China 'Going global' picks up speed

- By John Ross

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, March 2, 2013

E-mail China.org.cn, March 2, 2013

![[By Jiao Haiyang/China.org.cn] [By Jiao Haiyang/China.org.cn]](http://images.china.cn/attachement/jpg/site1007/20130301/001ec949c22b129a658d18.jpg) |

|

[By Jiao Haiyang/China.org.cn] |

China has advanced strongly from a low base – rising from a 1 percent share in 2004 to 7 percent in 2012. In single country comparisons China was 3rd behind the U.S. and Japan, although this overstates China's position since the EU is 2nd behind the US if it is treated as a single entity. China's large company revenue is slightly over half Japan's and a quarter of the EU and U.S.

China's outward FDI flow mirrors the position of China's large companies, except that in FDI China is weaker compared to the U.S. and EU. In 2011 China's outward FDI was slightly over half Japan's but only one sixth of the U.S. or EU.

Analyzing individual global industries indicates the unevenness of China's position, showing the different realistic tempos for China's companies to "go global."

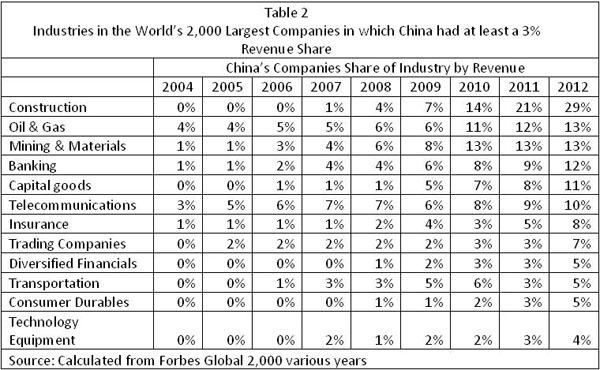

In 15 out of 27 major global industry groups China's share is less than 3 percent. This includes not only high tech sectors such as semiconductors, pharmaceuticals, and aerospace, but also basic industries such as personal care products, retailers, and media. The 12 global industry groups where China has a more significant market share are shown in Table 2.

China is strong in construction, which includes not only buildings but also railways and infrastructure, with the second largest share after the EU's 40 percent. For example China's dam constructer Sinohydro has US$21bn of projects in 55 countries, and receives a quarter of its revenue from overseas.

China's companies are strong in primary materials – oil and gas, mining, and basic metals such as steel. In basic materials and mining China holds second position after the EU's 25 percent share. In oil and gas China is third after the EU and U.S., both of which have 27 percent – although these figures are inflated as some of the world's most important oil companies, such as the Saudi Arabian Oil Company and the National Iranian Oil Company, are state owned without stock market listings. China's oil and gas companies have real international strength in FDI with US$92bn of foreign acquisitions since 2009, including a record US$35bn in 2012. By 2015 Chinese companies' overseas production will be equivalent to a major oil producer such as Kuwait.

Reflecting China's unequalled financial power, banking is also strong. First to globalize were China's official development banks. In 2005- 2011 China Development Bank and Export-Import Bank of China (Exim Bank) provided over US$75bn in loan commitments to Latin America. In 2010 their US$37bn commitment was more than the World Bank, Inter-American Development Bank and United States Export-Import bank combined. In Africa Exim Bank has lent more than the World Bank every year since 2005. But globalization of China's commercial banks is proceeding rapidly. By the beginning of 2013, ICBC, the world's largest bank by market capitalization, operated in 39 countries with overseas assets of US$170bn – a 30 percent increase on 2011.

But in many global industries, including manufacturing, China's companies are smaller than competitors. Even in China's strongest manufacturing sector, capital goods, its leading construction equipment makers Sany and Zoomlion only make 10 percent of revenue from overseas sales compared to 60-70 percent for U.S. competitor Caterpillar. In technology Lenovo is the world's 2nd largest PC maker but production is primarily in China. Haier, the world's number one domestic goods producer, which genuinely manufactures in many countries, is an exception not the rule. In most non-financial services China is weak – the scale of its telephone operators reflecting the size of its domestic market, not international operations.

But the dynamic is clear. Table 2 shows that in 2012 China had 12 industries with a more than 3 percent market share, in 2004 it only had one! As China's companies strengthen China's huge financial resources will allow them to globalize across a wide range of industries. In sectors such as banking, construction and basic materials China's "going global" is already well underway. In others it is simply a matter of time.

(Wang Juan contributed to research in this article.)

The author is a columnist with China.org.cn. For more information please visit: http://www.china.org.cn/opinion/johnross.htm

Opinion articles reflect the views of their authors, not necessarily those of China.org.cn.

Go to Forum >>0 Comment(s)