Made in China: luxury or liability?

- By Emily Ford

0 Comment(s)

0 Comment(s) Print

Print E-mail Shanghai Daily, June 15, 2012

E-mail Shanghai Daily, June 15, 2012

On the vast glossy billboards advertising Ermenegildo Zegna's suits in Shanghai, there is no mention of it. In the Prada handbags on sale in the boutique nearby, only a small label buried inside the lining gives any clue.

|

|

|

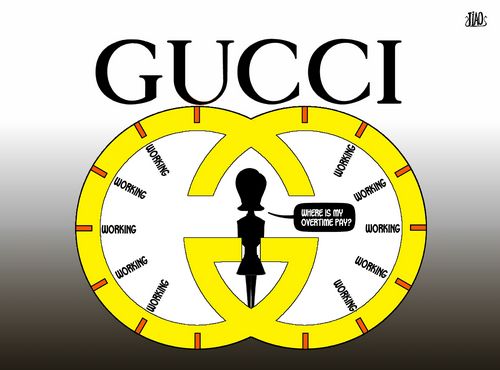

Behind the glamour [By Jiao Haiyang/China.org.cn] |

Both are made in China, but you'd be forgiven for not realizing it. Brands are still extremely reluctant to advertise the fact. After all, the ingrained belief that "made in China" is thoroughly incompatible with high quality is so enduring it even prompts local retailers to pretend their clothes come from Europe.

Yet this may change as more and more luxury brands move their production to China. Nissan said last month that its luxury Infiniti division would start making the exclusive cars in Hebei Province from 2014. Coach has been making its handbags in China for years, and chief executive Lew Frankfort swears there is no difference in the quality of bags produced by its European rivals - only in margins.

As more retailers follow suit, the lingering image of China as the home of low-end, cheaply made toys and clothes is gradually being replaced by a more nuanced picture.

"Not all brands like to shout about it," says Jeffrey Tan, China research director at Starcom MediaVest, a luxury research group. "While the quality can be just as good, it is a bit of a gamble from a brand perspective. Production quality has really come a long way. Apple's products are made in China and no one is complaining."

Lower costs

The reasons for manufacturing expensive, top brand products in China are persuasive. As factories "move up the value chain," a pool of increasingly skilled workers is created. Despite rising wages and commodity prices, the cost of making a crocodile-skin handbag in Zhengzhou is still vastly lower than employing artisans in Tuscany, and the results are often indistinguishable.

Keeping production local helps companies to contend with a strong yuan by reducing costs of ferrying goods from place to place. Crucially, when the market is such a huge force in your sales figures - Chinese people bought US$15.6 billion of luxury goods in 2011 - it makes good sense to move production near your customers.

As Shaun Rein of Shanghai-based China Market Research Group argues in his book "The End of Cheap China," the country is no longer cheap compared with Vietnam or Indonesia. But its skilled workers, infrastructure and proximity to the domestic market give it manufacturing advantages over Europe.

"Unless Italy can modernize its production facilities or convince consumers to pay even higher prices for items put together by Italian master craftspeople, brands like Zegna will shift more production to China as they have been steadily doing," Mr Rein writes.

Risks lurking

Despite the advantages, however, risks lurk. Chinese labor costs are rising at double-digit rates. Worries about fakes persist. Once a brand is in the marketplace, it can be difficult to prevent some unscrupulous factory down the road from making knock-offs. And quality control is a concern for luxury groups: a product pitched at the top end of craftsmanship can be damaged if there is any hint that shortcuts are being taken.

Perhaps the big question is whether the luxury brands' prized "brand heritage" based on the maisons of France or Europe is damaged by a move to China.

In February, Chateau Lafite said it was beginning production in China's southwestern province of Yunnan, where the terrain is prime for wine growing as French vineyards run out of land and China emerges as one of the biggest wine market in the world.

"I'm not sure from a marketing point of view whether this is a good move," says Dr Chiang Jeongwen, a marketing professor at the China-Europe International Business School. "Chinese people are known to differentiate between imported and locally made. It could dilute the brand image and result in two-tier pricing."

Much depends on the brand itself, said Thomson Cheng, the managing director of Hong Kong-based Imaginex, a major distributor for retail and luxury brands, including Ferragamo, in China.

While LVMH is beginning work on a sparkling wine in Yunnan for much the same reasons as Chateau Lafite, analysts say it would be brand suicide to take its Louis Vuitton label out of its native France, for example - where the emphasis on its handcrafted native products has seen workshops opened up as working museums. Brunello Cucinelli, the Italian maker of cashmere jumpers which sell for thousands of euros, has said that his sweaters could never be made outside of the Perugian hills.

"There is a definite trend for luxury goods companies to begin making their products in China," Mr Cheng said. "For some, heritage is not where they make their products, and it makes no difference in consumers' minds if it is made in China or not. But for others, such as Louis Vuitton or Ferragamo, it would be difficult to imagine it being made outside of its country of origin. Coming to China ... is not for the faint-hearted company."

Perhaps the way for luxury brands to lessen the perceived stigma is simply to be more open about where they make their goods. After all, many prospective customers already think the luxury products they covet are made in China. For Nicole Li, a twenty-five-year-old Chinese worker in a state-owned company in Shanghai, it makes little difference. "I just assumed that Louis Vuitton handbags were made here," she said.

Go to Forum >>0 Comment(s)