Dithering on AIIB is Obama's paranoid legacy

- By Sumantra Maitra

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, March 26, 2015

E-mail China.org.cn, March 26, 2015

|

|

|

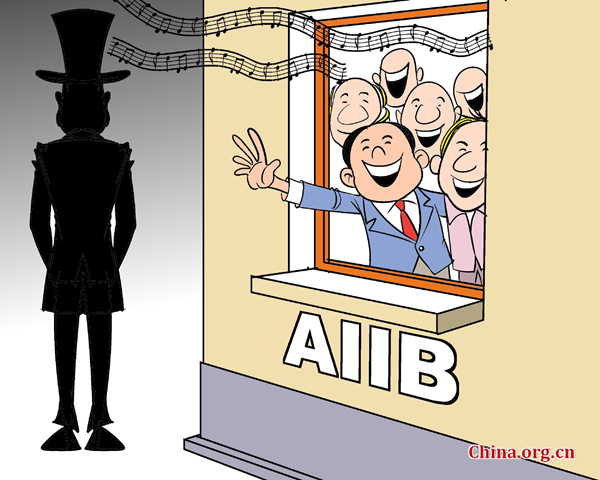

The more the merrier [By Jiao Haiyang/China.org.cn] |

Germany, Italy and France's interest in joining the new China-led Asian Infrastructure Investment Bank (AIIB) despite American lobbying against it, is yet another milestone showing how petulant, juvenile and haphazard American foreign policy has become under President Obama.

Britain already signaled its intention to join the bank, and it seems the rest of Europe is going to follow its lead.

Among the Pacific allies of the U.S., Australia seems to be interested, although no formal decision has been made. India, the second biggest Asian economy and an American ally, is a founder member of AIIB, as well as the BRICS bank. Japan and South Korea seem skeptical, but there is a rift at the top in the Japanese government when it comes to the merits of the AIIB, perhaps indicating the intense pressure Japan is facing. However in a recent shift, Japanese Finance Minister Taro Aso mentioned that AIIB and ADB working together would be ideal.

The United States first urged allies and non-allies alike in Europe not to join. Reuters quoted Treasury Secretary Jack Lew as telling Congress: "I hope before the final commitments are made anyone who lends their name to this organization will make sure that the governance is appropriate."

However, Britain, as a part of its look east policy, decided to join the AIIB. Similarly Germany's feral and reserved Finance Minister Wolfgang Schaeuble declared that Germany, along with other European countries, see China as the biggest trading partner, and would join to ensure the best practices of governance and trading were maintained in the bank.

Finally, under intense pressure from allies and under constant criticism from the analysts, United States changed its tone, and is now supportive of a cooperative infrastructure regarding the implementation of the AIIB. "The U.S. would welcome new multilateral institutions that strengthen the international financial architecture," Nathan Sheets, U.S. treasury under-secretary for international affairs was cited as saying. "Co-financing projects with existing institutions such as the World Bank or the Asian Development Bank will help ensure high quality, time-tested standards are maintained."

IMF Chief Christine Lagarde was also known to be "delighted" at the prospect of AIIB.

Go to Forum >>0 Comment(s)