Bankruptcy fears must not influence monetary strategy

- By Andy Xie

0 Comment(s)

0 Comment(s) Print

Print E-mail

China.org.cn, November 19, 2011

E-mail

China.org.cn, November 19, 2011

|

|

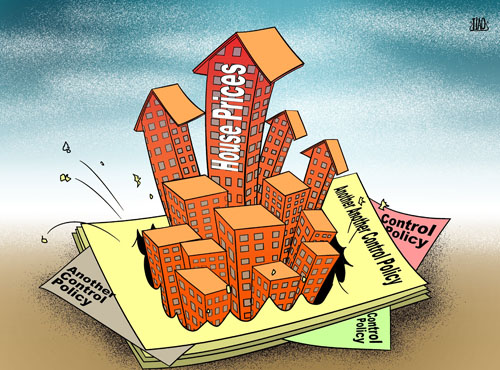

Do not work [By Jiao Haiyang/China.org.cn] |

Currently, China is suffering from a structural labor shortage. During the economic restructuring process, it is inevitable that some companies will fail. However, unemployment due to bankruptcies will likely be absorbed within a few months. Loosening controls now due to public pressure will likely only lead to even greater problems caused by inflation and the real estate bubble.

Let adjustments run their course

The housing market has already been affected by previous monetary tightening measures. Some real estate companies have tried to increase sales by reducing prices. This is a good sign. Since China is experiencing a real estate bubble, price adjustments are necessary to keep the market solvent.

Feeling strapped, many real estate developers are struggling to keep the bubble alive through "shadow loans" outside the banking system. Meanwhile, they are counting on the market to recover from this round of tightening and allow them to continue what was previously the status quo.

China's economic expansion has also slowed during the third quarter of the year as government measures to control inflation have hurt growth. With these new policies, a modest economic slowdown inevitable, and it's normal that some companies may fall into bankruptcy as a result. The elimination of the companies that are less competitive will be good for the country's economic development in the long term.

The government should not use taxpayers' money to rescue reckless speculators. Real estate developers should rescue themselves by cutting housing prices in order to increase sales.

Reducing the impact of bankruptcies

What's happening in Wenzhou is yet to happen in many places elsewhere in the country. As long as local governments and banks transfer the tangible assets of the bankrupt companies to other companies that are capable of operating them well, the impact of bankruptcies on the real economy should be very limited.

Local governments must protect the interests of creditors. They should not team up with the defaulting companies and force banks and other creditors to bear losses in the name of keeping social stability. They shouldn't allow bankrupt businessmen to retain their assets. Otherwise it will set a bad precedent for others facing the same situation. In the long term, structural readjustment will help inefficient enterprises improve their capability in making profits.

Integration leads to strength

The current system relies too heavily on a loose monetary policy to maintain its momentum. In addition, overcapacity has kept profits of the companies at a very marginal level. Thus, cash-strapped companies have no choice but to borrowing money in the name of investment to stay afloat.

Banks and local governments must assist the real estate industry in adapting to policy changes. They should not continue to extend credit to defaulting companies in order to keep them afloat. This will only lengthen the period of economic adjustment. The correct approach is to help the surviving developers take over the unprofitable companies. China does not need 20, 000 real estate developers; 2,000 is more than enough.

Like the property industry, China's steel industry is fragmented by local protectionism. This disruption undermines China's ability to bargain with the three major iron ore giants. In fact, fierce competition between Chinese steel manufacturers is one of the important factors for the iron ore price hike. With the current downturn in China's steel industry, local governments should not interfere with industry integration.

Many people, especially local government officials, developers and interest groups, have stressed the negative impacts of a potential real estate bubble burst on employment, industry and fiscal revenue. However, some short term anxieties at the local level must be sacrificed for the sake of the long term fiscal health, growth and stability of the country.

In the next few weeks, there will be more negative news on China's economy. As such, the pressure to ease the monetary policies will also be increased. If the government continues to bail out wasteful speculators, China's inflation problem will become even more serious.

The author is a board member of Rosetta Stone Advisors Limited.

(This article was first published in Chinese and translated by Li Huiru.)

Opinion articles reflect the views of their authors, not necessarily those of China.org.cn

Go to Forum >>0 Comment(s)