Islamic banking weathers global crisis

- By Mahmoud Mohieldin

0 Comment(s)

0 Comment(s) Print

Print E-mail

Shanghai Daily, January 16, 2012

E-mail

Shanghai Daily, January 16, 2012

|

|

|

[By Zhou Tao/Shanghai Daily] |

While uncertainty continues to roil global markets, driving many investors into full retreat, one part of the financial sector is expanding exponentially: Islamic-law-compliant financial assets have grown from about US$5 billion in the late 1980s to roughly US$1.2 trillion in 2011.

This asset class, which is characterized by shared risk between institutions and clients, avoided many of the most severe consequences of the global financial crisis that began in 2008. This resilience, along with several other key features, underpins the high performance and growing popularity of Islamic finance.

The global financial crisis adversely affected a small number of Islamic financial institutions as the real economy contracted and some issuers of Islamic bonds defaulted.

But the risk-sharing inherent to Islamic finance made such instruments more resistant to the first round of financial contagion that hit in 2008. Leading economists, such as Harvard University's Kenneth Rogoff, have suggested that Islamic finance demonstrates the advantages of more equity and risk-sharing over the conventional bias in favor of debt instruments.

Several distinctive features have made Islamic financial institutions relatively stable throughout the crisis.

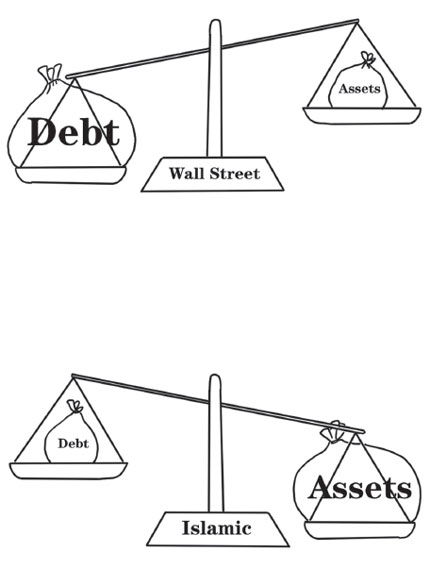

One such feature is that Islamic finance emphasizes asset-backing, thereby ensuring a direct link between financial transactions and real economic activities. Institutions' savings and investment returns are closely linked, because they are determined by the real sector, not the financial sector.

This creates a flexible adjustment mechanism, should unanticipated shocks occur. It also ensures that real asset and liability values are always equal, while prohibiting excessive leverage and several forms of complicated securitization. Moreover, Islamic finance is more equitable: lenders and borrowers share risks and rewards, which increases the focus on long-term goals and discourages excessive short-term risk-taking.

In short, Islamic financial institutions treat their clients like business partners.

They therefore have strong incentives to evaluate financing requests carefully, and to assist borrowers in bad times, thus reducing the pressure to sell assets at "fire-sale" prices and minimizing the likelihood of financial contagion.

Finally, the Islamic financial framework protects deposit balances, and prevents excessive credit growth.

Islamic financial instruments are currently available in at least 70 countries, and today represent about 0.5 percent of global financial assets. But the prospects for continued rapid growth are strong. In its November 2011 Global Islamic Banking Report, Deutsche Bank projects a 24 percent compounded annual growth rate in Islamic assets over the coming three years. There are five main reasons for this forecast:

Reasons for optimism

1. Islamic finance offers savers and investors practical alternatives to conventional instruments.

2. The quality of Islamic financial services is improving, and these services are not limited to particular clients.

3. Conventional multinational financial institutions are increasingly offering Islamic assets, and there is growing interest in them in London, Luxembourg, and other world financial capitals.

4. The commodity boom in some Muslim countries has generated surpluses that need to be allocated through financial intermediaries and sovereign wealth funds.

5. Islamic financial instruments can comply with sharia - Islam' moral code and religious law- as well as send signals of change compatible with recent developments in several Muslim-majority countries.

But realizing the potential of Islamic finance requires strong supervisory oversight.

Financial institutions need to enhance pre-lending screening and post-borrowing monitoring. It is also problematic that, in many countries, debt receives advantageous tax treatment. This should change.

Moreover, mortgages, mutual insurance, leasing, and micro-finance are underdeveloped in Islamic finance; insolvency and bankruptcy procedures must be improved; and mechanisms to deal with "Islamic bond" defaults must be established.

Finally, Islamic financial institutions must address concerns about liquidity-risk management, compliance with Basel III (the Basel Committee on Banking Supervision's most recent global regulatory standard), international accounting standards, and corporate governance.

By addressing its shortcomings, Islamic finance could encourage inclusive growth in many developing countries.

Mahmoud Mohieldin is Managing Director of the World Bank.

Go to Forum >>0 Comment(s)