Why China's growth target had to be cut

- By Dan Steinbock

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, March 9, 2015

E-mail China.org.cn, March 9, 2015

|

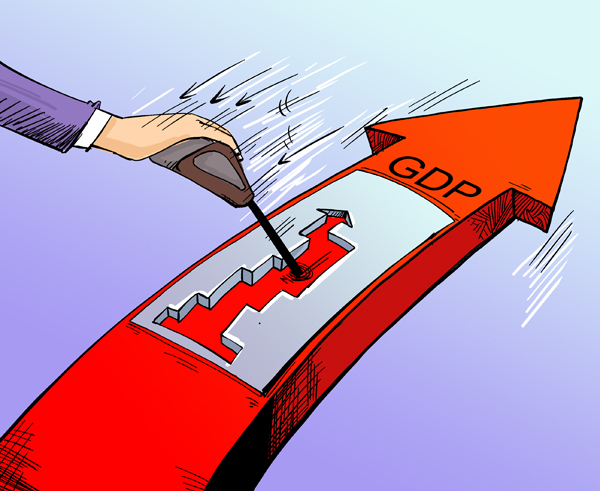

[By Gou Ben/China.org.cn] |

As the 5,000 members of the two sessions – the National People's Congress (NPC) and the Chinese People's Political Consultative Conference (CPPCC) – listened to Premier Li Keqiang in Beijing, the message was clear.

"With downward pressure building and deep-seated problems in development surfacing,"Li said, " the difficulties we are to encounter in the year ahead may be even more formidable."

After the economy expanded just 7.4 percent, the slowest in 24 years, the gross domestic product (GDP) target was lowered to about 7 percent. But that was only to be expected, in light of the "new normal."

Clearly, the Chinese economy has arrived at a crossroads, both internally and externally.

International headwinds

When the new Chinese leadership prepared to take office in Beijing, the prospects of the global economy were still more promising, or so it seemed.

In the early 2010s, the White House believed that the U.S. recovery was on its way, supported by the Fed's quantitative easing, while Brussels declared that the worst of the debt crisis was over in Europe. Indeed, global growth was expected to start climbing after 3.6 percent in 2013.

In reality, world output is expected to grow only by 3.5 percent in the current year – even less than what was anticipated already two years ago.

The U.S. recovery is picking up steam, but on the back of increasing debt. Despite the rhetoric of deleveraging, it has soared to US$18.2 trillion which exceeds the size of the U.S. economy. In the Eurozone, general government debt is also as large as the regional economy, despite austerity policies.

In the advanced world, growth prospects continue to rely on unsustainable debt-taking. The United States is recovering on the back of debt, while Europe is likely to rely on quantitative easing for some time to come.

In contrast, China is trying to sustain adequate growth, even as it is implementing structural reforms.

Correction in property markets

Ever since early 2013, Premier Li Keqiang's great challenge has been to manage the problems of the property markets, while continuing deleveraging at the local government level. It has been a precarious balancing act.

After a decade of strong though volatile expansion, China's real estate market is coping with excessive supply. These problems will not diminish in 2015. Rather, developers must tackle oversupply and price correction, even as they will struggle to meet their sales targets in 2015.

In 2013, sales still soared to 27 percent in the property markets, compared to the 7.8 percent plunge in the last year. During the ongoing year, growth is expected to range from being flat to a contraction of 5 percent.

What complicates the big picture is the uneven recovery across the mainland's regional markets. While the first to pull through are likely to be the first tier cities, whereas large inventories continue to burden lower tier cities.

Nevertheless, after the price contraction is over, the urbanization potential for another 5-10 years is likely to improve prospects in the property markets.

Go to Forum >>0 Comment(s)