Report on Top 500 Manufacturers of China in 2010

Summary: The China Enterprises Federation (CEC) and China Enterprise Directors Association have published their sixth annual list and report on China's top 500 manufacturing companies. The data about China's top 500 manufacturing companies in 2010 show that the impact of the global financial crisis has made a dent in growth of these companies, but their business still increased in 2010.

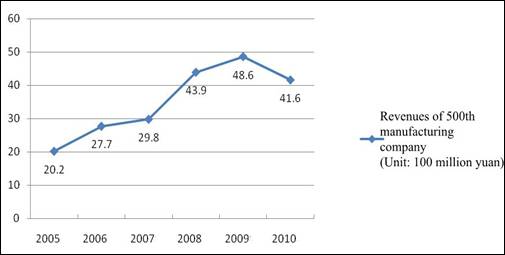

The threshold for making the list has fallen for the first time. The cutoff for qualifying for this year's list dropped 14.4 percent to 4.16 billion yuan from 4.86 billion yuan in 2009, down 5.24 percent from the 2008 requirement. The threshold had been on the rise in the previous five lists but fell in 2010 as companies suffered a loss from the financial crisis. Figure 2-1 shows coffers for firms qualifying for China’s top 500 manufacturers list between 2005 and 2010.

Figure 2-1. Revenue cutoff to qualify for China's top 500 manufacturer list from 2005-2010

Some 279 of the top 500 manufacturing companies who made the list last year appeared for a second time this year, compared to 295 last year. The 279 companies had a combined 11,385.728 billion yuan in sales, accounting for 41.21 percent of China's top 500 companies, 2.83 percent less than last year's 44.04 percent. The combined profits of 279 manufacturers were 453.927 billion yuan, or 30.20 percent of the total profits of China's top 500 companies, 0.60 percent more than the previous year.

The number of China's top 500 manufacturing companies which made the Fortune 500 list in 2010 was 14, down from 10 last year. Another four companies – namely Guangzhou Automobile Group, Shougang Group, Haier Group and China Shipbuilding Industry Corporation – did not apply for entry into the Fortune 500 list though they reached the threshold.

Chinese industries, especially the manufacturing sector, felt the impact of the financial crisis in 2009, but manufacturing companies fought their way through the nasty year by taking effective measures to limit their exposure to the crisis.

|

Chapter I. |

|

|

Chapter II. |

|

|

Chapter III. |

|

|

Chapter IV. |

|

|

Chapter V. |

|

|

Chapter VI. |

|

|

Chapter VII. |

0

0

Go to Forum >>0 Comments