Bogus arguments for RMB revaluation

One of the main purposes of Barack Obama's visit to China was to press for an increase in the exchange rate of the RMB against the dollar.

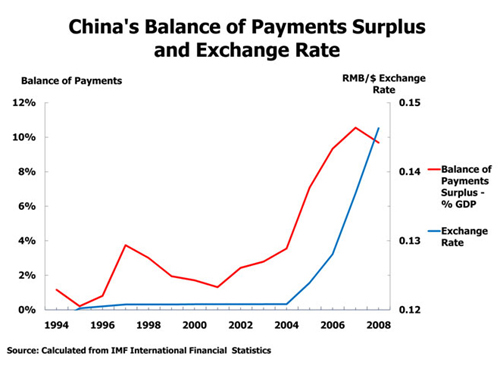

It is therefore rather disturbing for the rest of the world that President Obama's advisers do not appear to have made a serious study of what happened last time China revalued the RMB – and what it shows regarding the structure of China's trade. If they had done so, they would have found a very different picture to the one they appear to imagine – as a glance at Figure 1 should indicate. This shows clearly that as the exchange rate of the RMB rose after 2004, China's trade surplus did not shrink, as President Obama's advertisers appear to think would happen, but on the contrary, dramatically increased.

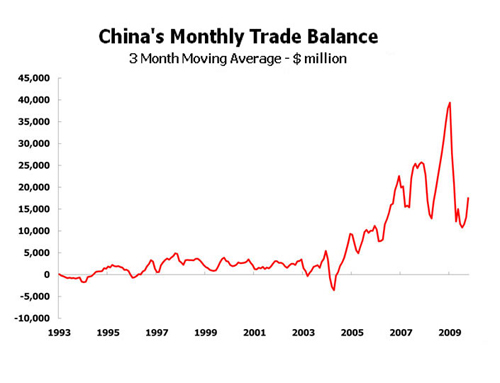

To show this trend in a wider context, Figure 2 illustrates China's trade balance over a longer period – using a three month moving average to smooth out purely short term fluctuations.

As can be seen, prior to 2005 China did not run a significant trade surplus. Both Chinese exports and imports were rising rapidly. China was correctly pursuing "export oriented growth" throughout this period – that is, the proportion of exports in the economy was increasing rapidly. But until after 2004 this rising value of exports was matched by a rising value of imports. Only after 2004 did a large trade surplus develop.

That China's large trade surplus only appeared after 2004 should immediately draw the attention of those arguing for RMB revaluation. Because 2005 was precisely the year in which China began to allow the RMB's exchange rate to rise. In other words, as shown in Figures 1 and 2, an increase in the RMB's exchange rate led not to a fall in China's trade surplus, but to an increase.

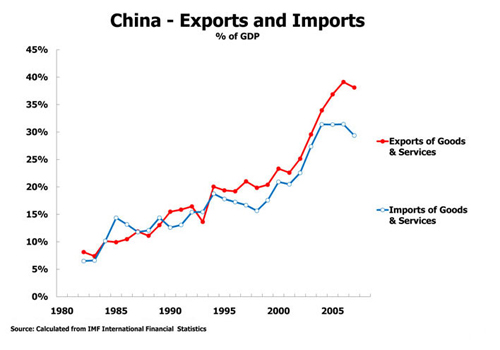

What took place is shown in Figure 3 – the factual data Barack Obama's advisers do not appear to have studied. It shows China's exports and imports as a percentage of GDP.

As can be seen until 2004 the value of both China's exports and imports rose rapidly as a percentage of GDP. However from 2005 onwards, while China's exports continued to rise, its imports began to fall relatively in value – and it was this combination that created the trade surplus. Factually, therefore, China's surplus was not caused by a surge of exports but by a relative fall in the value of imports.

It is easy to account for this development of a rising exchange rate leading to an expanding trade surplus. And it explains why there could be some very unpleasant trade surprises if China were to raise the RMB's exchange rate.

0

0

Go to Forum >>0 Comments