China not in search of money or power

He Maochun has changed roles with aplomb, from farmer to professor of economics, from sailor to government official, and from exporter who has traveled to 110 countries to a researcher on WTO.

His present role is as director of the center of economics and diplomacy of Tsinghua University, Beijing. He is also a member of China Democracy League, a non-communist party, and an electrifying speaker.

His favorite subject, as it is of most of his audience, is China's role in the future world. In just 10 years from now, the size of China's economy will be bigger than Japan's and get closer to that of the US. So, he says, "if you talk about the two greatest events in the 21st century, one has to be China's rise. And if you talk about just one, again it has to be China's rise."

His favorite subject, as it is of most of his audience, is China's role in the future world. In just 10 years from now, the size of China's economy will be bigger than Japan's and get closer to that of the US. So, he says, "if you talk about the two greatest events in the 21st century, one has to be China's rise. And if you talk about just one, again it has to be China's rise."

But He is not an ultra-nationalist, as his argument proves. "What is the purpose of China's rise? Let us think how can a superpower care only about itself? Our greatest glory will be (serving) mankind its common security its sustainable development."

Speaking at a recent conference on cross-border investment in Beijing, he says it's time Chinese companies made offshore investment one of their priorities to expand, and helped China grow into a bigger power.

Chinese have 55 trillion yuan ($8.05 trillion) in business and personal savings, the country has $2.2 trillion in foreign exchange reserves and last year, government revenue touched 6 trillion yuan ($878 billion). China is sitting on a huge amount of wealth, so "why don't we share it with the rest of the world?" he tells China Daily.

That is how China can shoulder increasing responsibility in world affairs and Chinese companies can expand and become more efficient, he says. This is the best time for Chinese companies to "go out". But offshore investment should not be a game reserved only for State-owned enterprises. "It should also be open to private small- and medium-sized enterprises (SMEs)."

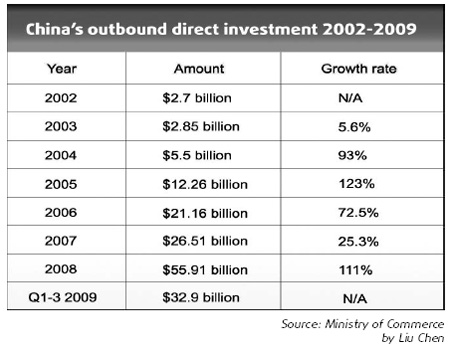

In fact, a quiet change is already taking place on the international direct investment map, where China is no longer a passive recipient but an increasingly active investor. From 2002 to 2008, Ministry of Commerce data show, the outbound direct investment (ODI) of Chinese companies in some 170 countries and regions reached $126.89 billion. Last year alone, Chinese ODI grew 111 percent to $55.91 billion.

And despite the global financial crisis and credit crunch, Chinese ODI touched $32.9 billion in the first three quarters of this year. In the same period, the ODI in Africa grew by 77.5 percent to $875 million, and China completed engineering contracts worth $17.84 billion, up 41.2 percent year-on-year.

But isn't China's ODI coming too soon and too fast, especially because it does not have any experience of building modern businesses in distant lands? Shouldn't Chinese companies adopt a "go-out-but-go-slow" strategy to avoid blunders such as TCL's loss in its takeover of France's Thomson SA, a consumer electronic company, and Lenovo's attempt to expand its global sales after taking over IBM's personal computer division?

Studies show that the "failure" rate of Chinese companies in their overseas M&A (mergers and acquisitions) bid reached 67 percent in the past two decades. This could mean that more than half of the investment money has evaporated.

But He says the figures don't speak the whole truth. He dismisses them as "inaccurate and ridiculous". There are different ways of measuring success, but it's the companies that always know best what they want. "We could say 67 percent of the companies are not earning profit, but it's premature to use the word failure."

Companies that "go out" do so with some long-term goals and cannot be measured by short-term results. On a broader scale, he insists, even a period of eight to 10 years is not enough for full evaluation. "Domestic companies need to do a lot of things just to learn to be global," he says.

And then comes his emphasis: People are wrong in assuming that the only goal of Chinese companies is to make money. "Money isn't the only thing. And it shouldn't be the only thing." It's more important for a domestic company to place itself on a learning curve - to see how to make the best use of its resources at home and abroad, how to work in and serve overseas markets, how to be responsible in a truly global environment and how to work for the ultimate good of China and the international community.

"To seek quality growth, companies will have to stop haggling over every ounce They should see the broader picture and think about the bigger issues." To build a good company, its leader should have a global strategy for material resources, markets, risks and human resources. "Entrepreneurs must be strategists."

One of the bigger issues, he says, is the inevitability of global business. "In the 1980s, China's task was to do away with policy-backed companies. In the 1990s, it was to get rid of the companies without core competence, those too weak to compete in the market. And now, companies cannot survive without a global vision and an understanding of related matters?"

Instead of focusing on quick profit, he says, companies should do some homework on the target country's economy, culture, politics and laws. These are crucial factors, although they don't usually reflect in a company's financial statement.

He advises Chinese companies to make a realistic assessment of their strengths, especially their integrating ability, before going in for M&As. Only this way can companies expect to grow in their host countries and achieve mutually beneficial results in offshore investments.

This is what China has been doing in Africa, as opposed to the old colonial powers, and winning the African peoples' respect and friendship, he says, recalling the time when he used to export goods from Europe to Africa.

One may think that He wants Chinese companies to invest abroad without caring about temporary losses because he wants China to assume global leadership, on which US seems to be losing its grip. But unlike most other China-rise advocates, he doesn't think the economic downturn points to the demise of the US as a superpower.

In a recent interview with the Chinese-language press, he has given his confidence vote to US President Barack Obama's economic program. The crisis has not eroded the many strengths of the US economy, he says, even though it has to go through a process of readjustment.

He expects China and the US to work together more closely in the post-crisis era to help lift the global economy. The US, he says, is China's best competitor and best teacher both. Chinese should learn from Americans how to build a national learning culture.

For China, becoming a world leader is first of all a learning process. The country's rapid economic development is only one aspect of its peaceful rise. The main aspects, he emphasizes, are "implementation of values such as equality, justice, transparency, freedom, rule of law and democracy".

0 Comments

0 Comments

Comments