U.S. Treasury Secretary Henry Paulson said Wednesday the U.S. government will not use the 700 billion U.S. dollar rescue package to buy illiquid mortgage-relates assets from the banks.

|

|

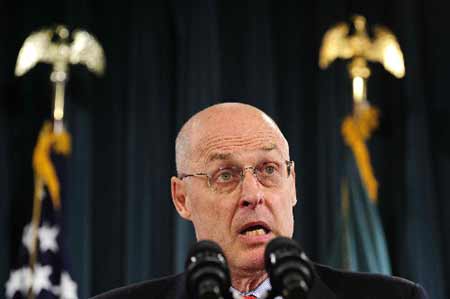

U.S. Treasury Secretary Henry Paulson speaks during a press conference at the Treasury Department in Washington Nov. 12, 2008. Paulson gave an update of the Troubled Asset Relief Program (TARP) Wednesday, saying the second half of the 700 billion U.S. dollar financial rescue program will not be used to purchase troubled assets as originally planned. [Xinhua/Zhang Yan] |

However, the Treasury will continue to use 250 billion dollars of the package to purchase stock in banks as a way to bolster their balance sheets and encourage them to resume more normal lending, said Paulson.

"Our assessment at this time is that this (the purchase of bad assets) is not the most effective way to use funds," said the Treasury chief.

"In consultation with the Federal Reserve, I determined that the most timely, effective step to improve credit market conditions was to strengthen bank balance sheets quickly through direct purchases of equity in banks," he noted.

"I will never apologize for changing an approach or a strategy when the facts change," he said. "I think the apologies should come the other way if someone doesn't change when the facts change."

"Our financial system remains fragile in the face of an economic downturn here and abroad, and financial institutions' balance sheets still hold significant illiquid assets," said Paulson, warning that market turmoil will not abate until the biggest part of the housing correction is behind us.

"Our primary focus must be recovery and repair," he said.

Meanwhile, Paulson said he believes that the Bush administration has "taken the necessary steps to prevent a broad systemic event.

"Both at home and around the world we have already seen signs of improvement. Our system is stronger and more stable than just a few weeks ago. Although this is a major accomplishment, we have many challenges ahead of us," he said.

(Xinhua News Agency November 13, 2008)