COVID-19 pandemic will bankrupt more economies than it kills

- By Fateh Belaïd, Adel Ben Youssef, Benjamin Chiao and Khaled Guesmi

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, May 19, 2020

E-mail China.org.cn, May 19, 2020

The current global medical crisis has sounded the death knell for conventional beliefs about the inability of oil resources to support the world economy.

For several decades, many experts predicted a decline in oil production in line with ideas like Marion King Hubbert's (1956) peak oil theory. However, the coronavirus epidemic event upset this.

Before the COVID-19 crisis, world consumption was around 100 million barrels of oil/day in total. In the period from April 2019 to April 2020, the drop in demand is estimated to have been around 29 million barrels/day.

To put this into perspective, during the 2008 financial crisis, demand for oil fell by around 5 million barrels/day. Following the current sharp drop in demand, the 13 OPEC members, holding almost 80% of world oil reserves, agreed to reduce production to ensure price stability.

The world's major oil-exporting nation

The OPEC+ alliance or the "Vienna Group" comprises 24 oil-exporting countries – the 13 members of OPEC and 11 other suppliers such as Russia, Mexico and Kazakhstan. The main objective of the OPEC cartel is to manage oil supplies so as to control world prices and avoid fluctuations affecting the economies of both the oil producing and purchasing countries.

Russia which is part of the wider OPEC+ alliance refused to cut production significantly for a longer period; in response, Saudi Arabia increased its production, triggering a price war. The result was sharply falling prices and a stock market collapse.

In April, after intervention by U.S. President Donald Trump, Saudi Arabia and Russia put an end to this price war and the OPEC+ association agreed to cut production by more than 2 million barrels/day by end of the year.

However, this has not prevented prices from falling. WTI, the American crude oil benchmark, turned negative for the first time on April 20, 2020. Indeed, this fall in the oil price has adverse effects on the world economy and on oil-exporting countries who depend heavily on oil revenues.

The beginning of the contagion

Most shale oil producers cannot survive with an oil price below $30. Many countries and their oil companies are massively reducing their planned investments. The future looks ever more uncertain as global demand continues to collapse.

This situation is not helpful to the economies of American oil producers. In 2019, the U.S. was the leading producer of oil, with extraction of around 13 million barrels/day. However, today, dozens of small and medium-sized American oil companies are facing bankruptcy as storage capacity is exhausted and wells are shut down.

In addition, concern over price destabilization has been replaced by risk of a persistent fall in demand due to the economic situation, stricter energy transition policies, and a switch to alternative energy sources to the detriment of fossil fuels.

Some countries are especially vulnerable

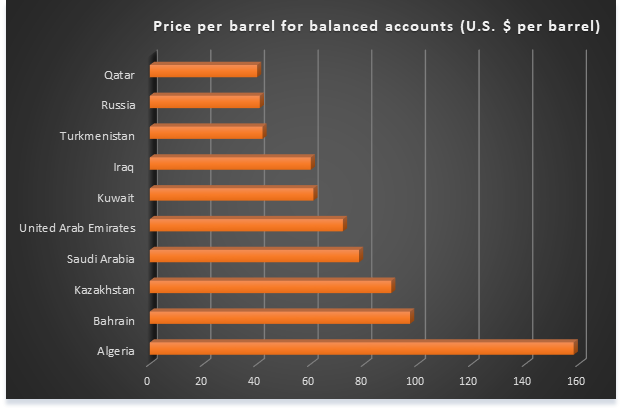

The economic threat posed by the coronavirus is exponentially greater than the health risks it poses for certain individual countries, and especially those that depend heavily on oil revenue. Although some such as Norway, Saudi Arabia, Kuwait, and Russia have sufficient fiscal room to maintain public spending until 2021, other oil-producing countries such as Iran, Venezuela, Iraq, Nigeria, and Algeria risk loss of liquidity with consequences for their health systems, employment, demand, financial conditions, etc.

The specter of a collapse of some of these undiversified economies with mixed economic performance even before the crisis is even more present.

Iran and Venezuela, already strangled by international sanctions and heavy pressure from the Americans, are at boiling point as are Algeria and Iraq.

In the case of Venezuela which is experiencing an ongoing structural crisis, the pandemic will worsen the economic situation. In Iran, the situation is different. Its hydrocarbons sector accounted for 80% of exports and the authorities had foreseen a drop in exports due to the economic sanctions imposed by Donald Trump.

Algeria and Iraq were rocked by social protest movements for several months before the economic crisis. In Algeria, the 2020 finance plan was based on a $60 per barrel reference price with the result that the fall in prices produced a substantial shortfall. More than 90% of Algeria's external revenue comes from exports of hydrocarbons.

Similarly, Iraq which doubled its production of oil since the American invasion to become the fourth-largest oil producer in the world, is likely to experience further turbulence which will be accentuated by the struggle for influence between Iran and the U.S.

So far, we have no precise data on the economic consequences of the COVID-19 epidemic on other African countries, but it is clear that the oil-producing nations will be the most severely affected. Nigeria whose economy is linked 95% to oil, plans to cut its budget as do Angola, Egypt, and Sudan. None of these countries has managed to diversify their economies and implement new economic models.

At the same time, countries such as Mali and Burkina Faso whose economies depend on agricultural exports, have been affected by the sharp fall in world prices for raw materials and the drop in world demand. The United Nations Conference for Trade and Development (UNCTAD) estimates Equatorial Guinea, Republic of Congo, and Gabon which are not large exporters in terms of volume, are likely to be affected by this possible drop in foreign trade.

Senegal called on Africa's trading partners to increase the continent's resilience by canceling its debt, a sentiment echoed by UNCTAD. The IMF has released $10 billion at zero interest, intended mainly for African countries.

Are non-oil producing countries safe?

Not even the non-oil producing countries are safe, because many African countries although they may not export hydrocarbons are involved in exports of other raw materials, for example, Democratic Republic of Congo, Zambia, and South Africa. The decline in tourism revenue will be an additional shock especially for countries such as Tunisia and Morocco. In the latter, tourism accounts for around 10% of both GDP and employment.

According to the IMF, real GDP in the Middle East and North African oil-exporting countries has contracted by 4.2% so far this year. Overall, this crisis could cost the African economies between 5 to 10 points of GDP in 2020 which in terms of revenue could be between $130-150 billion.

The restrictions imposed in recent weeks, the border closures, and the suspension of international flights are all reducing trade and diaspora foreign currency transfers.

So far, it is impossible to predict when this situation might end. A strong world economic recovery after the crisis might produce soaring demand for oil and greater volatility. However, we do not know when this recovery will occur; we do not know what form it will take or what will be the rate of the recovery.

Fateh Belaïd is Professor of Economics at the Faculty of Management of Economics & Sciences (Catholic University of Lille). This research is particularly concerned with the economics of energy and the environment.

Adel Ben Youssef is currently Lecturer at the University of Côte d'Azur and member of the CNRS research laboratory (GREDEG – CNR UMR 7321). He specializes in environmental economics and climate change.

Benjamin Chiao is Professor at Paris School of Business and Southwestern University of Finance and Economics. His areas of research are the Chinese economy, industrial economics and decision biology.

Khaled Guesmi is a professor of finance at the Paris School of Business and Director of the Center for Research on Energy and Climate Change (CRECC). His research focuses on subjects such as the financialization of raw materials and the effect of contagion between stock markets and energy markets.

Opinion articles reflect the views of their authors, not necessarily those of China.org.cn.

If you would like to contribute, please contact us at opinion@china.org.cn.

Go to Forum >>0 Comment(s)