China's market-oriented reform battles crises

- By Yao Zhizhong

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, May 21, 2013

E-mail China.org.cn, May 21, 2013

During the process of China's market-oriented reform, many crises have been prevented or ridden out.

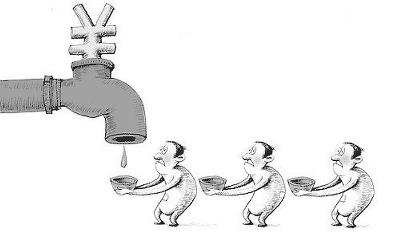

The first one is the crisis stemming from the reform of the pricing system. During the initial period of the reform, a double track pricing system was in place, meaning some commodities were priced by the government, and others priced by enterprises according to market demand. The system brought about pricing differences of the same commodity.

The government pricing was much lower than market pricing, which caused a large arbitrage margin. The right of government officials and state-owned enterprise managerial personnel to decide how many commodities were sold according to market pricing was a cause for corruption. If the prices had been freed at this point, it would have triggered high inflation; but at the same time a continual double track pricing system would have caused pervasive corruption.

In short, both would have caused social instability at that time. Fortunately, China chose to accept the inflation, and a pricing reform was phased in.

The second crisis hailed from the reform of state-owned enterprises. In the initial stages, under a state-owned enterprises management system without fundamental change, the development of non-state economies was allowed and price controls were liberalized.

Both state-owned and non-state-owned enterprises were exposed to the same market competition. State-owned enterprises incurred heavy losses because their competitiveness was bleak in comparison to the private and foreign-funded enterprises.

China stuck to the principle of market orientation, and made state-owned enterprises financially hard to continue bankrupt or reorganize. Many state-owned enterprises were privatized and the government kept a few large enterprises closely related to the national economy and the people's livelihood.

The government installed a social security system for some employees who had lost their jobs in the state-owned enterprises. Others were employed by new non-state economies or became self-employed.

The third one is the fiscal crisis. The fiscal revenues of China's government were based on state-owned enterprises prior to the reform. Ever since the reform was implemented, national economic growth was increasingly independent of the growth of state-owned enterprises. In other words, the economic growth had not led to the increase of the tax base accordingly. The proportion of governmental fiscal revenues in GDP therefore rapidly diminished.

In 1978, the ratio of fiscal revenues of governments at various levels, in terms of GDP, was about 31 percent, whereas in 1993, it had dropped to 10 percent, gravely affecting the central government's fiscal capacities.

On the long term, a fiscal crisis was bound to occur. Therefore, in 1994, China carried out reform in finance and taxation, and established a tax system with an emphasis on value-added taxes and a central as well as local revenue-sharing-scheme. All of these ensured the financial revenue growth of governments at various levels, and especially that of the central government.

The fourth are the financial crises. Since 1978, China's financial sector has found itself in two crises. One happened during the early and mid-1990s, when China began to reform its financial sector, encouraging the development of stock market, bond market, and the forward market on the one hand, whereas on the other hand, private financial dealings had been allowed to develop too, leading to irregularities in the financial sector.

During a second crisis in the late 1990s and the early period of the 21st century, in order to prevent unemployment and social disorder resulting from the losses of state-owned enterprises, state-owned banks provided loans to assist them. A great many non-performing loans therefore piled up and consequently the financial sector faced losses and even bankruptcy. Finally, China reformed its banking system according to market principles and strictly monitored the banking sector.

Before the crisis in the U.S., China's banking system had developed into one of the best in the world in terms of asset quality, as well as became one of the strongest in operation.

The final crises took place on the real estate market. China's real estate market has faced two crises. The first occurred after 1992. A large number of ventures entered the land and real estate markets, and the capital from banks had been invited to further drive up the land and real estate prices. In the end, the central government burst the real estate bubble by exercising strict macro-control.

In recent years, a large population has entered the big cities, and they need to settle down. Simultaneously, the reform of the market-oriented housing system has caused changes in the original housing system which saw the government allot houses. Before the crisis in the U.S., China had realized a rapid increase of prices in the real estate sector – and to some extent controlled this increase.

China came through the global financial crisis triggered by the crisis in the U.S. in 2008, but during the process of stimulating the economy after the crisis, local governments used land to finance various supporting plans of stimulation, leading to the increase of housing prices again.

The author is director of Research Center of International Investment, the Chinese Academy of Social Sciences.

The article was translated by Wang Yanfang. Its original version was published in Chinese.

Go to Forum >>0 Comment(s)