, and 99.77 billion yuan to strengthen applied technology research. We started full-scale independent research and development (R&D) on major scientific research equipment to raise the country's level of R&D in this area. We strengthened scientific and technological infrastructure in localities to improve their research conditions.

Expenditure on culture, sports, and media totaled 41.588 billion yuan, 111.1% of the budgeted figure and an increase of 31.6%. This figure consists of 18.872 billion yuan of central government spending and 22.716 billion yuan in transfer payments to local governments. We supported free admission to 44,751 museums, memorial halls, and other public cultural facilities, and continued with efforts to extend radio and television reception and develop other key cultural programs that benefit the people. We strengthened protection of key cultural artifacts, major cultural and historical sites, cultural resources related to the early history of the CPC, and intangible cultural heritage, and increased the international broadcasting capability of key media. We also deepened reform of the cultural administration system, and stimulated development of the culture industry.

Spending on medical and health care amounted to 174.778 billion yuan, 101.2% of the budgeted figure and an increase of 17.7%. This figure consists of 7.132 billion yuan of central government spending and 167.646 billion yuan in transfer payments to local governments. We allocated 76.655 billion yuan to increase subsidies to the new rural cooperative medical care system and basic medical insurance for non-working urban residents from 120 yuan to 200 yuan per person per year. We spent 35.22 billion yuan in subsidies to fully implement the national system for basic drugs; deepen the comprehensive reform of community-level medical and health care institutions and clear their debts; raise per capita spending on basic public health services for urban and rural residents from 15 yuan to 25 yuan each year; and carry out major public health service programs. We disbursed 14.999 billion yuan to reform systems and mechanisms for managing public hospitals and help medical and health care institutions to improve their services. We also spent 11.483 billion yuan to increase medical assistance in both urban and rural areas.

Spending on social security and employment reached 471.577 billion yuan, 106.8% of the budgeted figure and an increase of 23.9%. This figure consists of 50.248 billion yuan of central government spending and 421.329 billion yuan in transfer payments to local governments. We allocated 19.6 billion yuan in subsidies to extend the new old-age insurance for rural and urban residents to over 60% of the country and provide pension benefits for participants aged 60 and over. We provided living allowances totaling 31.1 billion yuan to more than 86 million people with financial difficulties, including urban and rural subsistence allowance recipients as well as childless and infirm rural residents receiving guarantees of food, clothing, medical care, housing, and burial expenses. We earmarked 184.69 billion yuan in subsidies to the basic retirement pension fund for enterprise employees to support efforts to increase basic pensions of enterprise retirees, with monthly benefits reaching over 1,500 yuan per person on average; to improve the overall planning system for basic retirement pension funds of enterprise workers at the provincial level; and extend coverage to uninsured retirees of collectively owned enterprises. A total of 79.74 billion yuan in subsidies was used to put in place a mechanism to raise social assistance and social security benefits when consumer prices rise, to raise average monthly subsistence allowances for urban and rural recipients from 251 and 117 yuan to 278 and 135 yuan respectively, to increase subsistence allowances for orphans, to provide more subsidies to help beggars and the homeless, and to support development of a social security system and a service system for people with disabilities. We spent 23.688 billion yuan to provide subsidies and living allowances to entitled groups and increase subsidy and allowance standards as needed, and 8.64 billion yuan to ensure basic living conditions of disaster victims. We supported policy-backed closures and bankruptcies of state-owned enterprises (SOEs) and made proper arrangements for their laid-off workers. We also disbursed 41.384 billion yuan to expand fiscal and tax policies to encourage and support business startups, implement various policies to support employment, and increase subsidies to help pay interest on guaranteed small loans.

Spending on guaranteeing housing was 172.063 billion yuan, 133.1% of the budgeted figure and an increase of 52.8%. This figure consists of 32.882 billion yuan of central government spending and 139.181 billion yuan in transfer payments to local governments. Spending to accelerate the construction of low-income housing projects was 143.257 billion yuan, and adding the 28 billion yuan carried over from allocations for previous years, total spending reached 171.257 billion yuan.

Spending on agriculture, forestry, and water conservancy amounted to 478.526 billion yuan, 104.3% of the budgeted figure and an increase of 23.3%. This figure consists of 41.657 billion yuan of central government spending and 436.869 billion yuan in transfer payments to local governments. We spent 139.878 billion yuan to strengthen agricultural and rural infrastructure. With this money, we built small irrigation and water conservancy facilities in 1,250 key counties, assisted 1,100 counties in preventing and responding to geological disasters due to mountain torrents, completed ahead of schedule all tasks of reinforcing dilapidated key small reservoirs, and harnessed 1,239 small and medium-sized rivers. We used 135.13 billion yuan to improve the dynamic mechanism for adjusting general subsidies for agricultural supplies and the policy of subsidies to help pay agricultural insurance premiums, consolidate the policy of subsidies for superior crop varieties, and further expand the scope of subsidies for the purchase of agricultural machinery. We allocated 16.3 billion yuan to promote wider application of agricultural technology and stimulate development of modern agriculture and specialized farmer cooperatives. We disbursed 23.012 billion yuan to upgrade 1.619 million hectares of low- and medium-yield cropland to high-yield standards, 13.6 billion yuan to establish a subsidy and award mechanism for grassland ecological conservation in major herding provincial-level administrative areas, and 31.41 billion yuan in subsidies to put in place a comprehensive fiscal policy system for poverty alleviation and support poverty relief efforts in contiguous areas with particular difficulties. We also earmarked 18.3 billion yuan to support the building of 340,000 village-level public works projects, the launching of which were determined by villagers themselves, and carry forward trials of paying off public service debts of villages and townships in an orderly manner.

Spending on energy conservation and environmental protection came to 162.303 billion yuan, 102% of the budgeted figure and an increase of 12.5%. This figure consists of 7.419 billion yuan of central government spending and 154.884 billion yuan in transfer payments to local governments. A total of 94.4 billion yuan was spent to conserve energy and reduce emissions. With these funds, we strengthened development of key energy conservation projects capable of saving the equivalent of more than 22 million tons of standard coal each year. We redoubled efforts to implement the project for promoting energy-efficient products for the benefit of the people, putting into use over 5 million kilowatts of energy-efficient electric motors, more than 16 million highly efficient and energy-conserving air-conditioners, and 160 million energy-efficient lighting products, and shut down backward production facilities with a total capacity of 150 million tons at cement plants, 31.22 million tons at iron foundries, and 19.25 million tons at coke works. We carried out major emissions reduction projects, including those to prevent and control water pollution in the watersheds of the Huai, Hai, Liao, and Songhua rivers and Tai, Chao, and Dianchi lakes; constructed 20,000 kilometers of sewer lines to complement urban sewage treatment facilities; and conducted environmental improvement demonstrations in about 10,000 contiguous villages across 17 provincial-level administrative areas. We spent 47.456 billion yuan to implement the second phase of the project for protecting virgin forest resources and consolidate achievements already made in returning farmland to forests and grazing land to grasslands. We spent 13.943 billion yuan to carry forward demonstration projects on the use of new energy in buildings, use biomass energy comprehensively, carry out demonstrations on the use of renewable energy in buildings, and promote the development of a circular economy.

Expenditure on transportation totaled 329.859 billion yuan, 115.1% of the budgeted figure and an increase of 26.9%. This figure consists of 33.111 billion yuan of central government spending and 296.748 billion yuan in transfer payments to local governments. We spent 219.921 billion yuan to strengthen public transportation infrastructure, upgrade or expand 20,000 kilometers of national and provincial highways, improve 1,091 kilometers of inland waterways, and build or upgrade 190,000 kilometers of rural roads. We used 64.148 billion yuan to provide fuel subsidies for urban public transportation and other public service industries. We also provided 26 billion yuan in subsidies to support local governments in phasing out tolls on government-financed Grade II highways.

Expenditure on resource exploration, electricity, and information came to 82.696 billion yuan, 111% of the budgeted figure. This consists of 46.412 billion yuan of central government spending and 36.284 billion yuan in transfer payments to local governments. We used 42.975 billion yuan to strengthen resource exploration, electricity, and information infrastructure. We spent 3.5 billion yuan to support technology R&D and demonstrations for industrial application in strategic emerging industries, carry out major industrial innovation and development projects, and subsidize R&D on high-end equipment manufacturing. We also allocated 10.296 billion yuan to promote the development of small and medium-sized enterprises in these areas.

Expenditure on stockpiling grain, edible oils, and other materials totaled 89.062 billion yuan, 78.8% of the budgeted figure and a decrease of 2.4%. The difference between the actual and budgeted amounts was mainly due to fewer actual interest payments being made for stockpiling grain. This total consists of 54.008 billion yuan of central government spending and 35.054 billion yuan in transfer payments to local governments. We spent 32.033 billion yuan to completely eliminate local contributions to grain risk funds in major grain-producing areas and cover the shortfalls thus incurred, and to give direct subsidies to grain growers. We used 45.023 billion yuan to steadily raise the minimum purchase prices of wheat and rice, implement the policy for temporarily purchasing and stockpiling canola seeds and soybeans, and increase reserves of petroleum, nonferrous metals, and other important commodities.

National defense spending was 583.597 billion yuan, 100% of the budgeted figure and an increase of 12.6%. This figure consists of 582.962 billion yuan of central government spending and 635 million yuan in transfer payments to local governments. These funds were used to improve living conditions and benefits of officers and enlisted personnel, strengthen informationization of the military, modernize equipment and supporting facilities, and improve the armed forces' ability to respond to emergencies and disasters.

Spending on public security amounted to 169.547 billion yuan, 104.8% of the budgeted figure and an increase of 14.9%. This figure consists of 103.701 billion yuan of central government spending and 65.846 billion yuan in transfer payments to local governments. We pressed ahead with reforming the system of ensuring funding for primary-level procuratorial, judicial, and public security departments to enhance their service capabilities.

It should be noted that decreases in actual expenditure on stockpiling materials such as grain and edible oils and on other items led to a surplus of 25.4 billion yuan in central government expenditure in 2011, which has been transferred to the central budget stabilization fund.

(3) Central government tax rebates and transfer payments to local governments

Central government tax rebates and transfer payments to local governments totaled 3.989996 trillion yuan, 106.9% of the budgeted figure and an increase of 23.4%. This figure consists of 507.838 billion yuan in tax rebates, an increase of 1.7%; 1.829993 trillion yuan in general transfer payments, up 38.3%; and 1.652165 trillion yuan in special transfer payments, a 17.1% increase. General transfer payments for making basic public services more equally available amounted to 748.681 billion yuan; for compulsory education, 106.501 billion yuan; for basic pensions and subsistence allowances, 275.098 billion yuan; for the new rural cooperative medical care system, 77.981 billion yuan; for the award and subsidy system for village-level public works projects, 18.471 billion yuan; for cities once dependent on now-depleted mineral resources, 13.5 billion yuan; and for reforming taxes and fees on refined petroleum products, 58.1 billion yuan.

2) Implementation of main items in local budgets

Main revenue items

Domestic VAT revenue was 598.925 billion yuan, up 15.3%; business tax revenue, 1.350405 trillion yuan, up 22.7%; corporate income tax revenue, 673.854 billion yuan, up 33.5%; individual income tax revenue, 242.103 billion yuan, up 25.2%; revenue from urban construction and maintenance tax, 260.809 billion yuan, up 50.2%; deed transfer tax revenue, 276.361 billion yuan, up 12.1%; and non-tax revenue, 1.134275 trillion yuan, up 43.4%.

Main expenditure items

Local governments spent 1.511706 trillion yuan on education altogether, up 27.8%; 186.423 billion yuan on science and technology, up 17.3%; 170.158 billion yuan on culture, sports, and media, up 22.2%; 629.617 billion yuan on medical and health care, up 33.1%; 1.064141 trillion yuan on social security and employment, up 22.6%; 349.367 billion yuan on guaranteeing housing, up 75.5%; 947.349 billion yuan on agriculture, forestry, and water conservancy, up 22.4%; 764.101 billion yuan on urban and rural community affairs, up 27.8%; and 714.126 billion yuan on transportation, up 78.6%. The above expenditures include appropriations of local governments using tax rebates and transfer payments from the central government.

An analysis of the above expenditures shows that in 2011 governments at all levels spent a total of 3.8108 trillion yuan, a 30.3% increase, in areas that have a direct bearing on people's wellbeing, namely education, medical and health care, social security, employment, guaranteeing adequate housing, and culture; and 3.5629 trillion yuan in areas that are closely related to people's lives, such as agriculture, water conservancy, public transportation, energy conservation, environmental protection, and urban and rural community affairs. Government spending on agriculture, rural areas, and farmers totaled 2.9342 trillion yuan, up 21.2%. This figure consists of 1.0393 trillion yuan for supporting agricultural production; 143.9 billion yuan in direct subsidies to grain growers, general subsidies for agricultural supplies, subsidies for superior crop varieties, and subsidies for purchasing agricultural machinery; 1.624 trillion yuan for developing rural education, health, and other social programs; and 127 billion yuan for expenses related to stockpiling agricultural products and associated interest payments. It should be noted that expenditure on ensuring and improving living standards or on agriculture, rural areas, and farmers do not constitute separate budgetary items. For ease of deliberation, we have combined all expenditure items concerned, so there is some overlap in the statement of expenditure.

2. Implementation of Budgets for Government-managed Funds

In 2011, revenue from government-managed funds nationwide came to 4.135963 trillion yuan, up 12.4%, and expenditure from them amounted to 3.964243 trillion yuan, up 16.8%.

1) Budget for central government-managed funds

Receipts from central government-managed funds totaled 312.593 billion yuan, 110.6% of the budgeted figure and a decrease of 1.6%. This figure includes 64.8 billion yuan from the railroad construction fund, 13.602 billion yuan from port development fees, 31.745 billion yuan from lottery ticket proceeds, 21.741 billion yuan from the fund for providing ongoing aid to residents relocated to make way for the construction of large and medium-sized reservoirs, and 10 billion yuan from the central government fund for repaying rural power grid loans. Adding the 79.487 billion yuan carried forward from 2010, utilized revenue from central government-managed funds totaled 392.08 billion yuan in 2011.

Expenditure from central government-managed funds totaled 310.349 billion yuan, 85.8% of the budgeted figure and an increase of 2.9%. This total consists of two parts. The first is 215.687 billion yuan of central government spending, down 5.6%, which includes 68.292 billion yuan on railroad construction; 7.335 billion yuan on port development; 19.125 billion yuan from lottery ticket proceeds, which was spent on social welfare, sports, education, and other public service programs; and 10.526 billion yuan from the central government fund for repaying rural power grid loans. The second part is 94.662 billion yuan in transfer payments to local governments, up 29.2%. A total of 81.731 billion yuan was carried forward to 2012 from central government-managed funds.

2) Budgets for local government-managed funds

Revenue collected by local governments from funds under their control reached 3.82337 trillion yuan, an increase of 13.8%. This figure includes 3.316624 trillion yuan from the sale of state-owned land use rights, 85.726 billion yuan from urban infrastructure construction fees, 31.16 billion yuan from lottery ticket proceeds, and 68.813 billion yuan from local education surcharges. Adding the 94.662 billion yuan in transfer payments from central government-managed funds, total revenue from local government-managed funds was 3.918032 trillion yuan.

Expenditure from local government-managed funds totaled 3.748556 trillion yuan, an increase of 18.4%. This includes 3.293199 trillion yuan of spending from proceeds of the sale of state-owned land use rights, consisting of 2.362997 trillion yuan paid out as compensation for land expropriation, housing demolition, and resident relocation; 235.106 billion yuan for developing and improving farmland, strengthening rural infrastructure, and subsidizing farmers; 19.746 billion yuan on education; 12.035 billion yuan for building irrigation and water conservancy facilities; 66.858 billion yuan on low-income housing projects; and 596.457 billion yuan on urban development allocated in accordance with the provisions of the Law on Urban Real Estate Administration. A total of 30.14 billion yuan from lottery ticket proceeds was spent on social welfare, sports, education, and other public service programs; 74.104 billion yuan was used to build urban infrastructure; and 38.651 billion yuan from local education surcharges was earmarked for education. Surplus revenue from local government-managed funds was carried forward to 2012.

3. Implementation of the Central Government's State Capital Operations Budget

In 2011, revenue from the state capital operations of the central government totaled 76.502 billion yuan, 90.6% of the budgeted figure and an increase of 36.9%. The difference between the actual and budgeted amounts was mainly because sales of state shares of enterprises amounted to less than expected. Adding the 3.559 billion yuan carried forward from 2010, utilized revenue totaled 80.061 billion yuan.

Expenditure on the central government's state capital operations came to 76.954 billion yuan, 89.6% of the budgeted figure and an increase of 42%. The difference between the actual and budgeted amounts was mainly due to proceeds from the sale of state shares of enterprises being less than expected, which resulted in a corresponding reduction in expenditure. This figure includes 49.166 billion yuan for restructuring the state sector and industrial restructuring, 2.312 billion yuan in subsidies for reforming central government enterprises and making them profitable, 3.5 billion yuan for fostering major scientific and technological innovations, 3.5 billion yuan for major energy conservation and emissions reduction projects, 2.318 billion yuan for overseas investment, 955 million yuan for strengthening production safety, 8 billion yuan for enterprise mergers and reorganizations, 2.609 billion yuan for supporting emerging industries, and 4 billion yuan transferred to the public finance budget and spent on social security.

4. Implementation of a Proactive Fiscal Policy

We followed a proactive fiscal policy, further consolidated and expanded upon the success in responding to the impact of the global financial crisis, spurred steady and robust economic development, and kept overall price levels basically stable.

We made full use of the role of fiscal and tax policies to keep overall price levels basically stable. We supported increases in the supply of agricultural products, stabilized the supply of fertilizers and refined petroleum products, increased support for hog production, strengthened regulation of the markets for reserve commodities, gave policy support to grain and edible oil sales in designated areas, expanded imports of daily necessities and raw materials, and thereby promoted a balance between supply and demand. We exempted vehicles transporting fresh farm products from road tolls, reviewed road tolls, and lowered distribution costs. We implemented all policies to grant subsidies to low-income groups in urban and rural areas, provided fuel subsidies to certain people facing financial difficulties and some public service industries, and lessened the impact of rising prices on disadvantaged groups.

We raised the incomes of urban and rural residents to increase their purchasing power. We made the distribution of national income more reasonable, expanded government subsidies, increased subsidies to farmers, strengthened agricultural infrastructure, and made further progress in providing financial support for alleviating poverty through development, in order to increase rural incomes. We raised subsistence allowances for both urban and rural recipients as well as basic pensions of enterprise retirees, extended trials of the new old-age insurance system for rural and urban residents, and implemented performance-based salary systems for compulsory education teachers and workers in public health institutions and community-level medical and health care institutions, thereby boosting people's purchasing power. We improved policies on providing subsidies for rural residents to purchase home appliances and subsidies for trading in old home appliances for new ones. We supported the development of goods distribution and improved the consumption environment.

We improved the investment structure to shore up weak links in economic and social development. The central government used its capital construction investment mainly to support the construction of low-income housing projects and the development of agricultural infrastructure, particularly water conservancy facilities, and education and health infrastructure; energy conservation, emissions reductions, ecological conservation, and environmental protection; economic and social development in Xinjiang, Tibet, and Tibetan ethnic areas in Qinghai, Sichuan, Yunnan, and Gansu provinces; independent innovation; and the development of strategic emerging industries. We gave priority to ensuring funding for key ongoing projects, and began construction on the major projects laid out in the Twelfth Five-Year Plan in an orderly manner.

We refined policies on structural tax reductions to guide business investment and consumer spending. We raised the individual income tax threshold on salaries from 2,000 yuan to 3,500 yuan per month and adjusted the tax rate structure to reduce the tax burden on low- and middle-income earners. We continued to implement a preferential income tax policy for some small businesses with low profits and initiated a series of tax relief and exemption policies, such as raising VAT and business tax thresholds, to reduce the burden on small and medium-sized enterprises. We put into effect lower provisional import tariffs on more than 600 resource products, basic raw materials, and key parts and components in 2011. We continued to implement preferential tax policies to promote the large-scale development of the western region. We rescinded, reduced or remitted 77 charges and funds to lighten the burden on businesses and consumers.

5. Progress in Fiscal and Tax Reforms

We continued to improve the structure of transfer payments and increased general transfer payments. We improved the mechanism for ensuring basic funds for county-level governments, and enhanced their ability to provide public services. We carried out the reform to place county finances directly under the management of provincial-level governments in 1,080 counties of 27 provincial-level administrative areas. We improved public finance budgets, made budgets for government-managed funds more detailed, and expanded the coverage of state capital operations budgets and the scope of compiling budgets for social insurance funds on a trial basis. We eliminated all off-budget funds and placed all government revenues under budgetary management. We improved budget management systems, such as departmental budgeting, centralized treasury collection and payment, and government procurement, and carried out performance-based management throughout the course of compiling, implementing and evaluating budgets. We devised a pilot plan for replacing business tax with VAT to promote development of the service sector. We reformed the individual income tax system. We carried out trial reforms to collect property tax on personal homes, and adjusted the business tax policy for selling them. We carried out a nationwide reform to calculate resource taxes on crude oil and natural gas based on their prices, and integrated the resource tax systems on crude oil and natural gas for domestic and overseas-funded enterprises. We increased central government subsidies to reform collectively owned factories operated by SOEs across the country. We supported the reform of state-owned financial institutions and improved performance assessment systems for financial enterprises.

6. Implementation of the NPC Budget Resolution

In accordance with the relevant resolution of the Fourth Session of the Eleventh NPC, as well as the guidelines of the NPC Financial and Economic Affairs Commission, we implemented fiscal and tax policies conducive to transforming the pattern of economic development, worked hard to ensure funding for key areas, strictly implemented budgets, and refined the budget management system and the mechanism for ensuring basic funds for county-level governments. We made fiscal management more scientific and meticulous, strengthened fiscal and tax legislation, carried out work related to enacting the Law on Vehicle and Vessel Tax and revising the Law on Individual Income Tax and Provisional Regulations on Resource Tax, and made steady progress in revising the Budget Law and the Law on Certified Public Accountants and in asset valuation legislation. We made public finance budgets more detailed, and continued to increase the funds for budgetary items available at the beginning of the year. We redoubled efforts to manage the implementation of budgetary expenditure, and implemented budgets more quickly. We conducted inspections of the implementation of major fiscal and tax policies; strengthened oversight of key funds related to maintaining living standards, including those for agriculture, rural areas, farmers, and medical reform; and constantly improved oversight mechanisms that cover all government-managed funds and all stages in the use of public finances. We intensified efforts to bring unauthorized departmental coffers under control, and a permanent mechanism for preventing them from recurring began to take shape. We pushed ahead with the work on releasing central budgets and final accounts to the public, and added subsection-level headings to publicly accessible final accounts. A total of 92 central government departments opened to the public their budget tables, appropriations tables, and final accounts. Public finance budgets at the provincial level were all made accessible to the public, and work was accelerated to release budgets of local government departments and special expenditures of primary-level governments. Relevant departments of the central and local governments released to the public information relating to their spending on official overseas trips, official vehicles, and official hospitality. We standardized management of debts held by financing corporations run by local governments, and reviewed and verified the amounts of their debts. We responded to the NPC Standing Committee's inquiries, reported to it on budget implementation, and put into effect measures to improve implementation on the basis of its response to our report. The State Council reported relevant developments to the Standing Committee.

In general, we successfully implemented the 2011 budgets and made further progress in all aspects of fiscal work. This was the result of scientific decisionmaking and correct leadership of the CPC Central Committee and the State Council; the oversight, guidance, and strong support of the NPC and the CPPCC National Committee; the close collaboration and diligent work of all localities and departments; and the concerted, strenuous efforts of all ethnic groups of the Chinese nation. At the same time, we are also keenly aware of the following difficulties and problems concerning fiscal operations and public finance work: the structure of the tax system needs to be rationalized, and fiscal and tax policies are not playing an adequate role in transforming the pattern of economic development and adjusting income distribution; the system of transfer payments can be improved further, and their structure needs to be optimized; it has become more difficult to restructure government spending, and the task of ensuring and improving living standards is onerous; mechanisms for local governments to borrow money and repay debts are not sound enough, and risks must not be overlooked; and losses and waste in the area of public finance occur from time to time, which calls for improved fiscal management, and government funds need to be used more efficiently. We attach great importance to these problems and will continue to take effective steps to resolve them.

Go to Forum >>0 Comment(s)