China's growth could address imbalance

- By Danny Quah

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, January 2, 2012

E-mail China.org.cn, January 2, 2012

Many take as fact that the current pattern of global imbalances — large and persistent trade deficits and surpluses across different parts of the world, eventually unsustainable — is due to China and the rest of East Asia consuming too little and saving too much. Since the global economy is a closed trading system, trade deficits and surpluses across all national economies must sum exactly to zero always. Therefore, that one part of the world saves too much and thereby runs trade surpluses means other parts of the world — notably the US — must be running trade deficits.

However, just because deficits and surpluses are tightly interconnected does not mean that trade surpluses in China, say, have been responsible for US trade deficits: absent further information, causality could well have flowed in the opposite direction. Moreover, China's high savings might be dynamically welfare-optimizing for its citizens — for instance, private enterprise in China might find self-accumulation the only way to generate investment funds — and, at the same time, only minimally if at all welfare-reducing for already-rich US citizens. Finally, it might be that global imbalances should best be viewed not as a bilateral (US-China) problem but instead a multi-lateral one.

Be all that as it may, many US policy-makers focusing on US trade deficits and China's trade surpluses urge policy actions against China to rebalance the global economy. Those policy actions include punitive tariffs against Chinese imports and tagging China a currency-manipulator — and thus moving it yet further from official free-market status. Some observers, such as Michael Pettis, Nouriel Roubini and MartinWolf, remark that without such external pressure, China will find it domestically too difficult to shift away from its reliance on export promotion, infrastructure investment, and restrained consumption towards a more balanced growth path.

The problem: To raise China's domestic aggregate demand, especially consumption. The difficulty: China's consumption cannot increase quickly enough to compensate for the shortfall in aggregate demand should both investment and exports decline. The danger: a hard landing for China and the global economy.

I want to suggest that such a redirection need not be that difficult. My proposal: Let China grow rich as quickly as possible. Why might this do the trick?

|

|

|

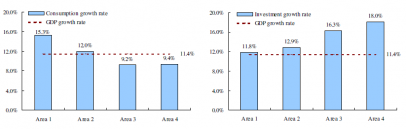

Figure 1: Regional incomes in China |

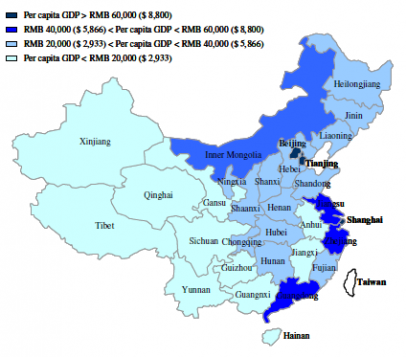

First, consumption within China is already rising faster than both income and investment, provided that we look at those parts of China where incomes per head exceed US$8,800 (Figures 1 and 2). Of course, China's current per capita income overall now is only US$2200, less than 6% that of the US. What this suggests, however, is as China's income grows its overall savings rate will naturally fall. The right policy is to encourage growth, not adopt punitive actions that might retard that growth.

|

|

Figure 2: China's regional consumption and investment |

(I took Figures 1-3 from a term paper that Daisy Wang wrote for my course Ec204 The Global Economy at theLSE-PKU Summer School, August 2011. The underlying data are from China's National Bureau of Statistics.)

Go to Forum >>0 Comment(s)